In our first blog post on the New York and New York City’s proposed amendments to their debt collection laws, we explored the proposed amendments and the alternative opt-out laws in the federal Fair Debt Collection Practices Act (FDCPA) and the Washington, DC debt collection amendment that achieve the same objectives without the unintended consequences. In this part two, we explore the benefits of digital communications for consumers in all other states and jurisdictions—except New York—as well as these unintended consequences New Yorkers face from these potential amendments.

Since the New York Department of Financial Services (NYDFS) is still considering the comments received to their proposed changes and the New York City Department of Consumer and Worker Protection comment period is open until November 29, 2023, there is still time for these Departments to revise their proposals to match the federal law or Washington DC’s law. Both the federal and DC laws permit debt collectors to communicate digitally about a consumer’s account as long as the digital communications contain clear and conspicuous opt-out language with strict penalties for failing to abide by the opt-out provisions. Washington, DC goes a step further and restricts digital communications to one per week unless a consumer opts in to more digital communications in a seven day period.

Both NYDFS and NY should allow their consumers to have the same experience as the consumers in the rest of the country.

Digital Communication Benefits Consumers, Creditors, and Collectors

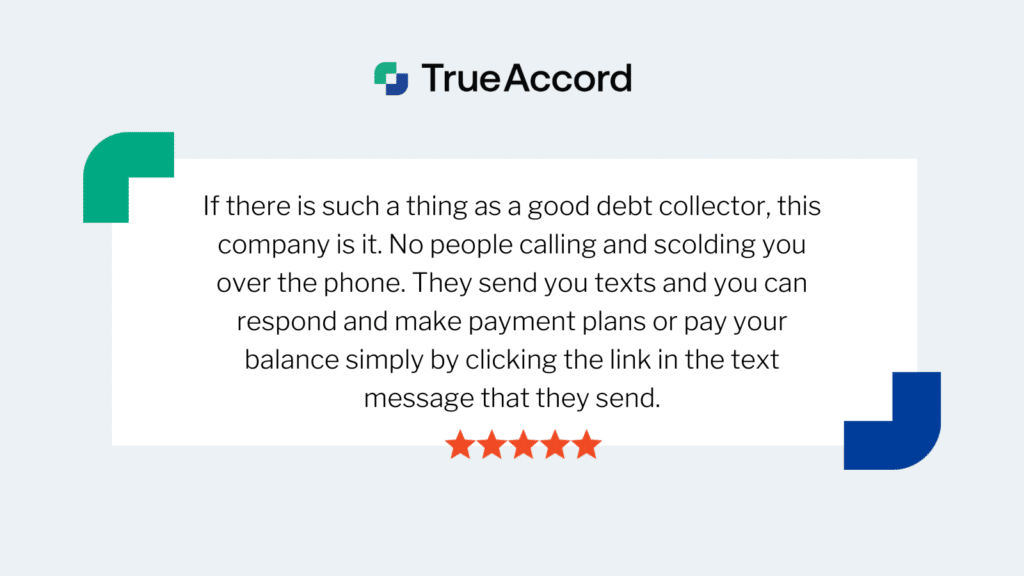

TrueAccord knows digital communication benefits consumers, as evidenced by countless consumers who have provided feedback (either directly or online) throughout our years in business, like this consumer who wrote in July 2023:

Digital Communications are a Step Forward in Consumer Protection

Digital communications are easily controlled by consumers and tightly managed by service providers with built in mechanisms to prevent harassment. These methods already provide superior consumer protections than phone calls and letters for several reasons:

- All digital communications are written, documented, and can be searched, automatically creating a paper trail of communication between the consumer and the collector.

- Electronic communications offer significantly better protection from unwanted or harassing communication compared to phone calls and letters. Consumers hold the power and can easily opt out of electronic communication by clicking “unsubscribe,” marking emails as spam, replying STOP to a SMS, or blocking a number entirely from their device.

- Service providers closely monitor inbound communications and those senders who appear to be mass marketing are often blocked from delivery altogether in the spam filters for both email and SMS. Unfortunately for licensed businesses, like law abiding debt collectors who have a legitimate reason for these digital communications, their digital communications may never reach a consumer’s phone or inbox without a very sophisticated delivery strategy that takes into account frequency.

Additionally, email is designed to travel with a consumer forever, whereas addresses and oftentimes phone numbers can change. Email addresses are not ever reassigned by service providers. If consumers frequently change addresses, like military families, email may be the best channel to use to communicate as it lowers the risk of missed communication when consumers forget to update their account information with their new physical address.

Consumers Prefer Digital Debt Collection

By and large, consumers prefer to communicate with their collection agencies digitally—they already predominantly communicate with their banks, creditors, and lenders digitally, so digital collection is a smooth transition when an account moves to collection. As this consumer reported just this past August 2023:

Almost all TrueAccord communications with consumers (96%) happen electronically with no agent interaction. This is possible because our electronic communications contain links to online pages where consumers can take action on their accounts. In fact, more than 21% of consumers resolve their accounts outside of typical business hours—before 8AM and after 9PM—when call centers are closed and it is presumed inconvenient to contact consumers under the FDCPA.

Consumers Should Not Have to Opt-In to Electronic Communications Twice

Consumers already opt in and communicate through primarily digital channels with their creditors. Requiring consumers who have already opted in to have to again opt in to digital communications in order to discuss the same account with a collection agency adds burden to consumers. When a consumer provides their electronic contact information (email address or cell phone number) to the creditor, there should be little doubt that the consumer desires to communicate electronically. If the consumer does not, they can unsubscribe or opt out from continuing to receive messages through these channels.

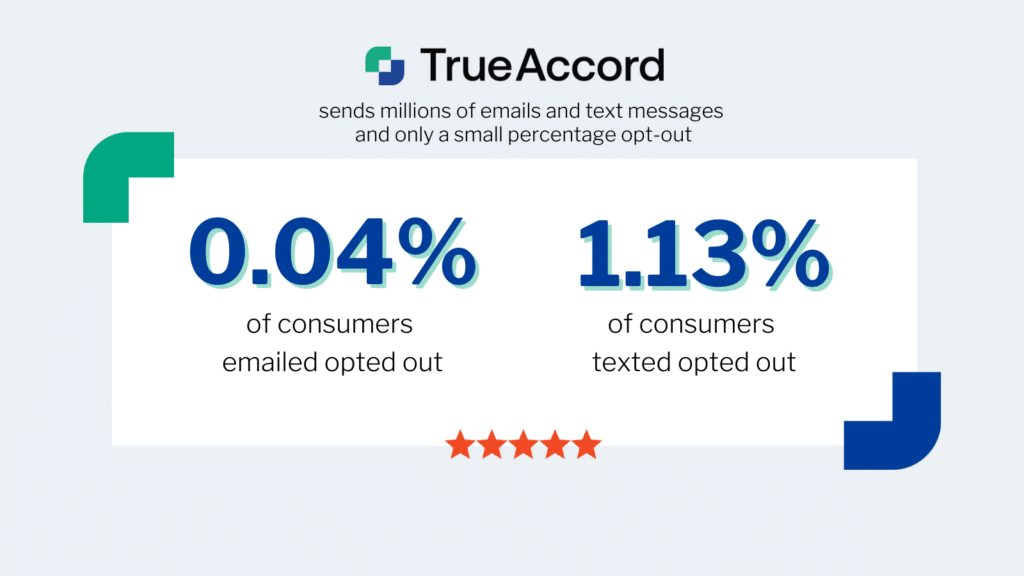

Consumers are familiar with opt-out methods such as the standard unsubscribe hyperlink in emails and the phrase “Reply STOP to opt-out” in text messages, as they do from all other unwanted communications in other industries. Not only can consumers opt-out from digital communications by simply replying stop to a text or clicking twice to unsubscribe, at TrueAccord consumers can also reply to any digital communication, phone into the office or send us a letter. Even with the multiple options and ease of opt out, few consumers unsubscribe. Of the millions of email communications TrueAccord sends, only 0.04% of consumers unsubscribe, most using the unsubscribe link provided in the email. And out of the millions of text messages we send, all text messages contain the phrase “Reply STOP to opt-out,” and on average only 1.13% of consumers reply stop.

It is a requirement of the FDCPA to include a clear and conspicuous method to opt out of digital communication. Additionally, failure to honor a request to stop communicating in a particular channel is a violation of the law subject to fines that include attorney’s fees. In addition, consumers expect an easy way to opt out, if that option is not available in digital communications (not only is it a violation of the law) but consumers can just as easily report the communication as spam which will result in the inability of the debt collector to send digital messages. All of these protections, along with the clear consumer preference for digital (in part demonstrated by their low opt out rate), negates the need to change the experience to one where the consumer has to take steps to phone in to consent before any digital communications can be sent notifying the consumer of their account in collections as will be the case if the NY and NYC amendments take effect.

Unintended Harms to Consumers if Digital Communications are Restricted

Limiting Digital Communication Use Hurts All Consumers

Requiring special consent for email, text messaging, or other digital channels, when no such consent is required for calls and letters, hurts consumers by increasing unwanted calls and litigation risk. The proposed changes will require debt collectors to capture consent from consumers directly, even when consumers already opted in to text and emails about their account with their creditors. This means that a debt collector cannot text or email to inform the consumer about their account being in collection, provide them with a notice of their rights, and detail possible next steps (the fastest, least bothersome methods of communication).

Instead, debt collectors must mail consumers letters and consumers must affirmatively respond to those letters by calling into the office (something that must be completed during working hours as opposed to electronic communications that can be explored at any convenient time for consumers). This stifles the flow of information that helps consumers make informed decisions about their finances and simultaneously helps creditors make informed choices about recovery options and future lending strategies. After all, we know busy consumers often do not respond to outbound letters.

If consumers don’t respond, then debt collectors place outbound calls—which we also know is no longer consumers’ most preferred method of communication—until they get the consumer on the phone to discuss their account and capture the direct consent that will be required if the NYC proposal takes effect.

When a debt collector cannot reach a consumer to communicate about their debt the creditor is forced to make difficult decisions about how to recover, absent an understanding of why a consumer is not reaching out. This includes a decision about whether or not to file a lawsuit to recover the debt (which, if successful, results in garnishment of a consumer’s paycheck or a lien against a consumer’s property).

In some instances where a consumer might not own property or be employed, a creditor may not file a lawsuit but simply accept the loss. This decision can have negative impacts on all consumers: in the future it will be more difficult or impossible to receive access to credit, not only for the individual consumer who was unable to repay the debt but for others consumers that have poor credit history or no credit history, as lenders become less likely to take risks when there is a lower chance of recovery. Additionally, and depending on the extent of their loss, lenders may choose to raise interest rates and APRs impacting all consumers to ultimately cover these losses.

Non-Digital Communications Can Be Disruptive to Consumers

Consumers use the internet, mobile devices, and their emails for communication, shopping, and financial transactions. When a customer defaults on their account, it is a disruption to their lives to suddenly receive phone calls and letters regarding an account for which they previously only communicated via digital channels. Many of TrueAccord’s creditor-clients, concerned about their consumer experience and their brand image, prefer a seamless transition to debt collection communications and prohibit TrueAccord from making any outbound calls or sending letters on their accounts because their customers have only ever interacted digitally.

This approach has proven to benefit the consumers that need help the most, as one customer explained to us in February, 2023: