As we speed towards the end of a tumultuous year, I wanted to share my thoughts on what the months ahead may bring for the collections industry.

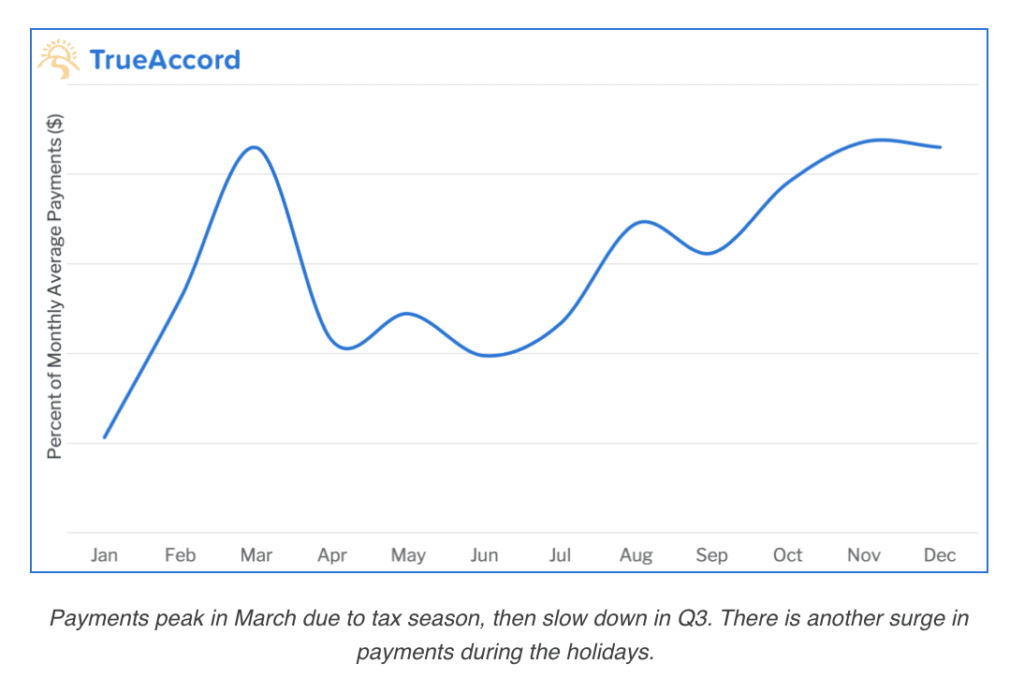

First, to address the riddle in the title of this post, what do the holidays and tax season have in common? Debt repayment. According to TrueAccord’s data from 12 million American consumers, debt repayment typically peaks twice a year: once during the winter holidays and again from February to early April when tax refund checks are received.

But those aren’t the only factors that may affect debt repayment in the near future. A second COVID stimulus package may be around the corner, and if the first stimulus package is any indication, that may lead to an increase in the number of Americans who are choosing to pay off debt. (In 2019-2020, there were not two, but three peaks in debt repayment—the winter holidays, tax season, and April-May, when stimulus checks were delivered.)

So, what will be the impact of a high debt repayment season coupled with an economic stimulus? A sharp and potentially unprecedented increase in debt repayment might be coming very soon.

If you’re worried about scaling your collections operations to effectively meet the increase in payments, reach out to TrueAccord. We put the consumer in the driver’s seat: 96% of consumers we work with resolve their debts through self-service on our digital channels. That high level of automation enables TrueAccord to run very lean, averaging 80,000 active accounts per agent.

At TrueAccord, we are changing the lives of the 77 million Americans in debt and leading the digital transformation of the collections industry. We’d love for you to join us.

Sheila Monroe is the CEO of TrueAccord Corp.