Social media in the business world is typically used in a few select ways: individuals that use platforms like LinkedIn to connect with one another, businesses that engage with directly with consumers on platforms’ brand pages, and businesses that place advertisements to reach specific audiences of prospective customers.

In the debt collection industry, the use of social media is regulated by the Consumer Financial Protection Bureau when used as a channel by which traditional call-to-collect debt collection agencies attempt to reach consumers that they couldn’t reach by phone must comply with the Federal Debt Communication Practices Act (FDCPA) and other state and city consumer protection laws.

The CFPB’s new debt collection rule addresses appropriate ways to use social media (among many other things), but the rule doesn’t explore the use of social media as a tool beyond private messaging. Social media platforms are very useful tools for digital debt collection agencies and creditors to communicate with consumers but not in the way you might think.

Two things you should not do with social media

Friend request

Sending friend requests to join a consumers’ social network without making it clear that the purpose of your friend request is to collect a debt is a deceptive practice. Businesses attempting to reach a consumer should never attempt to have an agent attempt to secretly infiltrate a personal network in this way.

Instead, if you are going to send a friend request to a consumer, your message should be similar to the Zortman message and make your intent behind the request clear. Beyond that, and must be a private request (see below on third party disclosure concerns).

Post on feeds

Posting a debt collection communication on a public-facing account that allows others to see the content of the message on their feed, is an explicit violation of the FDCPA’s prohibition on third-party disclosure. This would publicly expose the existence of that consumer’s debt to anyone who can view the page and is akin to the old (now prohibited) practice of public debtor boards that the FDCPA sought to end.

This doesn’t mean that social media platforms are entirely unusable in the collections space. They can actually prove to be great places to share resources and provide easy access to your team so that consumers can reach you at their discretion.

How social media can help digital debt collection

Directing to support teams

The easiest way to make effective use of social media platforms for your business is to clearly present your company’s website, phone number(s), email address(es), and mailing address(es) online. Increasing visibility and keeping your lines of communication open can lead to greater engagement.

This is especially important for digital debt collection agencies that make use of payment portals and other online tools as you can guide consumers directly to the answers they’re looking for.

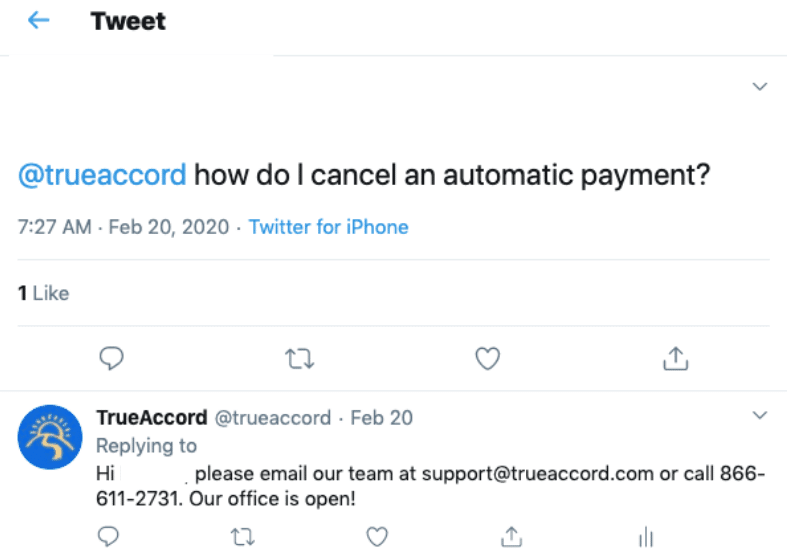

With a public-facing social media account, you will find that consumers will reach out to you with questions—even questions related to their specific accounts. You want to make sure that you are prepared to answer these questions in a discreet but helpful manner so that the consumers get the information they need without any extra disclosures about their debt.

Consumers expect this ease of access from any business, and it can make an enormous difference in the collections industry that remains largely call-based. Here’s an example of a consumer reaching directly out to our team on Twitter!

Brand Awareness

Social media platforms offer businesses the opportunity to advertise directly to specific customers based on their online activity. Collections agencies can use social media advertisements to build on brand awareness and help gain customer trust. Providing a hyperlinked statement about your company such as your mission, motto, or BBB rating that will appear in the personal advertising feed is not a collection communication – as long as it does not explicitly address that the consumer is in collections and cannot be shared to their social networks.

It allows the consumer, if they choose, an easy way to investigate a company’s website, identify your business as legitimate, and gain trust in your brand.

The role of social media in debt collection continues to evolve as legislative bodies more clearly identify how it is currently being used and how those uses overlap with existing legislation. Social media platforms are an omnipresent part of consumers’ lives, and it may seem like an easy way to reach them, but the most important thing to consider is the compliance and security of their information on evolving channels.

Mastering digital communications is easier when you choose a team at the forefront of the industry. Interested in learning more about digital debt collection? Check-in with our team.