When it comes to financial and lending services, the customer journey doesn’t drop off once a consumer enters delinquency—in fact, quite the opposite. In the world of debt collection, understanding this unique, and often overlooked, part of the customer journey is critical to securing repayment and debt recovery.

Welcome to the Debt Resolution Funnel. This goes beyond tracking roll rates and primary vs secondary vs tertiary account placements; it instead looks at the debt lifecycle from the consumers’ perspective in well-defined stages with the goal of repayment.

And for TrueAccord, it even goes a step further, with our resolution funnel taking a closer look at how to engage with each consumer in each stage with the optimal messaging, timing, and channel selection specific for that individual. This is possible thanks to our patented machine learning platform, HeartBeat, that automatically improves and optimizes engagement over time, all powered by engagement data from our over 20 million consumer journeys.

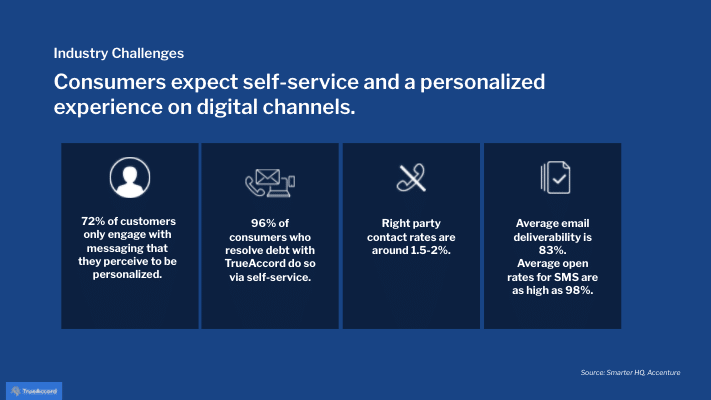

While many collection agencies still try to reach consumers through outbound calling (and struggle due to declining right-party-contact rates and tightening regulations), even those using email will typically only develop content based on what bucket the consumer is currently in and use the mass-blast approach for all customers in that particular bucket. Conversely, our patented machine learning engine, HeartBeat, dynamically optimizes the next best touchpoint for every consumer in real-time, including the content, timing, and channel for each customer.

In today’s digital world, one-size-fits-all communication strategies don’t work for any type of consumer engagement—and that has proven especially true in debt collection.

Understanding the Funnel: Tailoring Engagement Strategies for Success

Just as in marketing, where funnels mark the path from awareness to conversion, in debt collection it details the journey from debt placement to resolution. At TrueAccord, we’ve honed our strategies to optimize outreach at every stage of this journey, powered by our intelligent decision engine HeartBeat, delivering an effective resolution process for both our clients and their customers in delinquency.

Let’s take a high-level look at the distinct stages of the TrueAccord funnel and how successful engagement relies on our content, message timing, and communication channels.

Top of the Funnel: Debt Placement, Reachability, and Acknowledgement

- Debt Placement: The journey begins with debts placed with TrueAccord for collection

- Reachability: We strive to reach debtors through various channels, ensuring they are aware of their debts

- Acknowledgement: The consumer acknowledges their debts through interactions with our communications or with agents through inbound calling

Strategies at this stage focus on contact coverage, leveraging and learning through use of diverse channels for communication, and optimizing content and messaging to enhance engagement and acknowledgement rates.

Middle of the Funnel: Active Consideration and Commitment

- Active Consideration: The consumer explores their payment options, visiting payment forms, or interacting with inbound agents

- Commitment: The consumer commits to payment arrangements, initiating payment plans or settlements

Here, we concentrate on providing flexible payment options (including completely self-serve a payment portal), improving website usability, and employing targeted follow-up communications to facilitate commitment.

Bottom of the Funnel: Progression and Resolution

- Progression: Significant progress is made by the consumer towards their commitments, paying at least a percentage of their balances

- Resolution: The consumer successfully resolves their debts through payment or dispute resolution

Strategies in these stages prioritize payment plan management, personalized communications based on HeartBeat’s machine learning insights, and celebrating debtor progress to foster brand affinity.

Driving Success: Strategies for Each Stage

- Content and Messaging: Crafting compelling content tailored to specific consumer and funnel segments and leveraging HeartBeat’s machine learning for engaging messaging.

- Channel Optimization: Utilizing diverse communication channels, such as SMS and email, based on consumer preferences and behavior.

- Payment Offerings: Offering flexible payment options, including settlements and extended payment plans, to accommodate diverse financial situations.

- Website Usability: Enhancing website design and functionality to facilitate easy navigation and understanding of payment options.

- Continuous Discovery: Practicing ongoing experimentation and learning from consumer interactions to refine strategies and improve performance continually through HeartBeat.

Empowering Resolution Through Better Engagement Every Step of the Way

Shifting the mindset of the debt resolution journey only being defined through roll rates and placements to a consumer-centric resolution funnel instead can be a significant overhaul for any organization’s collection strategy. Whether communicating in-house, using a call center, or partnering with a third-party collection agency, adopting the nuanced approach we outlined above for better results takes time, a robust content library, advanced machine learning, and a platform able to scale to meet both your business’s and customers’ needs.

TrueAccord’s machine learning engine, HeartBeat, doesn’t just optimize our strategies for engagement and commitment. It leverages interaction signals to identify consumers at risk of breaking plans and automatically adapts to keep them successful until resolution. Our approach aims to engage and empower every step—and every funnel stage—along the way.

As we continue to listen, learn, and innovate, we remain committed to delivering exceptional debt collection experiences that prioritize consumer well-being paired equally with debt recovery. At TrueAccord, we’re not just collecting debts; we’re fostering resolutions and helping consumers build brighter financial futures.