Traditional call and collect strategies are becoming increasingly difficult to maintain. High agent turnover rates, plummeting right party contact rates, and ever-evolving legislation are driving companies to abandon long-standing practices and seek new solutions.

The two driving options for bringing collections strategies into the digital world are integrating digital collections software into an existing plan or partnering with a 3rd-party, digital debt collection agency. What are the key differences and which one will work for you? Let’s take a look at the pros and cons of each to help your team make a decision.

Debt Collection Software

Collections software can help existing teams build new, digital infrastructure. They cover a wide range of services including:

- Customizable self-service portals

- A/B testing for communication

- Engagement reporting

- SMS and email automation

- Chatbots

- Pay by text tools

These tools offer the ability to engage consumers based on their preferences for time and digital channels. They also bridge the gap between traditional collections methods and consumers that prefer emails and online portals over phone calls.

Compliance support

Software as a service (SaaS) companies in the collections space also boast built-in compliance adherence and aim to decrease the risk of agent-driven call centers.

Cons

Debt collections software solutions can offer incredibly extensive performance evaluation and automation tools, but the volume of tools available can easily become overwhelming for teams new to a digital experience. This can lead to underuse and turn a powerful tool into a wasted resource.

There is also a struggle at the industry level to help transition collections into a digital space. Call and collect strategies continue to be the norm for collections, and the voices seeking to shift the industry in a new direction are met with the Innovator’s Dilemma: “the very decision-making and resource allocation processes that are key to the success of established companies are the very processes that reject disruptive technologies…”

This caution is multiplied by the fact that these software platforms may not be all-in-one answers to a collection team’s problems. The process of integrating a single tool can be costly (in terms of both money and resources), and suddenly needing to integrate another one because the first solution did not offer a specific SMS-based tool, can mean a team starts to look more like they’re putting together technology tech stacks than a collection strategy.

Lastly, traditional call and collect teams that do integrate new technologies may rewire them to drive inbound phone calls rather than focusing on the possible growth of primarily digital approaches.

Digital debt collection agencies

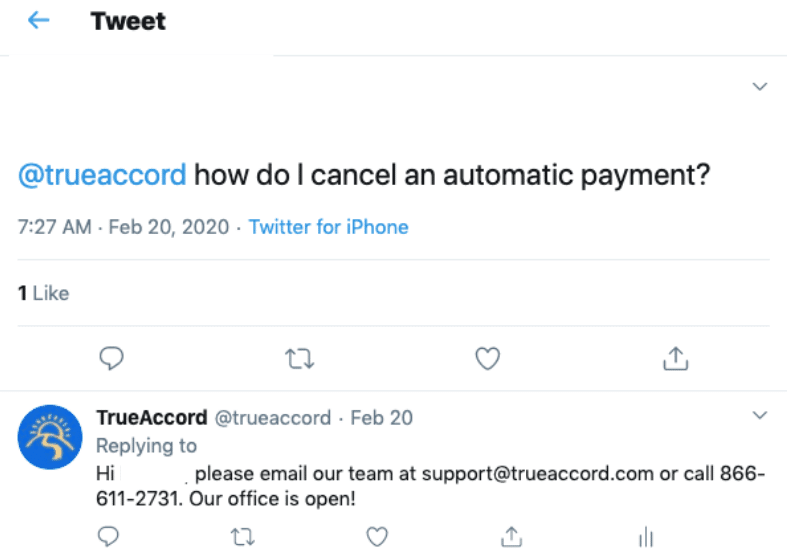

Full-service digital debt collection agencies offer many of the same benefits provided by SaaS platforms, but they also provide the expanded assistance of an expert team and end-to-end service. Software companies provide account support and insight into product performance, but digital-first agencies not only have full teams and systems dedicated to product optimization, they also have agents that are trained to work in tandem with the digital tools.

Fully integrated teams also mean that agencies can offer simple, accelerated onboarding. In contrast, software platforms vary in how easily they can be integrated into an existing strategy, but successfully maximizing their performance still requires committed internal resources.

Third-party team support

Digital debt collection agencies support their efforts with dedicated teams:

Product development

Product teams continually develop new strategies for improved digital performance including optimization of onboarding, enabling new digital tools, and continually improving the consumer user experience.

Deliverability experts

Email deliverability teams optimize contact rates across digital channels. Deliverability metrics such as open rates and click rates become essential for evaluating the success of digital campaigns when compared to traditional call-to-collect solutions.

Building a scalable email infrastructure is incredibly challenging. Companies cannot simply start sending hundreds or thousands of emails overnight. Check out this article on how to build scalable email infrastructure.

Legal teams

Dedicated agencies require licensing and must adhere to the same regulations and laws that traditional debt collectors do. This means that digital-first agencies rely on in-house legal support and compliance to keep them up to date with evolving industry legislation.

Account executives/success specialists

Account executives serve as liaisons between the creditor and the digital agency in a similar way they would for a SaaS platform.

Cons

Digital-first debt collection agencies are not the norm. The biggest challenge to working with a digital agency is trying to understand a completely new approach to debt collection. When traditional call center metrics are no longer useful and your agency partner is ready to discuss open, click, and deliverability rates, there’s a hurdle that must be overcome to viewing collections through a new lens.

The industry is gradually realizing the effectiveness of digital debt collection agencies, but their naturalization will only come after existing agencies recognize the impact of using debt collection software and encountering the challenges that come with it first-hand.

Whether your team integrates a powerful new software platform to support your internal collections efforts or brings on a third-party digital-first partner, digital debt collection is rapidly changing the collections landscape and redefining how collectors interact with consumers.

Ready to learn more about what it means to partner with a digital-first agency? We’re happy to help. Schedule some time with our team to show you what more an agency can offer!