You made the big step and decided to work with TrueAccord. Congratulations! You realized that you need a collection company. You want to reduce churn through proactive loss management. You’re ready to go. What happens now?

Notifying your debtors

Before we start working, you should notify your customers that they’ll be hearing from us. Read more about what to do before sending customers to TrueAccord.

Submitting debts for recovery

Sending debts to TrueAccord is easier than you’d think. If you’re handy with code, our API v1 is available for use. If not, just send us a CSV or XLSX file and we’ll load it into our system.

Setting a collection strategy

TrueAccord is an automated service. You don’t need to be an expert to use it – our experts and software do that for you. There are, however, some parameters you may want to control:

- What is the maximum discount rate you’d accept to consider the debt settled? We’ll make recommendations based on the debt’s age, but you can dictate what number we’ll use.

- What is the longest payment plan you’ll accept? We always recommend allowing longer payment plans to provide flexibility to your customers, but some businesses prefer to recover fast or not recover at all.

- How should we treat disputes? We always recommend allowing debtors to present their service or product complaints, if those caused the default. Going through the dispute process might tell you something new about your business, and increases the chances of retention, not only recovery.

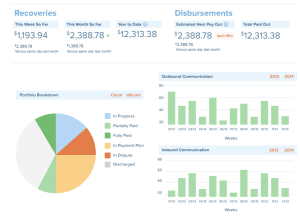

Using our Creditor Dashboard to follow up

TrueAccord’s Creditor Dashboard lets you track your portfolio distribution, see how much we recovered for you, and overall account activity. It also lets your operations team respond to incoming communication from debtors, such as requests for detail debt information.

Starting to Recover with TrueAccord

The Creditor Dashboard also lets you track the expected amount to be remitted in the next cycle. Watch the payments made by debtors who’ve gone through the industry’s most fair and personalized recovery process, and see them going directly to your bottom line. We’re happy to help!