Six months in, it’s safe to say 2020 is not the year that anyone expected. The worldwide spread of COVID-19 has ushered in a wave of unprecedented health and economic uncertainty that has rippled through every aspect of life.

In our report, Consumer Debt in the Age of COVID-19, we studied the impact this crisis has had on consumers so far and what it means for the months ahead, based on digital debt interaction data from more than 12 million consumers. Here are four key trends from the report:

1. Consumers chose to leverage CARES Act checks to pay off debts

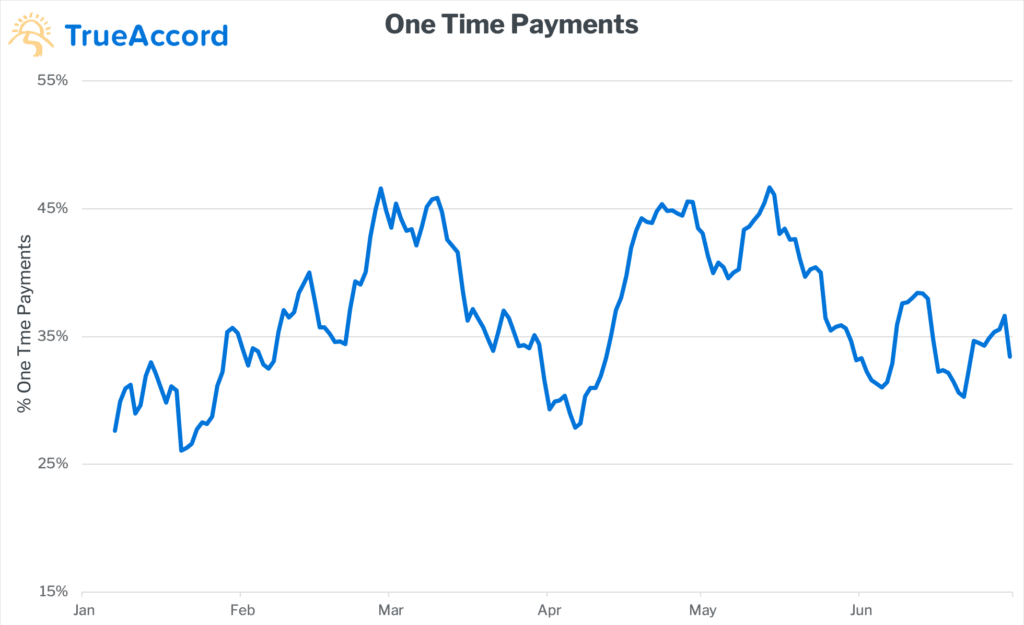

Unsurprisingly, there was a huge decrease in debt payments in early March as the nationwide economic downturn began, despite typically being the strongest performance month for debt collection. However, as a result of the CARES Act, the average personal income in the U.S. rose by 10.5% in April 2020 and many Americans chose to use this additional money to pay off debt. Specifically, there was a near-instantaneous increase in debt payments on April 15th, the day the first major wave of CARES checks hit bank accounts. On that day, debt repayment dollars were 25% higher than on February 26th, the first day of tax season and previous payment peak.

When presented with a one-time surge in income (like a tax refund or stimulus check), many consumers chose to pay off their debt all at once, rather than having to keep up with a payment plan over time. In April and May of 2020, 40% of payments were lump-sum payments — 50% more than the same period in 2019.

For many people, the stimulus check represented their path to a clean financial slate. With an uncertain economic future ahead, many opted to clear their debts completely rather than dole out payments over the course of many months. This can be especially important before a recession to ensure easy access to credit lines, should they be needed, in the future.

2. Engagement fluctuated throughout the crisis

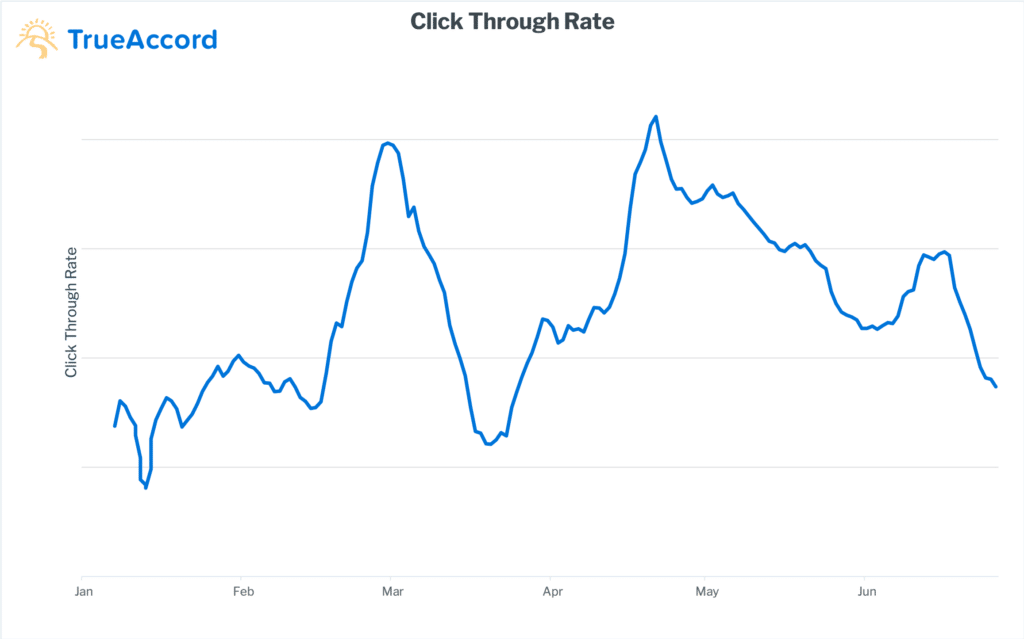

The actions consumers take before resolving a debt can provide insight into their intentions. For example, when a consumer visits a collection website, opens an email, or clicks on a link, it’s likely that they’re starting to consider their options in regards to their debt, even if they don’t take any action that day. Tracking these intention-driven engagements or “prepayment activity” can help a company understand how likely it is that consumers will pay their debts.

In terms of these types of engagement, 2020 started like any other year — there was a notable increase in prepayment activity in late February as the first tax refunds were being distributed. However, by early March, the severity of the coronavirus pandemic became evident and a steep decline in engagement began. Not long after a national emergency was declared on March 13th, engagement dropped to pre-tax season levels. For example, on March 14th, click through rates were almost 40% lower than the same date in 2019.

That all changed once the CARES Act, a $2 trillion relief bill including “economic impact payments” for many American families, was passed. The promise of an unexpected windfall caused consumers to consider paying off their debts. Even before these stimulus payments first started hitting bank accounts on April 15th, there was an increase in engagement across all channels. That bump was short-lived, as engagement began a steady decrease shortly thereafter.

3. Cash stimulus provided short-term financial stability for many

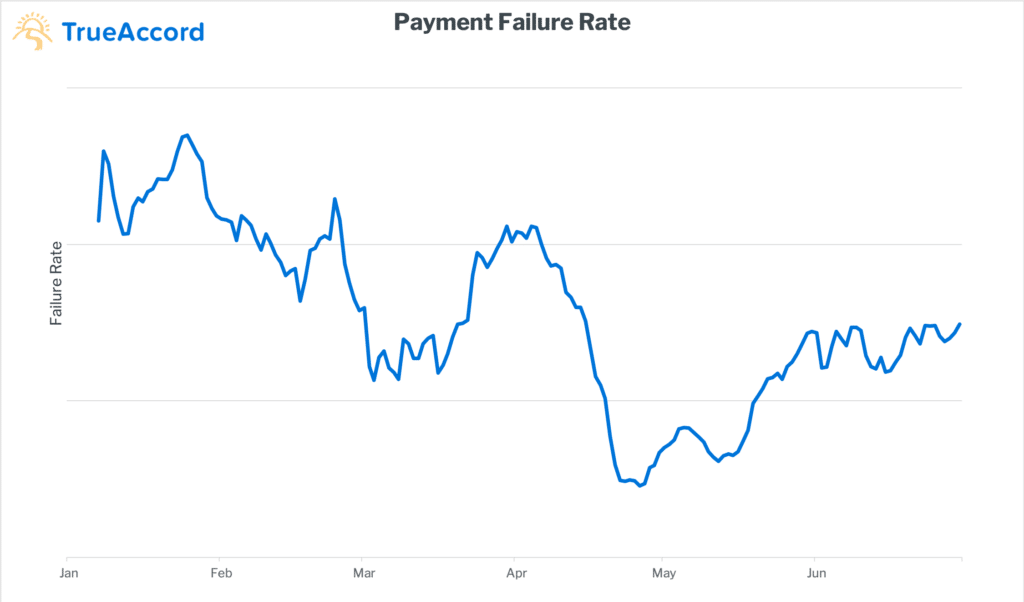

Despite the increased volume of payments, fewer payments failed in April and May than usual. In fact, for those months, there was a 35% decrease in failed payments year over year. This can be attributed to two factors: consumers preemptively modifying their payment plans in March and the sudden infusion of cash directly to consumers’ bank accounts. For some households, the combination of a tax refund, stimulus check, and additional unemployment benefits provided unprecedented liquidity.

Unfortunately, that trend (and that liquidity) did not last long. By late May, an increasing number of payments were failing. While failure rates were still below pre-pandemic levels at the end of June, they are unlikely to decrease again without additional governmental aid.

4. Flexible plan options were key in fast-changing environment

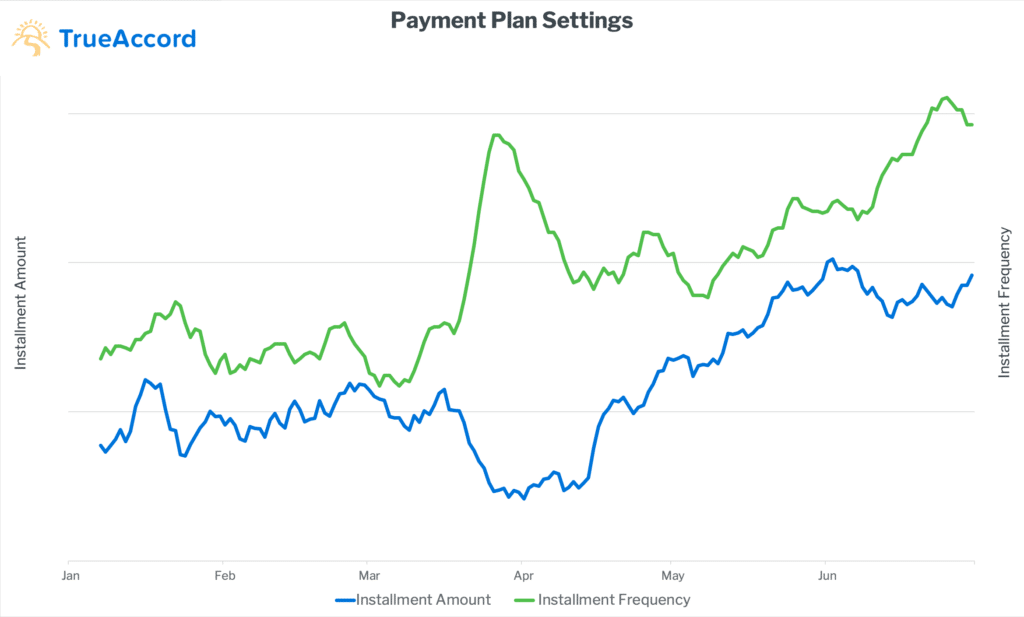

While resolving debts in full is the ideal for most consumers, it isn’t always possible. Most consumers choose to set up a payment plan that allows them to pay in smaller installments over time. In the first half of the year, consumers’ preferences for these types of plans rapidly shifted in line with changing economic conditions.

While fewer consumers started new payment plans in March than earlier in the year, those who did choose to start a plan opted for a longer time horizon and lower monthly payments. This trend was accelerated by many creditors offering longer payment plan options to better serve consumers at the start of the pandemic. In mid-March, the average payment plan was 25% longer than ones started during tax season. As uncertainty loomed, it’s likely these people tried to minimize their cash outflows.

As more money was infused into the economy through the CARES Act, that trend reversed, with consumers once again opting to start payment plans around April 15th (a 22% increase from the previous week) and choosing shorter timelines. However, by the end of May, consumers were once again opting for longer plans, and signing up at a slower pace.

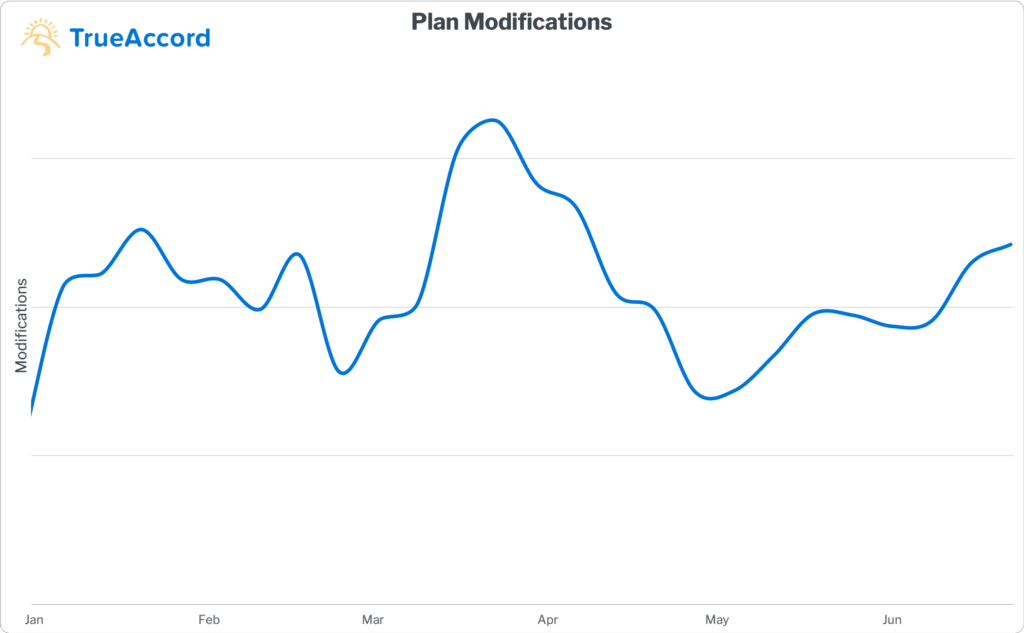

Similarly, consumers flocked to modify their existing payment plans in March as mass layoffs and furloughs spread through the country. This behavior slowed to pre-pandemic levels once stimulus was introduced, only to begin rising again in late May.

One thing is certain — the ability to set up and modify plans on their own terms was clearly important to consumers. Most consumers want to pay off their debts when possible, but in uncertain times, they may not be sure that they can afford to do so. Providing the freedom to customize a payment plan or lower monthly payments when necessary gives consumers the confidence they need to commit to a plan.

What’s next?

As Americans spend the last of their stimulus cash, and unemployment benefits are due to expire, the future looks uncertain. While one-time stimulus empowered many consumers to resolve their debts, by late May, payment failures once again began to rise, even as payments slowed. What happens in the second half of 2020 will depend on many factors including additional governmental aid, employment opportunities, viral spread, and the presidential election.

No one can be certain what will happen next, but one thing is clear: consumers need the flexibility to pay off debt on their own terms. The first half of the year showed that consumers want to pay off their debts when possible, but in uncertain times, they may not be sure that they can afford to do so. As the world settles into a “new normal,” the industry will have to be prepared for unpredictable payments based on the ever-evolving economic situation.

Want a deeper dive into the data? Download our report, Consumer Debt in the Age of COVID-19.