The collection industry has come a long way since local door-to-door agents tracking their accounts on index cards, and yet there is still a dearth of data. Most agencies rely on age-old adages or instinct to make operational decisions.

Our six years of working with millions of consumers to resolve their debts digitally has given TrueAccord unique insight into consumer behavior. We turned to our data—aggregated across more than 12 million U.S. consumers—to better understand how consumers were engaging with their debts and what it tells us about the future of the industry.

Consumer confidence in the economy matters

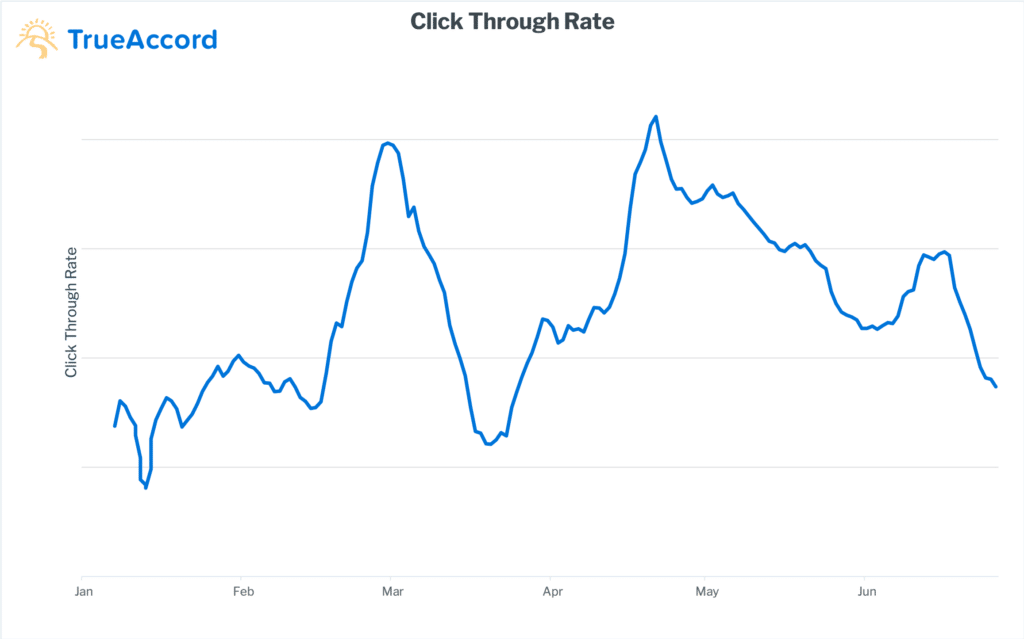

Before consumers even consider paying a debt, they start engaging with the debt collector. This engagement can take many forms, from clicking a link in an email or a text message, listening to a voicemail, visiting a debt collection website, or even calling into a support center. All of these actions indicate that a person is reviewing their options—a serious first step toward payment. Our work with consumers has shown us that engagement tends to increase when consumer confidence about the economy (and their own financial situation) is high and decreases when consumers are more uncertain about their ability to pay.

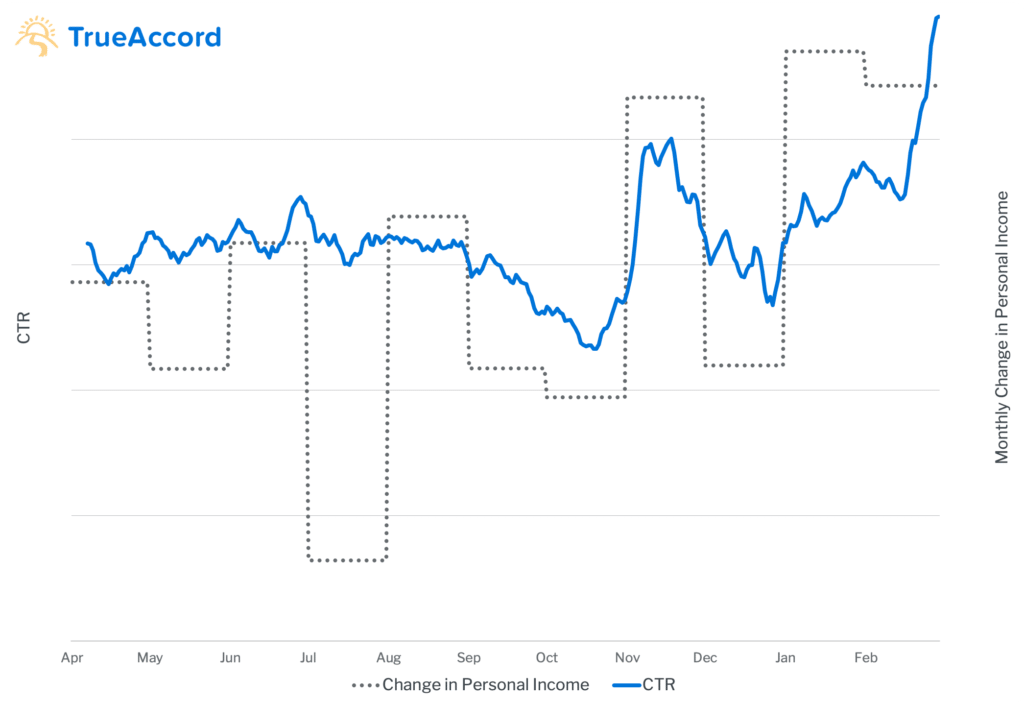

For example, the graph below shows click-through rate (CTR) trends for TrueAccord’s collection emails through late 2019 and early 2020 (the blue line), alongside the monthly change in U.S. personal income levels (the grey dotted line), based on data from the Bureau of Economic Analysis. While CTR is a more volatile metric, the overall direction mirrors the changes in personal income.

Engagement metrics, like CTR (shown here), trend positively with monthly changes to personal income.

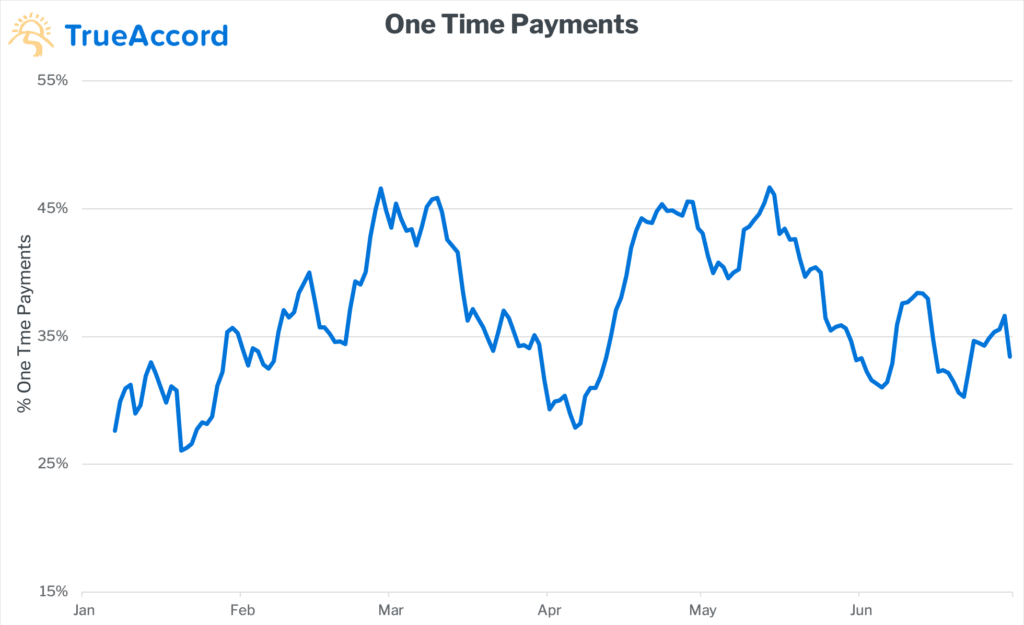

Payments are scheduled around paydays

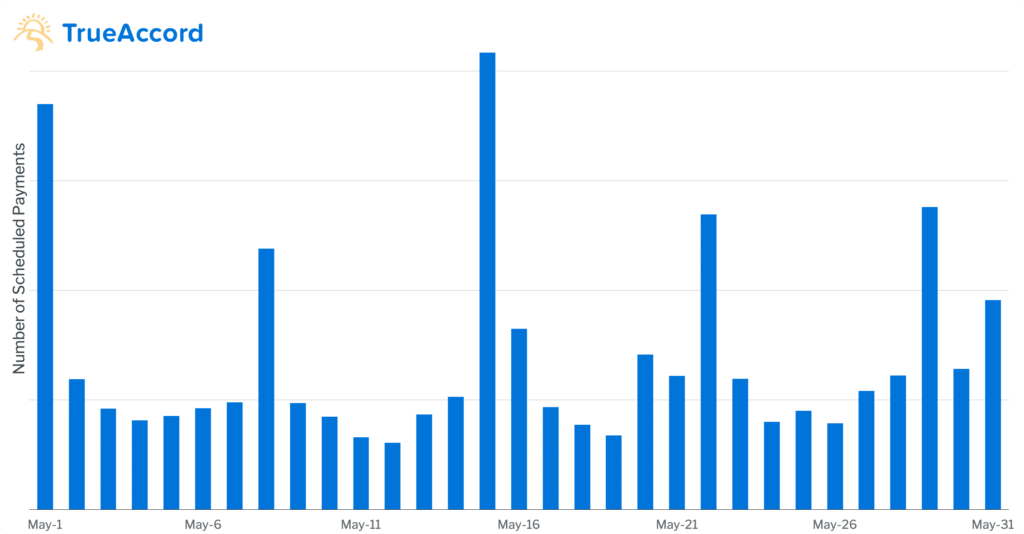

Based on TrueAccord data, it’s clear that consumers prefer to make payments on Fridays more than any other day of the week. Fridays accounted for only 14% of the days in 2019, yet 35% of payments from payment plans were made on Fridays. The first, fifteenth, and last of each month also have large surges of payment volume. It makes sense that consumers plan their debt payments around when they receive their paychecks each month.

In a typical month, payment volume is highest around popular paydays: Fridays, the 1st, 15th, and last day of the month.

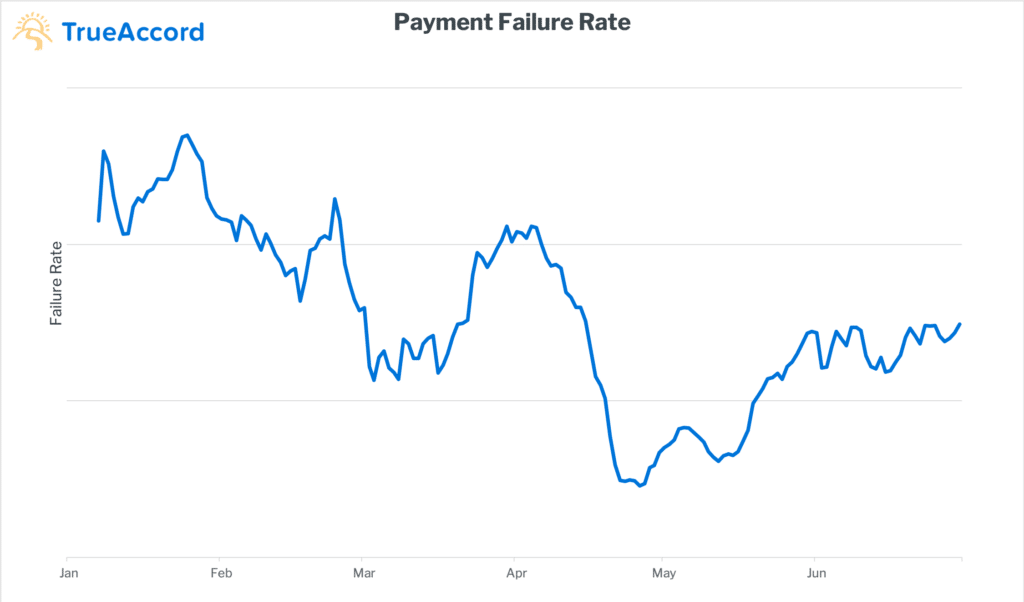

Tax season is the busiest time for paying off debt

Nearly 80% of U.S. households receive a tax refund each year, amounting to about $2,800 on average. This influx of cash can be a lifeline for many families struggling financially, so it’s no surprise that a survey by the National Retail Federation found that 34% of consumers who expect a tax refund plan to use it to pay down debt.

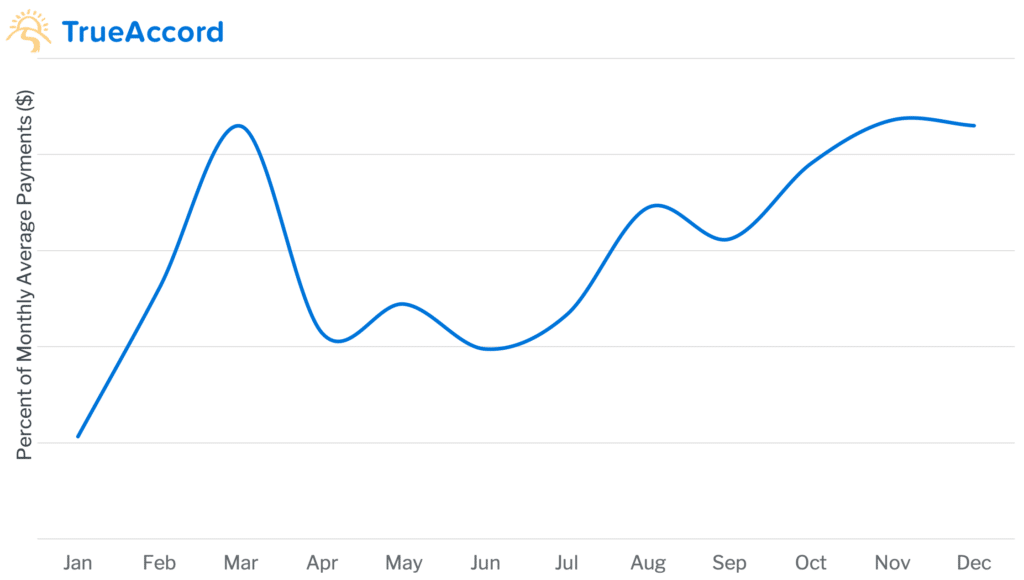

For this reason, late February through early April is the busiest time of the year for paying off debt (as shown with TrueAccord data below). In fact, we generally see a one-day peak in the last week of February, the first possible time to get a tax refund. After April, debt payments generally slow down again until Q4, when seasonal employment and gifting once again provide many American households with additional boosts of income.

Payments peak in March due to tax season, then slow down in Q3. There is another surge in payments during the holidays.

These trends all point to a simple truth—consumers choose to pay their debts when they have the money and confidence to do so. Rather than coerce consumers into making payments immediately, debt collectors should provide flexible (and ideally self-service) payment options. Especially in times of economic uncertainty, it is important for consumers to feel confident that they can adjust their payments to accommodate uneven or unpredictable cash flow.

To learn how these behaviors have changed during the coronavirus crisis, plus 4 specific actions collection agencies can take to adapt, download our report, Consumer Debt in the Age of COVID-19.