When most people think of debt collection, the word “empathy” rarely comes to mind. As a mission-driven company, we at TrueAccord, are trying to change that. We know life happens and financial anxiety has become more common than ever—especially when it comes to dealing with debt. By understanding and anticipating a customer’s needs, TrueAccord takes an empathetic approach which enables us to tailor our message and help the consumer’s journey back to financial health. With this in mind, it’s crucial for us to understand how a consumer might feel when they fall into debt.

Understanding and Engaging with the Customer

Life happens and so do delinquencies. So far, most fintechs have been good at focusing on customer experience by investing in user research and making sure that their products resonate with their target audience. However, a customer’s situation can change at the drop of a hat and with it their financial status, priorities, and motivations. When a customer, whom you thought you knew well, has an account that goes delinquent, they essentially become a stranger. Now a whole new approach is required in order to engage with this consumer.

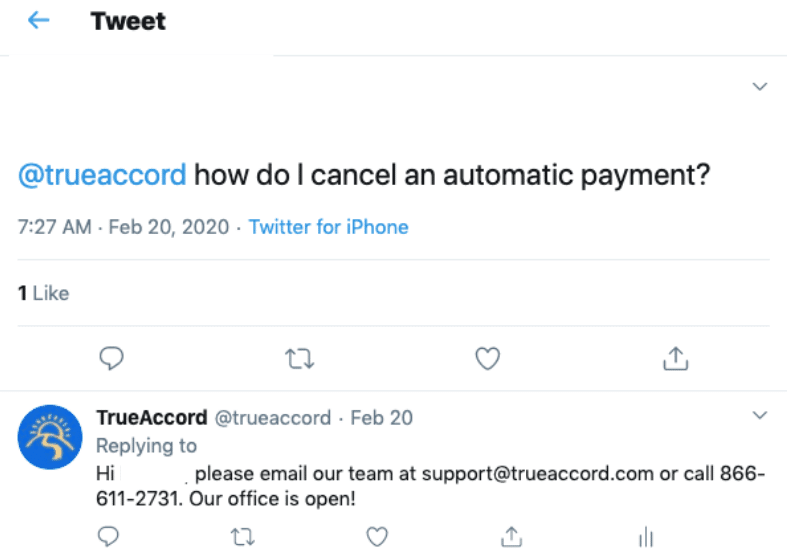

In order to adopt the right approach to engage a delinquent account, the first thing we have to figure out is who the customer is. What are their needs? What problems do they have? Do they have special circumstances? Not only is every customer different, but every interaction you may have with that customer could be different depending on what life situation they find themselves in. So it is very important to have a broad communication strategy and be ready to meet the customer when and where they are ready to engage. This means don’t limit communication channels and have options that consumers can explore, evaluate, and select on their own time.

Leveraging Digital-First Channels

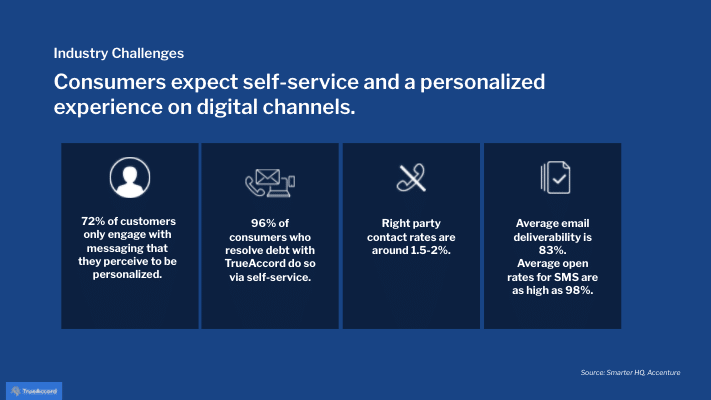

Most consumers prefer using digital channels over talking on the phone with research showing 94% of unidentified calls going unanswered. Digital channels allow people to choose when to respond without being put on the spot.

But starting a digital-first approach is not easy—it’s not just about sending emails or SMS messages to consumers. At TrueAccord we try to find the right communication channel to use for a specific consumer. We might start with a combination of email and SMS but once we get more engagement with one or the other, we’ll primarily focus on using the channel the customer engaged in.

We make sure that they’re aware of their debt and their options from obtaining more information, disputing, or evaluating payment plans all through a portal where the consumer is in control..

For consumers who do choose to set up a payment plan, we work to make sure that they have everything they need to be successful in their plan – whether that means changing the plan, the payment date, or amount, we monitor and provide content so that the consumer can effectively stay in control of their plan through successful completion – putting the consumer back in control of their own financial health while at the same time recovering for the creditor.

Using Data for a Personalized, Empathetic Experience

To truly engage consumers a successful digital strategy should go beyond a simple campaign that pushes out emails to all of your consumers at the same time every week or every other week with a generic message. Not only do you have to overcome the inboxing challenge to avoid spam filters, you need to deliver the communication at the optimal time for the consumer to open the message. And you have to have the right message, a personalized message that causes the consumer to act – to communicate back to you their intentions related to the account (dispute, full payment, payment plan, hardship, etc.).

But how do you personalize?

This is where it’s vital to leverage an understanding of your consumers. This can be done with experimentation in A/B testing consumer research, and machine learning. A/B testing and consumer research help identify what resonates with consumers and what does not. Machine learning allows personalization at scale. At TrueAccord, we rely on machine learning to continuously improve our models. We can see what digital channels, timing, and messaging each individual consumer responds best to and tailor those specific preferences to the individual journey for each consumer. We also make sure that compliance is included from the start as it needs to be regulated throughout.

For example, the best payment option is different for everyone. We provide a lot of flexibility, but we also know that showing them that flexibility up front, something that they can actually afford, will engage the customer to take the next step. Depending on the size and the age of the debt, we may show a couple of payment plans that we believe will be the most attractive to that customer along with the option to build their own payment plan. Once a customer sets up their payment plan, we send reminders when payment is due. We also have models that predict if a consumer is likely to break their payment plan based on past behavior and offer options to help keep them on track, like pushing the payment if they’re unable to pay on that date (because we understand that life happens, just like delinquencies). And as they make their payments, we celebrate their progress with them and acknowledge that they are making an effort to improve their financial situation!

The End-Product:

TrueAccord has worked with over 20 million consumers and sends over one million communications per day. For each of those communications, we’re making decisions on what to send, how to send it, and when to send it all in accordance with the legal and regulatory compliance obligations. We then use that data to continuously optimize and improve our communication method for each consumer. We’ve learned that if you’re building for the downtimes, it’s critical to realize that debt collection is a part of a consumer financial service. While our creditors are our clients, if we do what is right for the consumer (our clients’ customers), they are more likely to pay back to those creditors. A better consumer experience leads to better outcomes for all.

By incorporating an empathetic approach to debt collections, TrueAccord is able to collect more money while helping consumers with their financial situation.

Want to learn more about how your business can integrate more empathy into your collections communications? Schedule a consultation today!