When communicating with debt collectors it’s important to ensure they are legitimate before making a payment. Scammers posing as debt collectors will pressure you aggressively, use threatening language, and will not provide any documentation to verify the debt.. When a scammer is attempting to collect a fake debt using an email it’s called a phishing scam.

The vague nature of scammer scare tactics combined with the sense of urgency in their communications make for a worrisome case, but if you keep a level head and follow these quick tips, you can protect yourself from phishing scams.

1. Verify the sender’s email address

Scammers will often make themselves appear legitimate by operating under a company or other authority figure’s name, but they cannot replicate a sender’s address. For example, if you receive a collections communication from TrueAccord, it will be from one of our company domains meaning that the email address (after the @ symbol) will either read “trueaccord.com” or a related address.

Even if you are anticipating communications from a collector (or anyone else for that matter), take a second to review the “From” address confirm that they are who they say they are. And in the case of collections, if they seem suspicious or don’t have a company domain, don’t respond to the email or click on any links.

2. Validate but do not click on links

Debt collection phishing scams are designed to collect private information—like your credit card number or bank account and routing numbers—by tricking you into providing that data. Some of them are even more malicious and will try to get you to download malware directly onto your computer.

Any links provided in the body of the email could redirect you to fake sign-in pages that will share your login credentials with the scammer, payment portals designed to capture account numbers, or even prompt you to download malware that could jeopardize the security of your entire device.

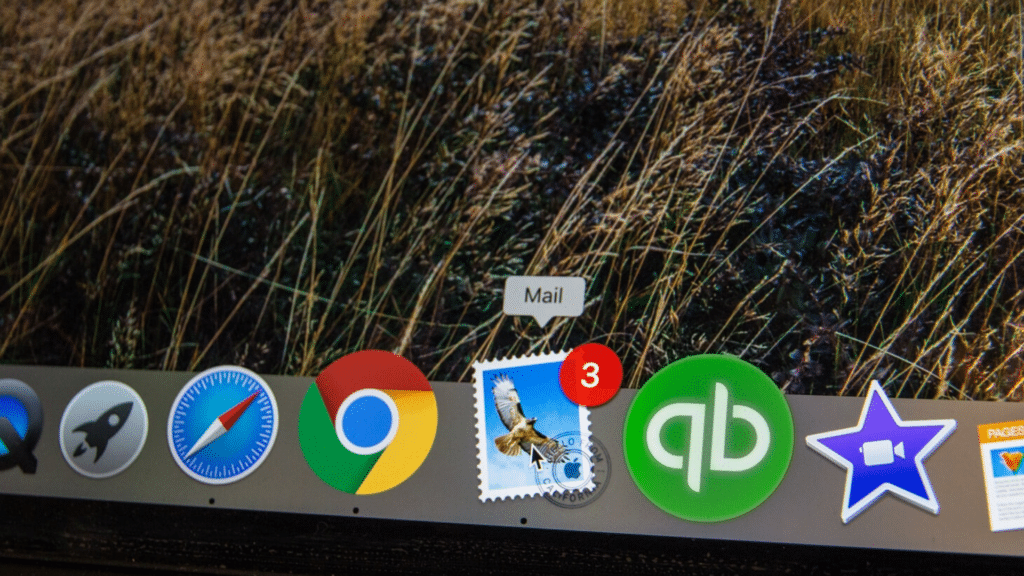

In order to check that the links in the email are legitimate, you can hover your mouse cursor over the link to see a link preview, likely at the bottom of your screen with the full URL. Make sure that you do not click when previewing the link, especially if you spotted a suspicious email address.

By hovering your mouse cursor over the link without clicking, you can make sure that the link address information matches the information in the email explaining where the link will direct you.

3. Investigate the company

If a collector’s information seems accurate, but you don’t recognize the debt the most surefire way to dissuade a phishing scam is to probe more deeply. Look up the debt collection company online see if the company is registered with the Better Business Bureau, conduct a Certified Business Search through RMAI or and email the company’s support team to confirm they sent the message.

Like we mentioned above: a scammer’s best friend is an unaware consumer.

If the content of the email is legitimate, they will also have a way for you to validate your debt before you pay them a penny. Call, write, or email the debt collection company directly and request additional documentation Scammers won’t offer additional details because they don’t have it—a company that collects real debt will.

4. Take your time to process the content

Scammers know that they don’t have much time to get the information they want. Once a recipient of a phishing email can process the details and recognizes that they don’t add up, the scam is a bust. This is why scammers posing as debt collectors rely on aggressive, manipulative, and urgent language. They may threaten legal action or other types of harm and will stop at nothing to make you pay as soon as possible.

Real debt collectors will not resort to these tactics, and many of the actions that these scammers threaten are actually against the law. Don’t let explicit language and threats pressure you into paying; while being in debt has obvious downsides, fake debt does not. By remaining patient and seeing through their smoke and mirrors, you can report the email as a phishing attempt and safely move on with your day.

5. Check for spelling and grammar errors

Phony debt collectors are hoping to catch you off guard. Their phishing emails are designed to look professional on the surface, but with a careful eye, they can easily be picked apart. Scammers target distracted, uninformed, and unaware consumers which is why their messages are often hastily thrown together.

This means that phishing emails are much more likely to have typos, spelling errors, and issues with proper grammar. Read the message carefully and remain suspect if a message doesn’t make sense or look like they were thrown through a quick Google translate.

Stay informed and stay safe

It’s easy to feel overwhelmed by debt, and mounting debts from multiple sources can make it feel like you’re in a spiral. Scammers that send phishing emails prey on vulnerable consumers and take advantage of those financial fears, but keep these tips in mind and protect your financial well being.