At TrueAccord, our goal is to meet customers where they are to personalize a strategy for each individual customer. We do this by sending them a communication via the right channel, using messaging that resonates with them, and making them an offer they can afford.

We’re able to achieve this thanks to insights from the 20 million customers. This includes data like what email and SMS messages drive the most engagement, which web pages are customers viewing the most, what is the ideal payment plan length, as well as where and when customers stop engaging with us. With every insight, we’re able to improve the overall consumer experience and help keep customers get back to financial health (and recover more efficiently and effectively in the process).

The Resolution Funnel

A funnel is built using a lot of data and a lot of consumer insights. It helps organize that data into a view of the customer’s journey within our product and allows us to identify areas where we can concentrate product improvements. Whether that’s making the website more user-friendly, promoting new and different channels, or utilizing our patented machine learning models—each is a different lever or strategy we can use at different stages of the funnel.

At TrueAccord, our funnel is tailored to fit our business needs while still getting all the benefits of understanding our customers’ behaviors to move them through the funnel, in our case to resolve their debt.

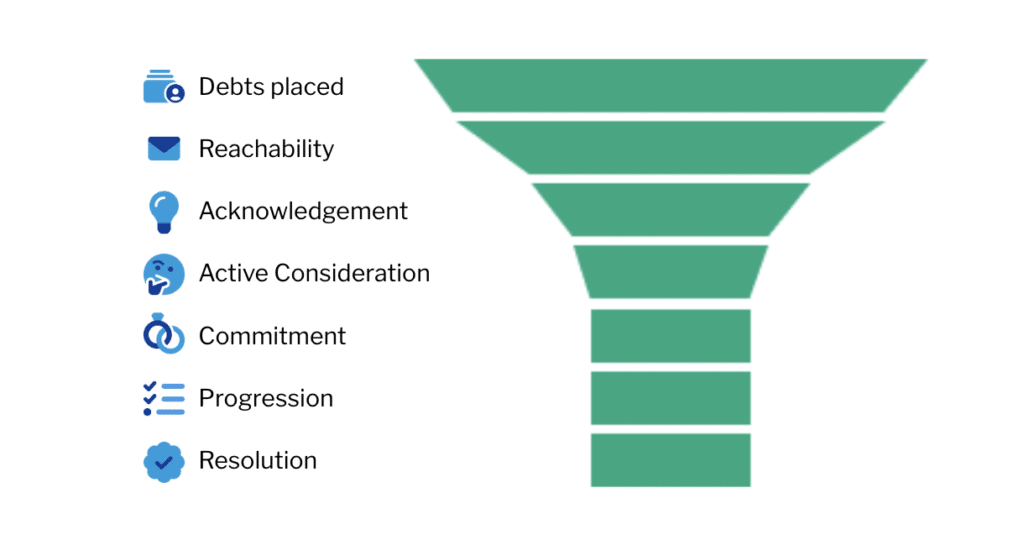

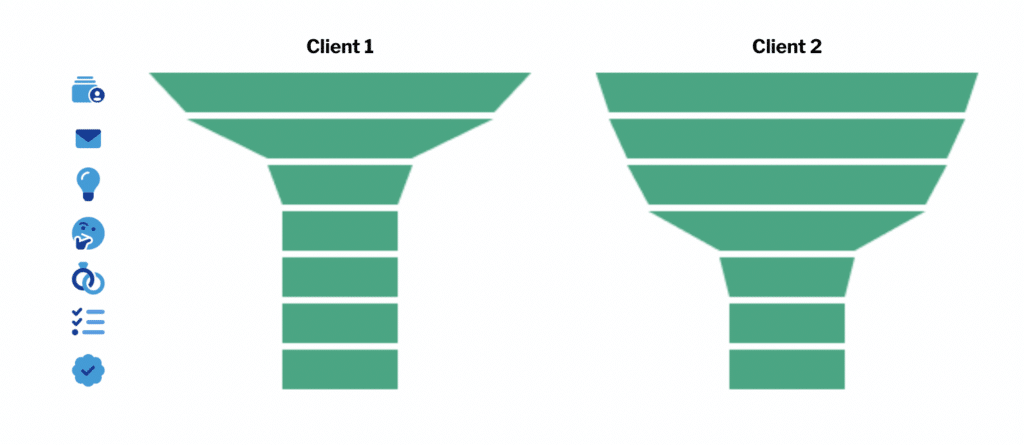

Here’s an example that gives you a good picture of how we think about the customer journey. We have two different funnels for two different clients we work with. You can see they’re fairly different in shape. At the top of the funnels you can see all of the debts placed. Next is reachability, which looks at how the customers were reached, and then if the customers acknowledged their debt, all the way down to when they resolved their debt. These funnels show that for Client 1 we should concentrate our improvements at the top of the funnel, while for Client 2 we need to look at improvements at the bottom of the funnel.

We can slice and dice the funnel in different ways to see how different customer segments are performing. This helps us identify what is working for different consumer segments and for different clients so we can see on a granular level what stages of the funnel to lean into to improve performance specifically for them.

Top of the Funnel

When planning strategies that will improve performance and customer experience at the top of the funnel, it’s important to make sure that the contact information for a customer is correct and that content is personalized in order to get engagement. The stages that make up the top of the funnel are: Debts Placed, Reachability, and Acknowledgment.

Debts Placed: All of the debts that are placed with the company.

Reachability: For the reachability stage, the goal is to reach the consumer and make sure that they’re receiving communication efforts which could be something like a customer opening one email.

Acknowledgment: This could be clicking on an email or SMS and visiting the company’s website, but it could also be from an interaction with customer support via phone or email.

Middle of the Funnel

The two stages we consider the middle of the funnel are: Active Consideration and Commitment. This is where the customer considers the options they have, chooses one, and then commits to a payment arrangement. By providing an online platform that’s easy to use and navigate through filled with helpful content, customers are more likely to self-serve.

Active Consideration: A customer visiting a payment form on the website or having the intent to pay.

Commitment: A customer signing up for a payment plan or agreeing to any other type of deferred payment.

Bottom of the Funnel

Lastly, we’ll cover the two bottom-of-the-funnel stages which are: the Progression and Resolution of the debt. In these stages, it’s essential to have a plan management system in place to help customers keep up with their payments as well as a plan in case they fall off and stop paying. The funnel ends once the customer passes through these last two stages and has paid off their debt.

Progression: A customer paying a portion of their balance either through partial payments or payment plans. Sometimes this stage is skipped if the customer pays in full or in a lump sum payment.

Resolution: The last stage of the funnel, where a consumer satisfies their agreement through paying in full, settling, or filing a valid dispute.

Effective Recovery Through the Resolution Funnel

The more you listen to your customers through their usage and their behavior, the more you can learn and improve your digital collection strategy. Funnels can be an effective tool when you’re trying to improve your performance and customer experience, which are key factors to getting customers through to repayment. It helps you segment customer groups and define how they move through your system and products so that you can focus your collection strategies on where they matter most.

Watch the full Resolution Funnel webinar on-demand to learn more about how TrueAccord gets insights on funneling customers through each phase of the repayment process.

Interested in seeing how you can funnel more customers through the repayment process? Schedule a consultation today!