Tax Season in Debt Collection

Tax season is to debt collection as holiday season is to retail. According to the National Retail Federation, of the 66% of consumers who are expecting a tax refund this year, 35.5% plan to spend their refund on paying down debt. For this reason, mid-February through May is considered the most productive time of the year for debt collection by many in the industry.

Impact on TrueAccord

TrueAccord’s approach is unique in the debt collection world, so we were curious as to how tax season would impact our business compared to traditional collection methods. In the first half of February, collections growth was trending similarly to what we saw in previous months. As the first wave of tax refunds reached consumer bank accounts the second to last week of the month, we saw a dramatic spike in customer engagement and payments towards debts. Factoring in a seasonal adjustment, we’ve estimated that tax returns more than doubled our month-over-month collections growth in February.

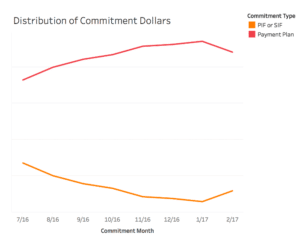

Change in Payment and Commitment Composition

When we look at the distribution between one time payments (paid or settled in full) and payment plan sign ups, payment plans as a percentage of total dollars have trended up over time as we continue to offer more consumers flexible payment options. As tax season hit, we saw a shift in composition where one-time payments as a percentage of total dollars increased by 2x.

Zeroing in on payment plans alone, we can further highlight the effect of tax refunds. The average installment amount per plan also increases with more people being able to afford shorter term plans. We see this trend across our client base with varying degrees of impact by client (from a few percentage points to over 300% month-over-month change).

Impact Compared to Traditional Collections

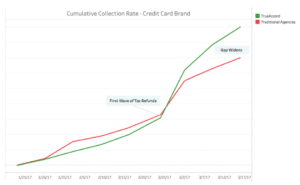

The first chart below shows cumulative collections rates for debts placed in January by one of our clients, comparing performance over time between TrueAccord and the client’s traditional collections agency partners.

Historically, collections rates for TrueAccord and traditional agencies start out relatively close (and sometimes with us trailing, as we are here) when competing head-to-head. Then about 50-60 days in, a typical shift in direction emerges where traditional agency curves begin to flatten while ours continue to trend linearly, creating an increased separation in performance over time.

In this particular case, the first wave of tax refunds hit before the 60 day mark, resulting in a sudden lift in collections on both groups. In less than two weeks, we start to see the gap widen substantially. When we include committed dollars on top of payments (second chart), the effect is even greater as many customers continue to take advantage of flexible payment options.

The tax season impact is more pronounced with TrueAccord than with traditional agencies. While traditional collections methods can be effective, success is dependent on interactions between collectors and debtors. TrueAccord’s machine learning system creates a personalized communication and offer strategy for consumers at scale, enabling more of them to commit to paying down their debts.