Keeping up with compliance in the debt collection industry can be a challenge—especially as artificial intelligence, machine learning, and other advanced technologies sweep through both the business and consumer sectors. In a webinar on January 29, 2025, industry experts Kelly Knepper-Stevens, TrueML Chief Legal Officer; Katie Neill, TrueAccord General Counsel and Chief Compliance Officer; and Lauren Valenzuela, Retain by TrueML Products General Counsel and Chief Compliance Officer, shared insights from 2024 and influences on 2025.

Let’s take a look at the takeaways from the webinar:

Compliance & Regulatory News in 2024

One significant trend coming out of the regulations and consent orders in 2024 was focused around companies’ failure to deliver a positive experience for consumers, with federal and state regulatory action against companies who fail to properly manage complaints and disputes. The White House, Consumer Financial Protection Bureau (CFPB), and Federal Trade Commission (FTC) all shared concerns that poor customer experiences may rise to the level of illegality.

October 2024 saw the opening of the CFPB’s nonbank registry, aiming to create a single database of any nonbank entity that’s received a consent order by requiring these entities to register when they have become subject to certain final public orders imposing obligations on them based on alleged violations of specified consumer-protection laws.

The Department of Justice (DOJ) revised their Evaluation of Corporate Compliance Programs to include new areas of focus like technology risk, merger and acquisition integration, and additional questions related to autonomy and resource allocation and anti-retaliation programs. It places significant emphasis on the need for companies to implement structured processes to assess and manage risks tied to AI and other emerging technologies. These updates underscore the need for organizations and individuals subject to compliance measures to have a competency level when it comes to artificial intelligence and all of the various tools and solutions that may be used or inadvertently used through vendors.

Additionally, last year email service providers began to roll out their own requirements, like Google’s one-click unsubscribe in June 2024, which may negatively impact email sender reputation if not adhered to. While this is not the law, not following this requirement can lead to business emails missing the inbox and landing in spam instead—a major risk for deliverability and consumer engagement.

Another digital channel got an update to best practices beyond direct Fair Debt Collection Practices Act (FDCPA) or Regulation F guidelines as well: the Federal Communications Commission (FCC) published an order in February 2024 requiring companies using an automatic telephone dialing system (ATDS) for text messages to honor opt-outs within 10 business days of receipt. Currently the FDCPA doesn’t outline any type of processing time to opt-outs, but the FCC order does provide a new standard for industry best practices.

What Do These Compliance & Regulatory Updates Mean for 2025?

A key takeaway from all the many updates and introductions in 2024 is that not only should organizations make sure they are compliant with the law, but also look at the quality of the consumer’s experience as companies evaluate their compliance programs.

And while last year saw different governing bodies and providers make a lot of progress handing down guidelines and best practices for better consumer experience overall, our experts expect the next wave of successful new regulations to come from the states versus the federal legislation.

That said, a particular proposal from 2021 has been reintroduced on the federal level, but is not expected to pass out of the House Financial Services Committee—which is a good thing for consumers and collectors alike when it comes to digital communications. Rep. Maxine Waters’ proposed debt collection legislation covers many articles, but the concerning portion focuses on introducing a nationwide prohibition from debt collectors reaching out to consumers by email and text message without the consumer’s consent first, which is ultimately a ban on those channels because it’s difficult to get a consumer on the phone to get them to opt in to those channels or to get them to respond to a letter. While it is not expected to pass, it is a prime example of the misunderstandings around these technologies and emphasizes the need to educate and advocate for digital adoption because consumers largely prefer these sorts of methods.

Overall, businesses and collectors need to strike a balance in 2025 between maintaining compliance while also keeping up with consumers’ more digital preferences despite regulations and legislation not always being 100% clear on what is and is not acceptable for compliance.

With that, one of the biggest opportunities and challenges for organizations and collectors in 2025 will be how to vet, adopt, and ensure compliance with exciting emerging technologies.

Emerging Technologies: Benefits, Risks, and Looking Ahead at 2025

Think about ways that you can use technology to help you work smarter, better, faster, but also where pitfalls might be with that technology—this is the mantra moving forward.

With technology getting smarter, especially for the digital communication landscape, it’s significantly less expensive to send emails and SMS than it is to mail letters or place phone calls. It’s safe to say that if your organization is already utilizing digital channels, you will probably send more communications through those channels in 2025, which could expose some of the greater compliance risks in the new year without the right compliance programs and strategies in place.

While consumer preferences consistently lean more towards digital, not all digital engagement is created equal—and poor consumer experience can be the result of poorly designed, implemented, or maintained digital outreach. And as noted above, a significant focus for staying compliant in 2025 hinges on consumer experience. In 2024, the CFPB identified one of their concerns over utilizing technology like AI is a lack of oversight, or even understanding of how to properly use it in consumer communications.

There hasn’t been any federal laws yet regarding the AI in debt collection, but federal agencies have put out significant guidance on using these advanced technologies and what sort of protections businesses need to have in place over them. The Department of Treasury is very interested in how organizations are using the AI technologies with several large sessions bringing in industry members and government regulators to talk about the risks and the benefits and what sort of controls would be best to put in place.

While legislation and explicit regulations may still be in the works on a federal level, businesses should start to prepare now to find both higher chances for success and compliance in 2025.

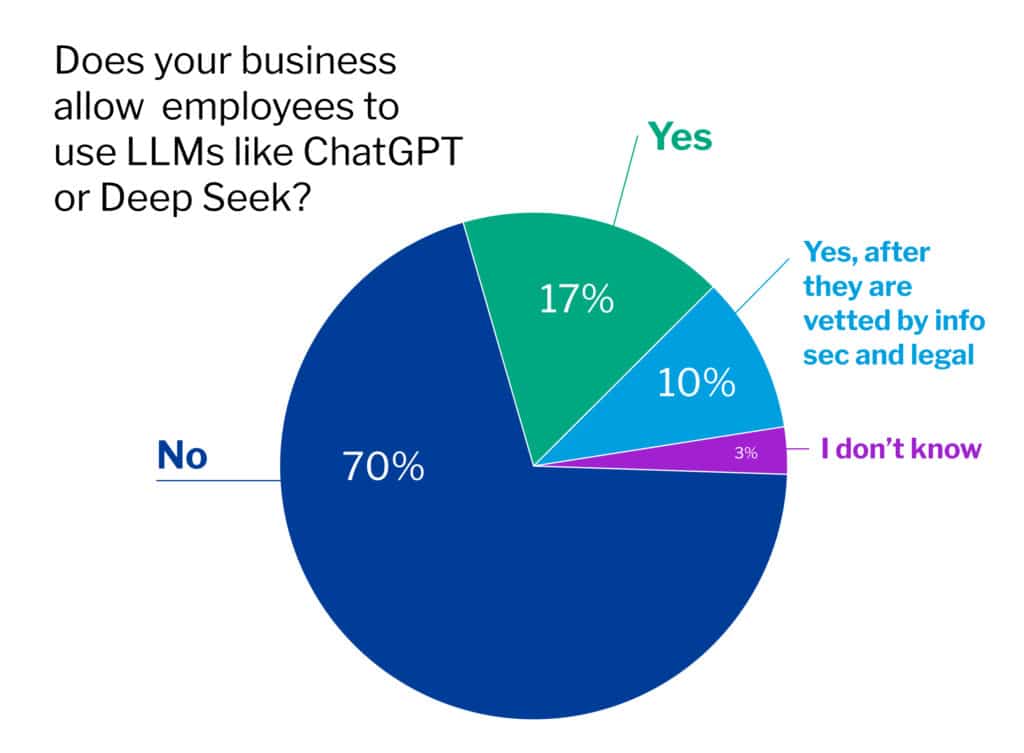

In a webinar poll, we found that when asked “Do you allow your employees to use LLMs like ChatGPT or Deep Seek?” attendees responded that 70% said a flat no, followed by 17% saying a straight yes, 3% unknown, and only 10% yes after they are vetted by info-sec and legal teams—we expect that 10% to grow exponentially further into the year as AI technologies become not only more prevalent and more accessible, but also more scrutinized on a business-level.

One key directive any business should take away: start writing policies and procedures about this, including putting these sorts of things into your risk assessment annually, at least to be assessing whether or not this is bringing more risk than you want to your organizations.

While using these emerging technologies does open organizations up to a new set of risks—both in compliance and overall consumer experience—using digital avenues for outbound communications can similarly be used for how your business manages compliance oversight of your processes. If you’re leveraging an omnichannel engagement strategy, it can be default to view each channel in isolation, but there are compliance solutions that help map out and monitor your outreach across channels. It is crucial for the positive consumer experience—and in turn, compliance—to make sure consumers aren’t getting stuck anywhere in your engagement process, to make sure your responses to your outbound digital communications are being scanned for different keywords and phraseology, just to name a few of the modern compliance elements.

Can Your Business Future-Proof Its Compliance Program?

As we saw in 2024, compliance and best practices can change rapidly but can also lag behind emerging technologies. Some of the best ways to future-proof your compliance strategy is to pull insights from the recent past, and 2025 has plenty to draw from.

But one way to take some of the pressure off internal teams trying to keep up with compliance is by partnering with industry experts with a proven track record of being ahead of the curve—and in TrueAccord’s case, even helping influence them. Our perspective since our company’s inception in 2013 has been that legal compliance is at the forefront of understanding the future of the collections industry and what it means to prioritize consumers.

TrueAccord is a licensed, bonded, and insured collection agency in all jurisdictions where we collect. Our legal team follows developments in regulations and case law to develop policies and procedures according to their constant changes. We ensure complete compliance control, auditability and real-time updates for changing rules and regulations. Our digital collections process is controlled by code, ensuring that all regulatory requirements are met, while still being flexible to quickly adjust to new rules and case law.