You’ve seen the headlines—the federal government last week resumed collecting defaulted student loan payments from millions of people for the first time since the start of the pandemic. And how—debt collection will be through a Treasury Department program that withholds payments through tax refunds, wages and government benefits. This will undoubtedly have negative effects on credit scores and the resulting loss of access to funding going forward for many Americans.

How did we get to this point where so many people with student loans are unable to make payments on them? Taking a look back at the financial activity of those who deferred student loan payments in the first place gives us a good jumping off point, and combined with the challenging economic landscape over the past several years we can begin to understand the precarious financial situation unfolding.

Student Loan Holders Took on More Debt During the Pandemic

Based on data analysis we reported on in “Consumer Finances, Student Loans and Debt Repayment in 2023”, the trend for student loan holders who deferred their payments from 2020-2022 was to take on more debt. Data showed that the total average debt of a consumer with student loans increased 14.6% from 2020 to 2022, while that of consumers without student loans decreased 4.8%.

In 2022, student loan holders increased their average number of open trade lines by 10.3% from 2020, while open trade lines decreased by 7.7% for non-student loan holders. Breaking it down, those with student loans added credit cards (up 8%), personal loans (up 4%) and personal installment loans (up 5%) to their debt balances, with the average total balance of other loans more than doubling from 2020-2022, from $2,078 to $4,747, a 128% increase.

Economic Stressors Have Persisted, Are Likely to Continue

While inflation has cooled significantly compared to the highs of 2021 and 2022, prices remain elevated and interest rates haven’t returned to pre-pandemic levels. Uncoincidentally, household debt and credit card balances have been on a steady upward climb for the past few years, suggesting that rather than catching up with their finances, many Americans have continued to find new sources of funds to support their lives.

Americans’ total credit card balance was $1.2 trillion as of Q4 2024, marking the 10th time in 11 quarters where credit card debt increased or stayed the same. In a bigger picture view, credit card balances have risen by $441 billion since Q1 2021—adding up to a 57% increase in less than four years. Given the still-high interest rates, stubborn inflation (that may or may not go back up due to tariffs) and other turbulent economic factors, these balances are likely to keep climbing.

A Perfect Storm of Financial Challenges for Student Loan Holders

While deferred payments on student loans granted a temporary reprieve for borrowers, the new debt accrued effectively negated the gains of deferral, leaving many student loan holders with monthly debt obligations that were only manageable without having to pay back student loans. The CFPB reported that as of September 2022, 46% of student loan borrowers had scheduled monthly payments for all credit products (excluding student loans and mortgages) that increased 10% or more relative to the start of the pandemic.

Monthly financial obligations directly impact a consumer’s overall financial flexibility, and maxing out budgets to keep up with the economy puts people in a precarious situation when demands on finances change. That’s what we’re seeing now—consumers put student loans on the backburner and weren’t able to financially prepare for when they would come due again.

What Happens Next?

The outlook isn’t great: financially at-risk consumers with student loans will either go into collections for their student loans or will start missing payments on other loans in an attempt to pay back student loan debt. When there is only so much in the bank to work with and the cost of accessing new money is high, consumers will have to prioritize financial obligations and inevitably won’t be able to cover them all.

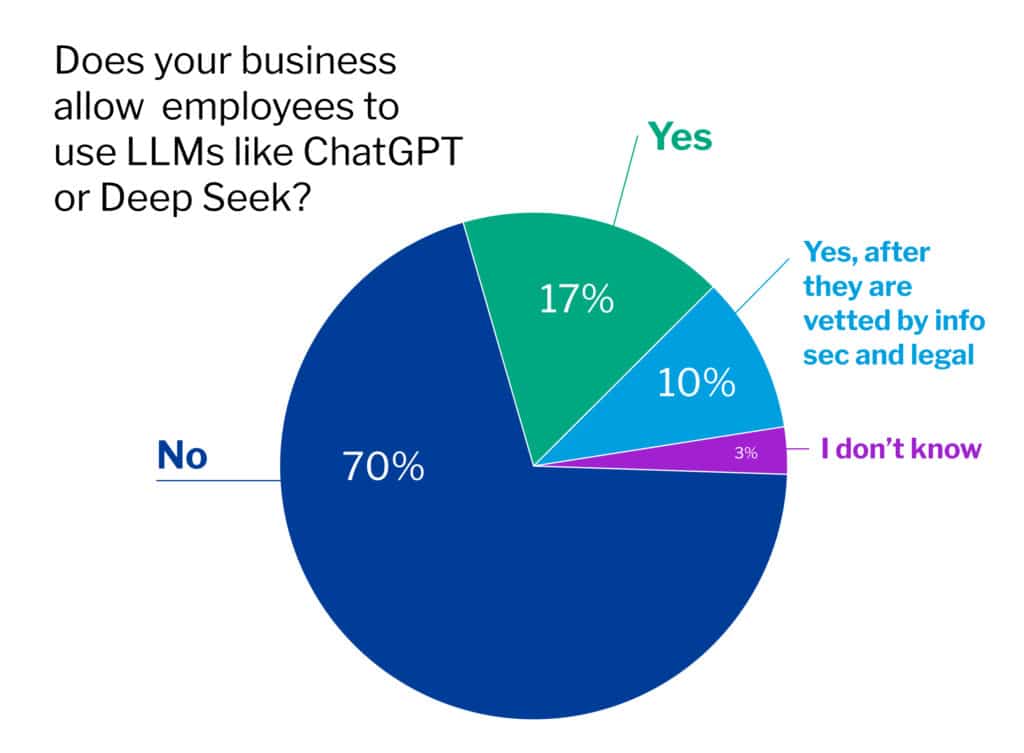

As we’ve learned from working with more than 40 million consumers in debt, empathy goes a long way, and understanding your customers’ financial situation is the first step to effectively engaging them in debt collection. For creditors and debt collectors looking to engage consumers in debt collection right now, it’s important to have a comprehensive, omnichannel communication strategy and be ready to meet the customer when and where they are ready to prioritize your account. This means don’t limit communication channels and do offer flexible options for repayment that consumers can explore, evaluate and select on their own time.

To engage your customers earlier in delinquency before charge off, consider leveraging consumer-preferred digital channels and AI-enabled decisioning for optimal results. Implementing a SaaS tool to automate digital communications will help you keep up with rising delinquencies while keeping your costs low.

For more data analysis insights on this topic and how to improve engagement with borrowers with student loans, download and read the full report “Consumer Finances, Student Loans and Debt Repayment in 2023”.