Disclaimer: The information provided in this blog post does not, and is not intended to, constitute legal advice.

Protecting consumer privacy is not an unfamiliar concept in our industry and it’s something that should already be woven into our policies, procedures, and practices. With the rapid increase of state privacy laws across the United States, any company that collects, uses, transmits, or receives consumer data has to stay up-to-date on all related compliance issues.

In a previous webinar, Coast to Coast—the State of Privacy and Compliance in 2023, TrueAccord’s legal experts discussed the newest federal privacy laws and all the related compliance issues. Watch the full webinar on-demand now!

The passage of the FTC’s Safeguards Rule, amending the Gramm Leach Bliley Act (GLBA), has been a big topic in data security conversations across the financial services industry as businesses prepare to be in compliance on or before the extended effective date of June 9, 2023. Meanwhile, several states have actively been considering and passing new legislation requiring additional policies, controls, and practices not only in the data security space but also for data privacy and data breaches. It is important for Chief Information Security Officers, Privacy Officers, and Chief Compliance Officers to stay on top of this legislation, as well as Chief Executive Officers since we have seen many federal and state actions naming the CEO in their individual capacity for failing to properly secure and protect data or to properly delegate these responsibilities to the appropriate persons within their organizations.

**Please note this article is not legal advice. This is not an exhaustive list of all laws. You should consult a lawyer if you have questions about federal and state data security, privacy or breach laws.

Data Breach Laws

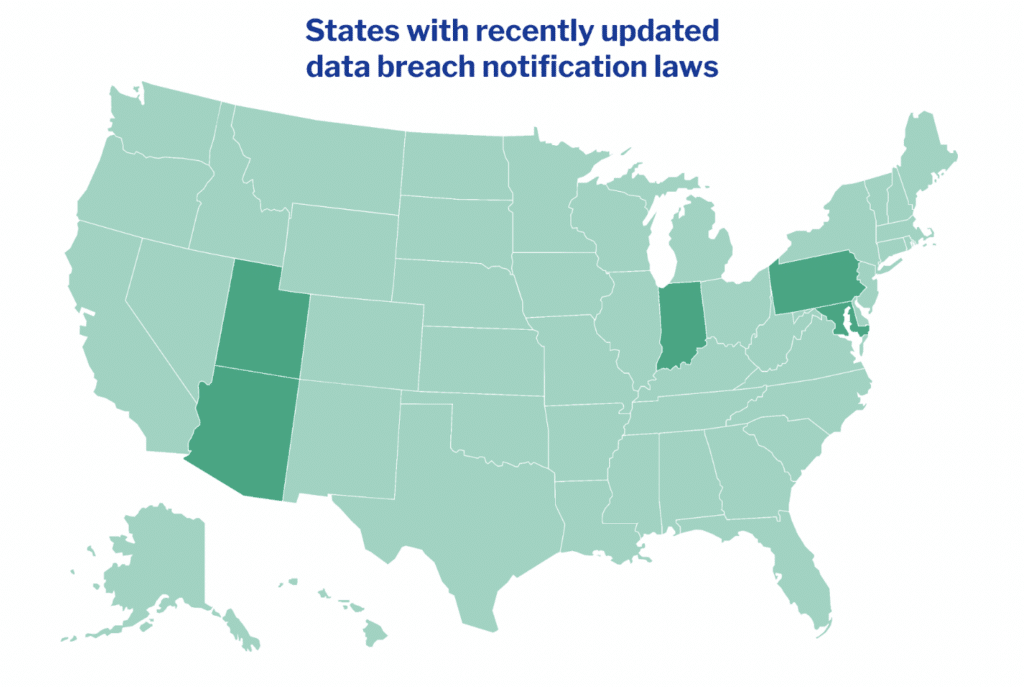

All 50 states have data breach notification laws on the books. In 2022, 19 states considered enhancing their data breach laws.

Those states that passed revised data breach laws, tightened up notification timelines, added additional definitions of what constitutes personal information, and expanded the notification requirements to include additional state agencies. For example, Arizona’s law HB 2146, amending Arizona Revised Statutes section 18-552, not only requires that notification be made to consumers but also to the Director of Arizona’s Department of Homeland Security. If the breach impacts more than one thousand people, then the law requires the notification also be given to the three largest nationwide credit reporting agencies, the attorney general, and now the Director of Arizona’s Department of Homeland Security.

While most states are shortening the time frame in which a consumer must be notified of a data breach to 45 days or less, some of these laws include exceptions or a short list of situations in which a delay in notification is permissible. For example, Indiana’s revised law, H.B. 1351, amending Indiana Code 24-4.9-3-3, limits a permissible delay in notification three circumstances: (1) when the integrity of the computer system must be restored, (2) when the scope of the breach must be discovered, or (3) when the attorney general or a law enforcement agency asked to delay disclosure because disclosure will impede a criminal or civil investigation, or jeopardize national security.

Both Maryland (H.B. 962, amending Maryland Personal Information Protection Act and section 14-3501 of the Annotated Code of Maryland)and Pennsylvania (S.B. 696, amending the Pennsylvania Breach of Personal Information Notification Act) expanded the definition of “personal information” to include medical and health information, including a definition of “genetic information” in Maryland’s law.

Since the webinar, Utah Governor Spencer Cox signed into law Senate Bill 127 on March 23, 2023, which amends the state’s data breach notification statutes. The amendments go into effect May 2, 2023.*

Along with updates to states’ laws, Federal regulators are also providing additional guidance too. For example, the Office of the Comptroller of the Currency (OCC) recently released more information regarding when banks need to know from their vendors about data breach including ransomware notifications.

Data Privacy Laws

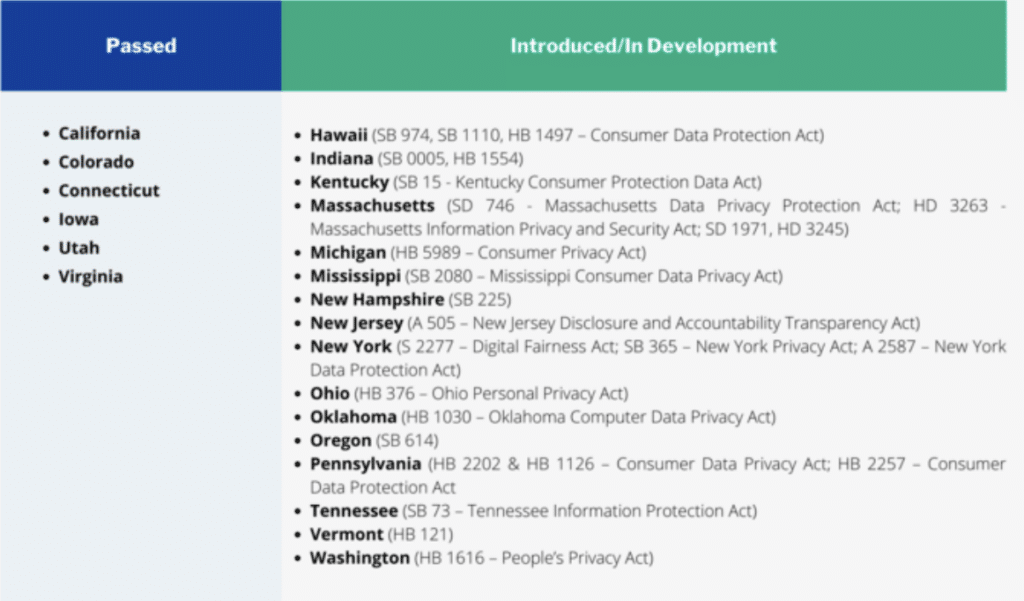

In addition to creating and updating laws to help consumers in the event of a data breach, states have also been enacting laws dedicated to protecting consumer privacy. There are six states with comprehensive data privacy laws: California, Connecticut, Colorado, Iowa*, Virginia, and Utah. These laws give consumers various rights over their personal information, such as the right to know what information companies collect and use, a right to correct their information, a right to opt-out of the sale of such information, and a right to request deletion.

In 2022, Congress introduced a federal privacy law, HR 8152, the American Data Privacy and Protection Act; however, it did not make it to the finish line despite having bipartisan support. It contained some preemption of state privacy and data protection laws, which would have been a relief to many companies navigating the existing patchwork of state laws. As of January 2023, many states have introduced privacy-related bills and this is likely to continue throughout the years to come.

California took the privacy law lead in passing the California’s Consumer Privacy Act of 2018 (CCPA) that went into effect in January of 2020 to protect the use and sharing of personal data. California recently expanded the CCPA with the California Privacy Rights Enforcement Act (CPRA) that took effect on January 1, 2023. The law created the new California Privacy Protection Agency and gave it the power, authority, and jurisdiction to implement and enforce CRPA. Additionally, businesses must regularly submit their risk assessment on the processing of personal information to this new agency.

The four other states that followed suit have substantially similar laws with broad definitions of personal information. These laws typically apply to persons that conduct business in the state and processing a set minimum of consumer data records (typically 25,000 or more) or businesses who earn at least 50% of their revenue from the sale of consumer data.

These laws give consumers various rights, such as the right to access their personal data, correct inaccurate personal data, delete personal data, in certain circumstances, obtain a copy of the personal data they previously provided to a controller, opt-out of the processing of their personal data if related to targeted advertising, sale of personal data or certain profiling activities, appeal a controller’s refusal to take action on a request, and submit a complaint to the attorney general if an appeal is denied. Interestingly, Colorado’s law makes clear that a consumer’s consent is not valid if obtained through the use of a “dark pattern.”

These laws do not give consumers a private right of action but are enforced by the state’s attorney general with civil monetary fines calculated per violation. These laws also contain exemptions for data already protected by other laws, such as HIPAA, FCRA, and GLBA.

Virginia’s law took effect January 1, 2023. Both the Connecticut and Colorado Data Privacy Acts will go into effect July 1, 2023. The Utah Consumer Privacy Act takes effect December 31, 2023. The Iowa privacy bill (SF 262) was signed into law by Gov. Kim Reynolds on Tuesday, March 28, 2023. The legislation is set to take effect Jan. 1, 2025.*

Best Practices for the Future of Data Security & Privacy

Having good security practices in place is not only beneficial for both consumers and businesses, but is absolutely critical to stay compliant with all the new laws and amendments being introduced.

So what are some of the best privacy and security practices to implement to protect customers, companies, and stay compliant?

- Practice data minimization.

- Know where personal information lives at all times by creating a data map of where the data goes and is stored throughout your systems, which includes knowing your vendor’s data security and privacy practices and controls.

- Know who has access to personal information and routinely examine if that access is necessary to complete that job function.

- Be intentional with how data is organized and stored so it can be easily segmented and treated differently if need be (think network segmentation).

- Have a public facing Privacy Notice–and make sure it accurately reflects your practices for use, collection, deletion and correction.

- Conduct an annual data security and privacy risk assessment to continually reassess areas for improvement and where you may need additional controls.

- Ensure contracts with parties whom you receive and/or give personal information to specifically address each parties’ obligations and restrictions for how personal information is used, shared, disclosed, stored, and sold (if permitted).

Compliance with data privacy and data security requirements will continue to progress as new laws and regulations are passed. Best practices will continue to evolve as well, as we continue to learn more about the expectations from Federal and state legislators and regulators, and as companies navigate evolving threats and vulnerabilities. Watch the full Webinar: Coast to Coast— the State of Privacy and Compliance in 2023 here »»

Learn more in our Compliance & Collections Resource Center or schedule a consultation today!

Footnotes:

*The Iowa privacy bill (SF 262) was signed into law by Gov. Kim Reynolds on March 28, 2023 after TrueAccord’s Coast to Coast webinar.

*The data breach law for Utah was passed on March 23, 2023 after TrueAccord’s Coast to Coast webinar