Today, TrueAccord released Consumer Debt in the Age of COVID-19, a report exploring how debt repayment and other consumer behaviors have changed throughout the coronavirus crisis. Based on aggregated, anonymized data from 12 million U.S. consumers, the report highlights that consumers choֵse to pay off debt when provided with an infusion of cash, even during a time of unprecedented economic uncertainty. Despite an initial slowdown as the crisis worsened in the U.S, debt repayment volumes hit a record high on April 15th, the day the first wave of CARES Act checks hit bank accounts.

Key insights and trends from the report include:

- Consumers chose to leverage their CARES Act cash to pay down debt. On April 15th, there was a near-instantaneous increase in debt payments as the first wave of checks hit bank accounts. Payment dollars were 25% higher than the previous tax season peak.

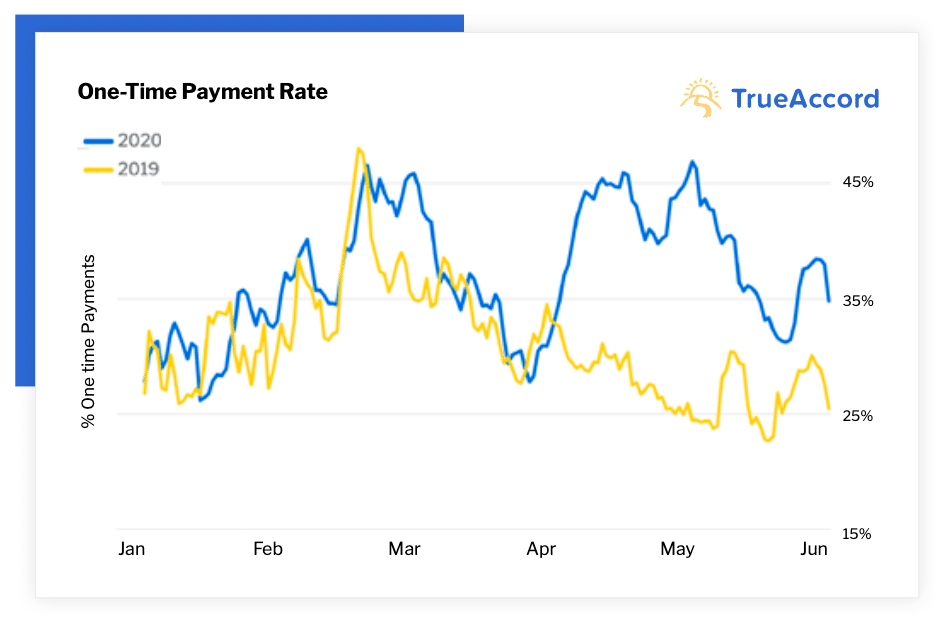

- One-time stimulus changed consumer behaviors. With stimulus checks in hand, consumers flocked toward paying off their debt in full — the rate of lump-sum payments was 50% higher than the same period last year. The ones who did sign up for payment plans chose shorter payment terms with higher monthly installments.

- Payments will continue to be irregular. In early March, nationwide panic led to decreased engagement and payment activity from consumers. While stimulus payments and unemployment benefits empowered consumers to pay off debt in record numbers in April and May, that trend won’t remain constant over the coming months.

“TrueAccord has always known that consumers in debt aren’t villains or victims — they’re caught in a difficult situation, trying to optimize for day-to-day survival while managing their obligations,” says Ohad Samet, CEO of One True Holding Company, the parent company of TrueAccord. “So when presented with an unexpected windfall and fewer spending opportunities, many of these consumers chose to repay debt. This trend was especially clear for a company like TrueAccord, which puts consumers in charge, by providing self-service tools, rather than coercing them into making a payment.”

With an uncertain economy and the possibility of additional stimulus packages, debt collectors must be prepared for unusual spikes in engagement and payment in the coming months. In order to best serve consumers, they must streamline their processes to make it as easy as possible for consumers to pay their debts when they choose to and to modify their plans when they can’t. The report includes four recommendations that companies collecting debt can implement to update their operations for this unusual time.

“Consumers have learned to expect digital-first solutions from their financial service providers, and the collections industry needs to keep up,” said Sheila Monroe, CEO of TrueAccord. “Our systems and processes empower consumers to engage when they want to, where they want to, using their device and channel of choice, and provide the flexibility to set up payment arrangements that fit their irregular schedules.”

For more information, download the full report, Consumer Debt in the Age of COVID-19, here.

Sign up to get future reports and updates: