In a technology driven world, effectively gathering and acting on data-driven decisions is essential for success. A growing market of analytical tools combined with an exponentially expanding pool of accessible data means that companies can make more precise decisions than ever before. The realm of machine learning makes accessing and processing that data even easier.

Machine learning is a field of computer science and statistics focused on giving computers the ability to make decisions that they haven’t been explicitly programmed to make. By leveraging data to enable computer systems to make decisions, some of the biggest companies in the world are able to provide better experiences for their users.

Streaming services are able to automatically curate precise recommendations for their viewers, email service providers can more accurately filter and categorize incoming emails, and collection agencies can more effectively contact consumers in debt.

The future of debt collection communication is digital, and what better to aid in digital efforts than powerful, adaptable computer models? Here’s what you need to know about machine learning and how it can change your (and your consumer’s) debt collection experience.

How can a machine learn?

Just as a person can learn by consuming more information on a subject, machine learning algorithms are able to learn by aggregating large data sets and identifying patterns, but they still require help getting started! When building a machine learning system, engineers and data scientists collaborate to establish parameters that help the model define data in a set that it can use to extrapolate from. Here’s an example:

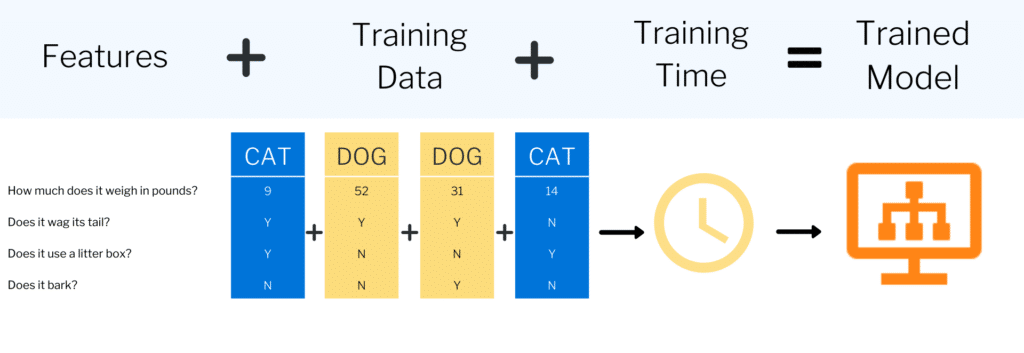

A simple, supervised machine learning model known as a binary classifier can serve as a foundation for more complex decision making. Imagine a program that is designed to distinguish cats from dogs. The data scientists building the system know the difference between the two and can pick a few features that are likely to identify one or the other and break the qualitative information into quantitative values that the model can recognize.

Figure 1 (below) depicts how physical features of cats and dogs can be broken down into numbers or binary (Y/N) responses to help the computer model understand what features likely indicate a cat and which features likely indicate a dog!

Once the model has been trained using this data, it can learn what features are most likely correlate to a cat or a dog without the team telling it what to do! (See Figure 2, below).

The binary classifier described here is a supervised learning algorithm, meaning that it still requires designers to engineer its features in order to get it up and running.

Going beyond our cat and dog model, unsupervised machine learning models can aggregate data like this in order to make further predictions and decisions without human involvement!

Applying machine learning to debt collection

So your machine learning algorithm can now fairly reliably recognize the difference between a cat and a dog, but how can this process help in debt collection? When algorithms can slowly learn to distinguish results or users and place them into groups, they can learn to do things like:

- Understand what kinds of messaging people respond to

- Recognize what kinds of payment offers seem to be accepted

- Define different types of consumers

With enough data to analyze and enough features extracted from that data, machine learning algorithms can help you to optimize collections processes. Rather than telling us “this is a cat” or “that is a dog,” a similar system could be used to make observations like:

- “This type of account will be especially difficult to collect on”

- “That consumer may like to receive fewer emails”

- Or even something as specific as “this content might be more engaging for this consumer”

This information can help to inform new collections strategies, dictate the use of different communication channels, or provide further insights into effectively segmenting a customer base.

By crunching enormous amounts of information, an unsupervised machine learning model may be able to recognize patterns in groups that have similar preferences or needs and relay relevant communications to them based on that information!

If you’re interested in learning more about how machine learning can be harnessed to communicate with customers, check out this interview with two of TrueAccord’s data team!

Experimenting to learn more

One way to continue improving a machine learning model’s decision making ability is to provide it with more data and features to learn from. Perfecting a model requires a very scientific (and iterative) approach:

- Start with a hypothesis that you want to test

- Monitor what decisions it is making based on the data available

- Introduce new information

- Review how the system operates and what decisions it makes with the newly presented data

- Iterate

By experimenting with various tools and approaches, a debt collection-focused machine-learning model can work in conjunction with data teams to rapidly evolve and improve collections efficiencies at different stages of the collections process.

Machines learn and collections grow

As it becomes more and more difficult to contact consumers in debt, integrating digital collections solutions into a collection strategy is becoming invaluable. Digital debt collection offers more opportunities for in-depth analysis, and by introducing machine-learning to that evaluation process, you can build systems that can support their own growth and improvement!

The more data you have, the better you can collect, and the more you collect, the more data you have. The self-sustaining nature of machine learning is revolutionizing approaches to collections, but it isn’t as easy as it sounds. Building and continuing to maintain complex systems requires a talented team and a stable infrastructure that can support these processes at scale.

Those that can properly build and manage these systems will be the driving forces in the future of the collections industry, so find your partner and learn what you can. Maybe these machines can teach the industry a thing or two.