The Startup culture has always been characterized by herd-style behavior. There is a tendency to focus on a bunch of areas that are “ripe for disruption”. After a promising / well-publicized startup draws attention to a area – be it ride-sharing, marketplace lending, payments processing, risk management, or one of many others – many more rush in, attempt to differentiate themselves and get a piece of the action.

Call me a skeptic – but when I see new entrants rushing into an already crowded niche, their reason for being there (Differentiated value prop? Superior talent? Can’t come up with a new idea, and investors are giving out free money here?) is rarely obvious.

There is one industry I can think of that has been aching for innovation, and yet has seen next to no startup activity. This industry

- Touches ~80 million Americans a year, in a way that is highly inconvenient, even disturbing

- Makes little-to-no use of digital communication

- Often burdens consumers with hefty service fees

- Is responsible for more consumer complaints to the Federal Trade Commission than any other

This industry offers an experience that many go to great lengths to avoid – and yet, because consumers have no voice in the selection of the “service provider” they deal with, customer experience is frankly not a factor industry players optimize for. The only party looking out for the consumers’ experience in this ecosystem are the regulators, who have recently proposed new rules that will improve customer experience – and, in doing so, may endanger the livelihood of the traditional service providers. Do I have you on the edge of your seats yet? The industry is Debt Collection.

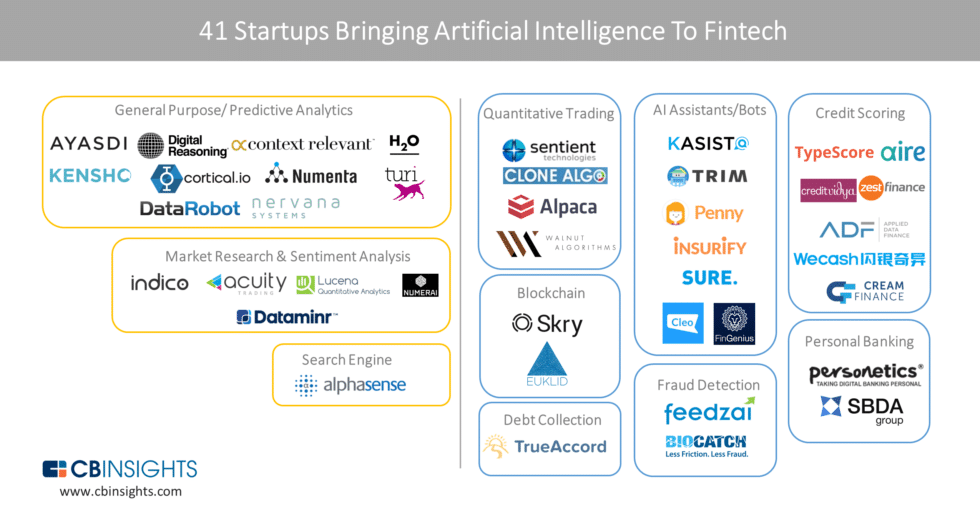

If this industry isn’t begging for innovation through usage of technology and analytics to interface with consumers in a more friendly, convenient, compliant, and effective way, what is? And yet, in the infographic CB insights published last week (see below) which shows startups bringing AI / Machine Learning to Fintech, the Debt Collection box is not crowded at all – in fact, TrueAccord is the only player in it.

This is not totally a mystery to us. Debt Collection is not a “sexy” space. The barriers to entry are also significant – it has taken us over two years to become fully licensed (as most States have separate licensing processes and requirements), and procedural Compliance requirements are complex and State-specific as well. What makes it all worth the hard work is the opportunity to make a difference for tens of millions of people, many of whom don’t know where their next rent payment will come from, who are desperately struggling to attain financial stability, and can use a service provider who is on their side and is looking to make the experience less difficult for them.

We are proud of making significant headway in a space few other startups have ventured into. Over the past three years, through a massive investment of Data Science, Analytics, and Engineering talent, access to millions of records of data, and multiple iterative optimization efforts, we have built an intelligent, automated, highly scalable Collections engine. We are excited to hear consumers tell us “We’ve never worked with a friendly collections agency before – where did you come from?”. And we are overjoyed to work with over 100 corporate clients, including several large financial institutions, that care about treating their customers (even former customers) well and are excited about the recoveries we bring (compliantly) to the table.

Will other startups join us in the Debt Collection box? If they do, we are ready – with our 3-year first-mover advantage and a product-market fit that took several years to find and build for, we are uniquely positioned to continue driving innovation, taking share in this market, and making Debt Collection a less unpleasant experience for millions of people.