Q4 Industry Insights: Cautious Optimism with a Side of Holiday Hangover

2023 brought a whirlwind of an economy, and we spent most of the year trying to predict when things would finally turn around. The good news is that things are looking up, and so are consumer sentiments on their financial outlook. Despite the optimism, consumers are still battling high prices and interest rates, though the holiday shopping numbers would make you think otherwise. For consumers, the challenge of balancing finances persists and holiday spending hangovers are adding to the swing. If you’re a creditor or collector working with financially distressed borrowers, considering consumer situations against the economic landscape and accommodating their financial needs and preferences when collecting is critical to your success. Read on for our take on what’s impacting consumer finances and our industry, how consumers are reacting, and why employing digital strategies to boost engagement is more important than ever for debt collection in 2024 and beyond. What’s Impacting Consumers and the Industry? After a lengthy struggle against inflation and high interest rates, the economy is showing welcome signs of strength and stability, ending the year in a far better position than most predicted. Headline PCE fell 0.1% in November and was up only 2.6% from last year, unemployment remained flat at 3.7% and the economy grew at an annual rate of 4.9% from July to September. The Federal Reserve has indicated that the rate hikes are finished and it will be looking at cutting rates starting in 2024, an encouraging sign for the economy and consumers. The fourth quarter marked the resumption of student loan payments for 22 million Americans, but repayment results were low. In October, the first month of resumed payments, 8.8 million borrowers missed their student loan payment—that’s 40% of loan holders. Some of this miss is attributed to an overwhelmed system and people making use of the Education Department's 12-month "on-ramp" period, which guarantees that missed payments will not be reported to credit agencies until September 2024, protecting borrowers from the harshest consequences of missed payments like delinquency, default and collections. But interest will continue to accrue and only time will tell how much of this miss is actually due to inability to repay and what that will mean for those who can’t. The Consumer Financial Protection Bureau (CFPB) has had its hands full overseeing actors across sectors–from regional and large banks to auto and online lenders to mortgage and credit agencies–in an ongoing effort to protect consumers in an ever-growing landscape of financial product offerings. And as offerings grow, so do the issues the CFPB must watch. In Q4, the CFPB issued statements and proposed rules relating to accelerating open banking, oversight of big tech companies and other digital financial service providers, and discrimination concerns. Bureau director Rohit Chopra himself has an eye on the future, saying he's concerned that a handful of firms and individuals could wield "enormous control over decisions made throughout the world" with advances in artificial intelligence. The CFPB also took a close look at fees and interest rates, issuing guidance to stop large banks from charging illegal fees for basic customer service and finding that many college-sponsored financial products offer students unfavorable terms and unusual fees. And despite recent changes at banks and credit unions that have eliminated billions of dollars in fees charged each year, a December report found that many consumers are still being hit with unexpected overdraft and nonsufficient fund (NSF) fees. A reported 43% were surprised by their most recent account overdraft, while 35% thought it was possible and only 22% expected it. Key Indicators and Consumer Finances According to the New York Fed’s Quarterly Report on Household Debt and Credit, total household debt increased by $228 billion (1.3%) in the third quarter of 2023 to $17.29 trillion. Breaking it down, credit card balances increased by $48 billion to $1.08 trillion in Q3 2023, showing a 4.7% quarterly increase while auto loan balances rose by $13 billion and now stand at $1.6 trillion. Student loan balances also increased by $30 billion up to $1.6 trillion. Other balances, which include retail cards and other consumer loans, increased by $2 billion. Experian’s Ascend Market Insights for November reports overall delinquency (30+ DPD) rose in November, with a 7.26% increase in delinquent units and an increase of 3.54% in delinquent balances month over month. Serious delinquency (90+ DPD) continued to rise month-over-month for all products except auto loans, which appear to be stabilizing. Credit card delinquency rates, on the other hand, rose sharply in Q3, landing at 5.3% and up more than 2% from the previous year. Notably, according to a Liberty Street Economics blog post examining the composition of newly delinquent credit card borrowers, the rise in credit card delinquency rates is broad across demographics, but is particularly pronounced among millennials and those with auto loans or student loans. After months of increasing delinquency rates, it’s not surprising that charge-off rates are following. The charge-off rate for all consumer loans was 2.41% at the end of Q3, up from 1.32% a year ago. As for credit card debt, the charge-off rates clocked in at 3.79%, up more than a half point from Q2 2023 and up from 2.1% a year ago. The savings rate fell to 3.8% in Q3, down from 5.2% in Q2, while consumer spending jumped by 4%. This spending helped drive up the quarter's GDP growth rate, but less saving could be a sign of financial strain amidst nagging high prices. And the excess savings from the pandemic? Americans outside the wealthiest 20% of the country have run out of extra savings and now have less cash on hand than they did when the pandemic began, which could spell trouble for consumers in the event of an emergency or unexpected life event. About 116,000 consumers had a bankruptcy notation added to their credit reports in Q3, slightly more than in the previous quarter. And currently, approximately 4.7% of consumers have a 3rd party collection account on their credit report. Consumer Sentiment on Financial Outlook Improves The economy’s resilience seems to be encouraging for consumers, with Americans’ perceived likelihood of a recession in the next 12 months falling in December to the lowest level seen this year. In fact, the Conference Board Consumer Confidence Index® increased to 110.7, up from a downwardly revised 101.0 in November. The overall increase in December reflected more positive ratings of current business conditions and job availability, combined with less pessimistic views of business, labor market and personal income outlook over the next six months. The Federal Reserve Bank of New York’s November 2023 Survey of Consumer Expectations supports the optimistic findings. The report found that median one-year ahead inflation expectations declined by 0.2 % in November to 3.4%—the lowest reading since April 2021. Combining economic optimism with a decline in expected spending, the result is a 0.2% decrease in the average perceived probability of missing a minimum debt payment over the next three months, which is good news for lenders. Similarly, Deloitte’s ConsumerSignals financial well-being index, which captures changes in how consumers are feeling about their present-day financial health and future financial security based on the consumer’s own financial experience, increased to 101.4 in November, up from 99.1 last month and up from 97.6 a year ago. The overall takeaway is that many consumers are feeling better about their financial situations and are more optimistic about the future of the economy. Preparing for Debt Collection in 2024 Optimism about the economy’s turnaround hasn’t hit wallets just yet—consumers are still feeling the financial pinch of the high costs of rent, groceries and other basics that haven’t started retreating to pre-pandemic levels. But that didn’t stop holiday shopping—U.S. consumers spent a record $9.8 billion in Black Friday online sales, up 7.5% from 2022. Cyber Monday numbers were even stronger—consumers spent $12.4 billion, up 9.6% from the previous year. And those figures don’t include the 118.8 million Americans who spent money at brick-and-mortar stores on Black Friday weekend. Today’s consumer is using more and different financial products to cover the cost of the holidays, and Buy Now, Pay Later (BNPL) was a big driver of purchasing power this year amidst elevated interest rates. BNPL purchases, which allow shoppers to buy items on short-term credit and frequently with no interest, also reached a record high on Cyber Monday, making up $940 million of the total online spending—an increase of 42.5% over last year. While a helpful product for consumers, BNPL can be tricky as it doesn’t show up on most credit reports and can be an invisible and unaccounted-for debt burden. Every year, an estimated one-third of American adults go into debt to pay for holiday expenses. Growing debt balances, stubborn interest rates and elevated prices are still a thorn for consumers, and contribute to their overall financial stability. For lenders, service providers and debt collectors, guaranteeing repayment will still be a challenge as we start into 2024. So what’s the best way forward in engaging customers in debt collection who are balancing expenses and a bit of a holiday shopping hangover? Here are some things to consider: Prepare for timely factors. Keep in mind post-holiday bills can make January a difficult month to collect from consumers. But tax season is almost here, when consumers’ refunds create a better scenario for repayment of past-due balances. Plan for this time accordingly and ensure your engagement strategy is in place before February. Consider email deliverability. Just sending emails doesn’t guarantee your message will reach your customer. With inundated inboxes, your outreach strategy needs to include how to cut through the clutter and ensure successful email delivery of your customer communications. Learn more about deliverability, the most important debt collection metric you probably aren’t measuring, and how it impacts your debt collection efforts. Options are your way forward. If there’s one thing we’ve learned from our consumer interactions, including the 16.5 million we added in 2023, it’s that no two consumers are the same, and what works for one may not work for the next. That’s why options are so important—in communication channel, customer support method, and perhaps most importantly, in repayment. Give your customers options for engagement and payment (think partial payments, payment plans, etc.) and you’ll likely see better collection results and customer experience.

New Yorkers Should Receive the Same Digital Communications Benefits All Non-New Yorkers Receive: Part Two

In our first blog post on the New York and New York City’s proposed amendments to their debt collection laws, we explored the proposed amendments and the alternative opt-out laws in the federal Fair Debt Collection Practices Act (FDCPA) and the Washington, DC debt collection amendment that achieve the same objectives without the unintended consequences. In this part two, we explore the benefits of digital communications for consumers in all other states and jurisdictions—except New York—as well as these unintended consequences New Yorkers face from these potential amendments. Since the New York Department of Financial Services (NYDFS) is still considering the comments received to their proposed changes and the New York City Department of Consumer and Worker Protection comment period is open until November 29, 2023, there is still time for these Departments to revise their proposals to match the federal law or Washington DC’s law. Both the federal and DC laws permit debt collectors to communicate digitally about a consumer’s account as long as the digital communications contain clear and conspicuous opt-out language with strict penalties for failing to abide by the opt-out provisions. Washington, DC goes a step further and restricts digital communications to one per week unless a consumer opts in to more digital communications in a seven day period. Both NYDFS and NY should allow their consumers to have the same experience as the consumers in the rest of the country. Digital Communication Benefits Consumers, Creditors, and Collectors TrueAccord knows digital communication benefits consumers, as evidenced by countless consumers who have provided feedback (either directly or online) throughout our years in business, like this consumer who wrote in July 2023: Digital Communications are a Step Forward in Consumer ProtectionDigital communications are easily controlled by consumers and tightly managed by service providers with built in mechanisms to prevent harassment. These methods already provide superior consumer protections than phone calls and letters for several reasons: All digital communications are written, documented, and can be searched, automatically creating a paper trail of communication between the consumer and the collector. Electronic communications offer significantly better protection from unwanted or harassing communication compared to phone calls and letters. Consumers hold the power and can easily opt out of electronic communication by clicking “unsubscribe,” marking emails as spam, replying STOP to a SMS, or blocking a number entirely from their device. Service providers closely monitor inbound communications and those senders who appear to be mass marketing are often blocked from delivery altogether in the spam filters for both email and SMS. Unfortunately for licensed businesses, like law abiding debt collectors who have a legitimate reason for these digital communications, their digital communications may never reach a consumer’s phone or inbox without a very sophisticated delivery strategy that takes into account frequency. Additionally, email is designed to travel with a consumer forever, whereas addresses and oftentimes phone numbers can change. Email addresses are not ever reassigned by service providers. If consumers frequently change addresses, like military families, email may be the best channel to use to communicate as it lowers the risk of missed communication when consumers forget to update their account information with their new physical address. Consumers Prefer Digital Debt CollectionBy and large, consumers prefer to communicate with their collection agencies digitally—they already predominantly communicate with their banks, creditors, and lenders digitally, so digital collection is a smooth transition when an account moves to collection. As this consumer reported just this past August 2023: Almost all TrueAccord communications with consumers (96%) happen electronically with no agent interaction. This is possible because our electronic communications contain links to online pages where consumers can take action on their accounts. In fact, more than 21% of consumers resolve their accounts outside of typical business hours—before 8AM and after 9PM—when call centers are closed and it is presumed inconvenient to contact consumers under the FDCPA. Consumers Should Not Have to Opt-In to Electronic Communications TwiceConsumers already opt in and communicate through primarily digital channels with their creditors. Requiring consumers who have already opted in to have to again opt in to digital communications in order to discuss the same account with a collection agency adds burden to consumers. When a consumer provides their electronic contact information (email address or cell phone number) to the creditor, there should be little doubt that the consumer desires to communicate electronically. If the consumer does not, they can unsubscribe or opt out from continuing to receive messages through these channels. Consumers are familiar with opt-out methods such as the standard unsubscribe hyperlink in emails and the phrase “Reply STOP to opt-out” in text messages, as they do from all other unwanted communications in other industries. Not only can consumers opt-out from digital communications by simply replying stop to a text or clicking twice to unsubscribe, at TrueAccord consumers can also reply to any digital communication, phone into the office or send us a letter. Even with the multiple options and ease of opt out, few consumers unsubscribe. Of the millions of email communications TrueAccord sends, only 0.04% of consumers unsubscribe, most using the unsubscribe link provided in the email. And out of the millions of text messages we send, all text messages contain the phrase “Reply STOP to opt-out,” and on average only 1.13% of consumers reply stop. It is a requirement of the FDCPA to include a clear and conspicuous method to opt out of digital communication. Additionally, failure to honor a request to stop communicating in a particular channel is a violation of the law subject to fines that include attorney’s fees. In addition, consumers expect an easy way to opt out, if that option is not available in digital communications (not only is it a violation of the law) but consumers can just as easily report the communication as spam which will result in the inability of the debt collector to send digital messages. All of these protections, along with the clear consumer preference for digital (in part demonstrated by their low opt out rate), negates the need to change the experience to one where the consumer has to take steps to phone in to consent before any digital communications can be sent notifying the consumer of their account in collections as will be the case if the NY and NYC amendments take effect. Unintended Harms to Consumers if Digital Communications are Restricted Limiting Digital Communication Use Hurts All ConsumersRequiring special consent for email, text messaging, or other digital channels, when no such consent is required for calls and letters, hurts consumers by increasing unwanted calls and litigation risk. The proposed changes will require debt collectors to capture consent from consumers directly, even when consumers already opted in to text and emails about their account with their creditors. This means that a debt collector cannot text or email to inform the consumer about their account being in collection, provide them with a notice of their rights, and detail possible next steps (the fastest, least bothersome methods of communication). Instead, debt collectors must mail consumers letters and consumers must affirmatively respond to those letters by calling into the office (something that must be completed during working hours as opposed to electronic communications that can be explored at any convenient time for consumers). This stifles the flow of information that helps consumers make informed decisions about their finances and simultaneously helps creditors make informed choices about recovery options and future lending strategies. After all, we know busy consumers often do not respond to outbound letters. If consumers don’t respond, then debt collectors place outbound calls—which we also know is no longer consumers’ most preferred method of communication—until they get the consumer on the phone to discuss their account and capture the direct consent that will be required if the NYC proposal takes effect. When a debt collector cannot reach a consumer to communicate about their debt the creditor is forced to make difficult decisions about how to recover, absent an understanding of why a consumer is not reaching out. This includes a decision about whether or not to file a lawsuit to recover the debt (which, if successful, results in garnishment of a consumer’s paycheck or a lien against a consumer’s property). In some instances where a consumer might not own property or be employed, a creditor may not file a lawsuit but simply accept the loss. This decision can have negative impacts on all consumers: in the future it will be more difficult or impossible to receive access to credit, not only for the individual consumer who was unable to repay the debt but for others consumers that have poor credit history or no credit history, as lenders become less likely to take risks when there is a lower chance of recovery. Additionally, and depending on the extent of their loss, lenders may choose to raise interest rates and APRs impacting all consumers to ultimately cover these losses. Non-Digital Communications Can Be Disruptive to ConsumersConsumers use the internet, mobile devices, and their emails for communication, shopping, and financial transactions. When a customer defaults on their account, it is a disruption to their lives to suddenly receive phone calls and letters regarding an account for which they previously only communicated via digital channels. Many of TrueAccord’s creditor-clients, concerned about their consumer experience and their brand image, prefer a seamless transition to debt collection communications and prohibit TrueAccord from making any outbound calls or sending letters on their accounts because their customers have only ever interacted digitally. This approach has proven to benefit the consumers that need help the most, as one customer explained to us in February, 2023:

New Yorkers Should Receive the Same Digital Communications Benefits All Non-New Yorkers Receive: Part One

The New York City Department of Consumer and Worker Protection (NYC DCWP) just released an updated proposed amendment to its rules relating to debt collection. This updated amendment changes significantly more than the first proposed amendment released by NYC DCWP last year. Interestingly, this update contains revisions that are similar to the New York Department of Financial Services (NYDFS) proposed amendments to New York’s debt collection law, 23 NYCRR 1, that NYDFS released last year. After receiving a number of comments to the proposal, including a comment from TrueAccord, NYDFS paused the rulemaking and has not yet released any revised proposal. Both of these departments, NYDFS and NYC DCWP should change their proposed amendments to give New Yorkers the same digital communication benefits all non-New Yorkers receive. The NYC DCWP and NYDFS proposed amendments are designed in part to align with the federal Consumer Financial Protection Bureaus’s Debt Collection Rule, Regulation F, that took effect in November 2021. Even though consumers often prefer to communicate digitally, the NYDFS and NYC DCWP updated proposals are more strict than Regulation F, particularly as it relates to the proposed restrictions on digital communications. While attempting to provide additional protections for consumers when debt collectors reach out using digital channels, these NYDFS and NYC DCWP restrictions create unintended consequences that raise barriers for NY consumers to correspond with collection agencies in their channel of preference and hinder communication efforts. The effect will raise the number of lawsuits brought against NYC consumers and ultimately increase the cost of credit for all consumers across the US to offset New York losses. As a company that predominantly leverages digital communications for virtually all aspects of our customer interactions, TrueAccord has unique experience and information from serving over 20 million consumers, which showcases the benefits of digital communication in collections. Small edits to these proposed amendments can have the same desired impact (protecting consumers from a barrage of digital debt collection messages) without limiting the ability of debt collectors to proactively reach out—in fact, both the federal debt collection rule, Regulation F, and Washington, DC’s recent debt collection law amendments restrict the frequency of outbound digital communications and include specific requirements for opt-outs on all communications with severe penalties for failing to honor a consumer’s request. In this two part blog series, we explore the provisions in these proposed amendments that focus on restrictions on digital communications, the unintended consequences to consumers when laws require opt-in instead of opt-out rules for debt collectors, and how the proposals could be changed to accomplish the same result without placing barriers on consumers ability to communicate in their channels of preference—read part two here. This first installment focuses on the provisions of the law, consumers preference for digital communications, and the small changes that could be implemented before these amendments are final. The second installment seeks to provide information about the benefits of digital communications for consumers in all other states and jurisdictions—except New York. If you are impacted by the current NYC proposal, consider speaking at the upcoming hearing (virtually or in person). Information on how to register is below. Proposed New York State and New York City Amendments Three proposed amendments, two different departments, two different jurisdictions, and potential unintended consequences that can harm consumers. Let’s start by evaluating the different proposals by jurisdiction. New York’s Approach to Digital CommunicationsThe New York debt collection law, 23 NYCRR 1, which took effect in 2019, already restricted the ability of a debt collector to reach out proactively to consumers via email without first having direct express consent from the consumer. This means that a debt collector must first call a consumer to obtain consent before the collector could send an email message about the account. While a debt collector can send proactive emails in an effort to obtain consent, to comply with the law these emails cannot reference the reason why a consumer would want to opt-in to communicate by email with the company, (i.e. about a past due account) and cannot even reference information about the account. So, they ultimately sound like spam. For example, if a consumer received a message from a company they do not know, without any information about why the company is reaching out and asking for consent to email, why would a consumer opt-in? The result, not surprisingly, is that New York consumers who had already opted in to communicate via email about the account with the creditor would, after falling behind on payments and being referred to a debt collector, only receive phone calls and letters from debt collectors. New York’s First Proposed AmendmentDecember 2022 NYDFS released its first proposed amendment to its debt collection rules. Comments were due February 13, 2023. The first New York proposed amendment also never became final. The amendment included the following: Revised definitions of communication, creditor and debt and a new definition of electronic communication Revised requirements for the validation notice, including that the initial communication must be made in writing to avoid having to send another written communication within 5 days of the initial communication Revised requirement that the validation notice cannot be made by electronic communication but may be made in the form requested by a consumer to section 601-b of the General Business Law Revising the disclosure requirements for debts that have passed the statute of limitations for the purpose of filing a lawsuit Revisions to the substantiation requirements, including a 7 year retention period and requirement to provide full chain of title Revisions to the requirement for a debt collector to obtain consent from a consumer before emailing, including, extending the consent requirement to text messages, requiring the consent to be given in writing and retained for 7 years, requiring electronic communications to include clear and conspicuous opt-outs, requiring collectors to honor such opt-outs, and explaining opt-outs are effective upon receipt New provisions covering the relationship with other laws, clarifying, for example, that local laws are not inconsistent with this law if they afford greater protections New section on severability making clear that if any court rules one section of the law to be invalid, it does not invalidate the other sections of the law The proposed changes to Section 1.6(b) seek to extend the prohibition on a debt collector to reach out proactively to consumers via email without first having direct express consent from the consumer to text messages. This limits the only digital channel currently available for proactive outbound debt collection communications with consumers in New York. New York City’s Approach to Digital CommunicationsNew York City’s debt collection laws did not contain any restrictions on digital communications. But, after the New York law restricting proactive emails took effect in 2019, New York City consumers who had already opted in to communicate via email about the account with the creditor would, after falling behind on payments and being referred to a debt collector, only receive phone calls and letters from debt collectors. New York City’s First Proposed AmendmentNovember 2022 NYC DCWP released its first proposed amendment to its debt collection rules, comments were due December 5, 2022. These first NYC proposed amendments contained changes to align their laws with those of New York, however, the proposals never became final. The amendments included the following: Revised the out of statute disclosure agencies must provide on communications with consumers whose accounts have passed the statute of limitations for the filing of a lawsuit to recover the debt Revised requirements for debt collectors to maintain records of attempted communications, complaints, disputes, cease and desist requests, calls, including what calls are recorded and not recorded, credit reporting, unverified debt notices, and communication preferences (if known) as well as unsubscribes or opt-outs from particular channels New definitions for attempted communication, electronic record, electronic communication, clear and conspicuous, language access services and limited content message New prohibition on electronic communications unless the debt collector sent the initial communication with the validation notice by mail and the consumer opted in to electronic communications with the debt collector directly and clear and conspicuous opt-outs without penalty or charge on all electronic communications Revised unconscionable and deceptive practices to include: adding attempted communications anywhere communications appeared, such as adding attempted communications to the excessive frequency prohibition New prohibition on social media platform communications unless the debt collector obtains consent and communicates privately with the consumer New rules on requirements prior to furnishing information to credit reporting agencies Revised validation notice disclosures and obligations for translating, if notices are offered in different languages New York City’s Revised AmendmentNovember 2023 NYC DCWP released an updated NYC proposed amendment. Comments can be submitted through November 29, 2023. A hearing will be held that same day at 11AM. The updated version contains all of the changes suggested in the first proposal as well as: Additional revisions to what information is required to be maintained in debt collection logs that would require major changes to all collection software systems Additional new definitions for covered medical entity, financial assistance policy, itemization reference date, original creditor and originating creditor Clarifies that any communications required by the rules of civil procedure in a debt collection lawsuit do not count toward frequency restrictions New disclosures for medical debts as well as specific treatment of medical accounts, such as validation procedures and verification of covered medical entity obligations prior to collections These amendments align the New York City law to that of New York. If these amendments become final, New York will be an opt-in jurisdiction instead of an opt-out jurisdiction, meaning debt collectors must communicate by telephone or letter to obtain consent to text or email, even when a consumer already opted into digital communications about their account. This puts New Yorkers at a disadvantage from consumers in all other states who are able to communicate electronically under the provisions of the federal Fair Debt Collection Practices Act (FDCPA) and Regulation F. Opt-Out Jurisdictions Offer Consumers the Same Protections The rest of the United States have approached debt collection attempts via digital communications very differently from New York. For all consumers outside of New York, debt collectors may send proactive debt collection communications via email or text messages. The laws require all digital communications contain clear and conspicuous opt-out methods (unsubscribe flows in emails and “reply STOP to opt-out” in text messages) with strict penalties for debt collectors who do not honor a consumer's request to opt-out of digital communication channels. Digital communications also fall under the frequency limitations of the FDCPA and Regulation F. Only one other jurisdiction to date has created additional restrictions related to digital communications that exceed the protections in the FDCPA and Regulation F. Washington, DC amended their debt collection law Protecting Consumers from Unjust Debt Collection Practices Amendment Act of 2022, and the changes that took effect in January 2023. DC remains an opt-out jurisdiction with specific requirements for opt-outs on all email and text communications with severe penalties for failing to honor a consumer’s request, but also added a specific frequency limitation on digital communications. Debt collectors are only permitted to send a consumer one digital communication per week—one email or one text message (one time in a seven day period). A debt collector may only communicate digitally more than one time per week after a consumer opts-in to additional digital communications. As a result in these opt-out jurisdictions, consumers can still receive the digital communications they prefer without having to have phone calls attempting to get them to opt-in to digital communications, like the consumers in New York. Additionally, with these opt-out jurisdictions consumers learn about their account faster, can explore options on their own time, and receive the additional benefits that come with early communication about their debts—such as setting up a payment plan, having a credit reporting tradeline updated or deleted, providing evidence of fraud or identity theft, and disputing all or portions of the balance. New York consumers who do not answer their phones are less likely to receive these benefits that come with knowing there is a debt in collection and the options to resolve. Ultimately, New York still has time to amend their proposals to ensure their consumers receive the same treatment as all other consumers in the US. Consumers Prefer Digital Communication By and large, consumers prefer to communicate with their collection agencies digitally—they already predominantly communicate with their banks, creditors, and lenders digitally, so digital collection is a smooth transition. For example, almost all TrueAccord communications with consumers (93%) happen digitally with no agent interaction because the digital communications contain links to online pages where consumers can take action on their accounts. In fact, more than 21% of consumers resolve their accounts outside of typical business hours—before 8AM and after 9PM—when it is presumed inconvenient to contact consumers under the FDCPA. In fact, consumers often post publicly about their positive experience with digital collections: We believe restricting digital methods to reach and serve consumers will disadvantage vulnerable populations of consumers who primarily conduct most of their affairs digitally. According to the Pew Research Center, “reliance on smartphones for online access is especially common among younger adults, lower-income Americans and those with a high school education or less.” As the consumer described above, TrueAccord’s approach of sending digital communications helps consumers easily navigate to our website and perform actions at their convenience online. We will continue to explore the impact of these proposed amendments in the second blog post of this series, including how: Limiting digital communication use hurts all consumers Multiple opt-in requirements burden consumers Non-digital communications can be disruptive to consumers Email and text messages are a step forward in consumer protection Register to Speak at the Upcoming Hearing Sign up to speak for up to three minutes at the hearing by emailing Rulecomments@dcwp.nyc.gov. You do not have to be present at the hearing to speak if you join the video conference using this link, https://tinyurl.com/z3svub58, meeting ID: 255 089 803 499 and passcode: 8HGNSw. Read Part Two of Our Series: New Yorkers Should Receive the Same Digital Communications Benefits All Non-New Yorkers Receive Discover the unintended harms New Yorkers face if digital communications are restricted by proposed amendments to New York and New York City’s debt collection laws and the digital communication benefits consumers get in all other states here»»

Why Q4 is the Time to Evaluate Your Collection Partners

It’s hard to believe that the year is already winding down, but consumer debt certainly isn’t. And not having the right collection partner today can equate to missed recovery opportunities tomorrow. So what makes the end of the year such an important time to evaluate your current collections partner? Let’s take a look at some of the timely factors. Why Evaluate Your Collection Partner in Q4? To be Better Prepared for 2024 Be Ready for the Aftermath of Holiday Spending It should come as no surprise that consumer spending typically increases in the last few months of the year—Black Friday, Cyber Monday, Super Saturday, Boxing Day, not to mention the expenses around holiday travel too. But last year marked a particular surge in consumers putting a lot of that spending on credit, with 41% of Americans putting more than 90% of their holiday expenses on their credit cards, and one-third using credit cards for all their holiday expenses. With this heavy reliance on credit, nearly 42% anticipate going into debt to pay for the holidays—especially when considering that US shoppers took on over $1,500 in holiday debt in 2022. It feels almost inevitable that by the end of Q1 in 2024 some consumers will already be rolling over past the 90-day delinquency mark. To be ready, your debt collection should be preparing for Q1 late-stage collections now. Get a Jump on Engagement Before Tax Season Even though tax season may feel far off today, now is the time to start preparing engagement strategies to reach and remind consumers to prioritize repayments when tax refunds come around. And this shouldn’t be a novel concept to customers already dealing with debt: surveys find one in five respondents intend to pay off their holiday spending bills with federal tax refunds. In 2023, 44% of Americans reported earmarking their refunds to pay off their debt overall, according to the CNBC Your Money Financial Confidence Survey. Although paying off debt is a priority, 34% of those surveyed said they were worried their refunds wouldn’t make as big of an impact due to inflation/rising costs while still reporting that their tax refund would be critical to their household finances—don’t let your collection partner show up late to the competition when consumers are allocating those tax refund dollars. Bottom line: many consumers will likely fall into debt in Q4 due to holiday expenses, but being prepared to engage them come tax season can help influence opportunities to secure repayment as we roll into 2024. Why Opt for Digital Outreach? To Meet Consumers Where They Already Are Your collection partner needs to be prepared for when and where your customers are ready to engage. And after the holidays and gearing up for tax season, many consumers are already active online—so don’t miss the chance to engage them through digital outreach. By the numbers, consumers are primed for digital communications in Q4 and Q1 considering: In 2022 online holiday sales rose 3.5% year over year, marking the largest ever online holiday season 68% of Americans report they pay more attention to emails from companies during the holidays 93.8% of individual tax returns were filed electronically Convenience was one of the top six reasons Americans prefer filing taxes online Given that consumers will be spending a lot of time online through Q4 and into Q1, digital communications is crucial to stay top of mind as holiday spending rolls into delinquency and competition for tax refund dollars ramps up. Your collection strategy should not only include email but also be ready with the right message at the right time to secure repayment—it takes more than just generic mass blast emails to get consumers to engage. Does your collection partner have a plan to capture delinquent customers’ attention at just the right time with the right message? And not just looking ahead for Q1 engagement, but all year round. Consumers Prefer Digital for Financial Services—Any Time of Year While we see spikes in online shopping during the holiday season and more consumers choose to file taxes electronically, these aren’t the only times of year that financial transactions happen digitally. During any given month, surveys find that 73% of people worldwide turn to online banking at least once a month, with 59% specifically using mobile banking apps. This marks an increasing adoption rate of digital channels by customers to get their banking done, jumping to 83% in 2023 up from 77% in 2020. Globally, the number of online banking users is expected to reach 3.6 billion by 2024. Overall, consumers are opting for a digital experience when it comes to their finances, so using digital channels needs to be an integral part of your collection strategy year-round when you consider: 59.5% of consumers prefer email as their first choice for communication Contacting first through a customer’s preferred channel can lead to a more than 10% increase in payments 14% of bill-payers prioritize payments to billers that offer lower-friction payment experiences Is your collection partner set to deliver personalized digital communications at scale any time of year? How to Evaluate a Debt Collection Partner Selecting a debt collection partner makes an impact regardless of season, but Q4 offers businesses the opportunity to set their recovery efforts up for better success leading into tax season. But what are the questions to ask and qualities to look for in a partner? Whether your business is looking to work with a collection agency for the first time or want to reassess how effective your current provider may actually be, our latest eBook provides the Top 10 Questions to Ask along with explanations of why each specific question matters and what to look for when evaluating—available for download here»» Ready to get a jump on your debt collection strategy for 2024? Schedule a consultation with TrueAccord’s experts to get started»»

Email Deliverability: Six Key Questions to Ask Your Debt Collection Provider (and How TrueAccord Measures Up)

Did you know one of the most common reasons for missing a payment is because delinquent customers simply forget to pay their bill? But staying top of mind for consumers is harder than ever using traditional call-and-collect methods considering stricter compliance regulations and the fact that 94% of unidentified calls go unanswered. Plus, surveys have found that when it comes to debt collection, 40% of consumers state email as their first preference of communication, and contacting through a customer’s preferred channel first can lead to a more than 10% increase in payments. But, even if your collections partner claims to use digital engagement, are you actually getting better recovery rates? Simply adding email into the communication mix isn’t enough—there’s a lot that goes on between hitting “send” and reaching the inbox. Understanding the core components of a successful email program is helpful, but are your collection emails actually making it to your delinquent accounts? Unopened emails or messages trapped in spam won’t help those liquidation rates. In today’s digital world, businesses can’t afford to work with collection partners who claim to engage consumers via email but can’t back it up with the metrics to prove that their messages actually reach their intended recipients. Let’s look at six key questions to ask your collections partners, why each question is important, and how TrueAccord measures up. Want to learn more about email deliverability? Click here»» 1) What is their primary method of consumer engagement in debt collection? Why It MattersThe success of traditional call-and-collect methods are waning compared to modern digital engagement due to more consumers preferring digital communications, declining right-party contact rates, and increasing compliance restrictions. How TrueAccord Measures UpTrueAccord is a digital first, omnichannel debt collection agency—and has been a leader in digital consumer engagement. 2) How long have they used email as a form of consumer engagement in debt collection? Why It MattersMany debt collection providers have been slow to adopt digital communication as part of their consumer outreach, and even those who have integrated digital are still refining strategies for optimal outcomes. How TrueAccord Measures UpFrom the very start back in 2013, TrueAccord’s approach to consumer engagement has been digital-first and continues to grow into a robust omnichannel operation through machine learning driven by data from 20 million customer engagements and counting. 3) What is their email delivery rate? Why It MattersEmail Delivery Rate refers to the successful transmission of an email from the sender to the recipient’s mail server, measured by emails delivered divided by the number of emails sent. How TrueAccord Measures UpTrueAccord has a 99% email delivery rate, compared to the average email delivery rate of approximately 90%. 4) What is their deliverability rate? Why It MattersSuccessful email delivery doesn’t mean that it actually makes it into the recipient’s inbox. Deliverability divides how many emails reach the recipient’s inbox, as opposed to their spam folder, by the total number of emails sent. How TrueAccord Measures UpTrueAccord has a 95% deliverability rate, compared to the worldwide average of 84.8% 5) Do they measure open rates and/or click rates? Why It MattersMeasuring open rates (percentage of recipients who opened your email) and click-through rates (percentage of those who clicked on a link in the email) play a dominant role to understand which communications are resonating with recipients and which are not. How TrueAccord Measures UpTrueAccord has a total open rate 52% and total click rate 1.77%, compared to the 2023 average industry total open rate of 27.76% and click rate of 1.3%. 6) How do they make adjustments when delivery and/or deliverability rates fluctuate? Why It MattersEmail delivery and deliverability rates will fluctuate, but how a provider responds and adjusts to these changes is crucial to keeping the rates as high as possible. How TrueAccord Measures UpTrueAccord’s dedicated Email Operations and Deliverability Team proactively monitor and make adjustments, along with using our patented machine learning engine, HeartBeat. Ready to Reach Optimal Consumer Engagement in Your Debt Collection Operations? Start by scheduling a consultation to learn more about what influences email delivery and deliverability rates and how TrueAccord consistently performs above the rest. Get Start Now»»

Q3 Industry Insights: Preparing for Credit Card Bills, Student Loans and Holiday Spending

We’re approaching the end of the year and fall is in the air - along with consumer financial uncertainty. Economic stressors persist and are likely contributing to many consumers relying on credit to cover expenses, while the resumption of student loan payments adds another financial obligation to the mix. For consumers, the conundrum of balancing finances continues as the holiday spending season sneaks up. If you’re a creditor or collector working with financially distressed borrowers, considering consumer situations and preferences when collecting is critical to your success. Read on for our take on what’s impacting consumer finances and our industry, how consumers are reacting, and why employing digital strategies to boost engagement is more important than ever for debt collection in 2023 and beyond. What’s Impacting Consumers and the Industry? People are watching inflation and interest rates like hawks as effects from previous rate hikes slowly set in. The PCE price index excluding food and energy increased 0.1% in August, lower than the expected 0.2% gain. On a 12-month basis, the annual increase for core PCE was 3.9%, matching the forecast and coming in as the smallest monthly increase since November 2020. While recent indicators suggest that economic activity has been expanding and the U.S. banking system seems sound, inflation remains elevated. Tighter credit conditions will likely impact economic activity, hiring and inflation, but the extent of these effects is unpredictable. While the Fed’s latest move in September was to maintain the existing rate of 5.25-5.5%, the end goal is maximum employment and inflation at the rate of 2% and they are closely watching indicators to determine future rate changes. Since April 1, more than 7 million Americans have lost Medicaid coverage since the forced hiatus of cancellations during the pandemic ended. Many people lost their coverage because their income is now too high to qualify for Medicaid, but a larger share have been terminated for procedural reasons and states are now seeing increased appeals and complicated legal processes. After three years of relief from payments on $1.6 trillion in student debt under the CARES Act, student loan payments resume this month. 40+ million borrowers who paid $200 to $299 on average each month in 2019 will soon face the resumption of a bill that is often one of the largest line items in their household budgets. For a deeper, data-driven analysis of how student loans impact consumers with debt in collections, read our report, “Consumer Finances, Student Loans and Debt Repayment in 2023”. Meanwhile, the Consumer Financial Protection Bureau (CFPB) has been looking at lending practices, advanced technology considerations and credit reporting that impact consumers. Of note for lenders, it issued guidance about certain legal requirements for specific and accurate reasons when taking adverse actions against consumers that lenders must adhere to when using artificial intelligence and other complex models. Bottom line: “the algorithm said so” doesn’t qualify as a reason. The CFPB also started the process of issuing a rule barring reporting medical debt collections through the credit reporting system. The CFPB’s rulemaking would block credit reporting agencies from including medical debts on consumer reports that are used in making underwriting decisions. The proposal would not stop creditors from medical bill information for other purposes such as verifying the need for loan forbearance or evaluating loan applications for medical services. Key Indicators and Consumer Spending According to the New York Fed’s Quarterly Report on Household Debt and Credit, total household debt increased in the second quarter of 2023 by $16 billion (0.1%) to $17.06 trillion. Credit card balances increased by $45 billion from Q1 2023 to a series high of $1.03 trillion in Q2, a 4.6% quarterly increase. Other balances, including retail credit cards and other consumer loans, and auto loans also increased by $15 billion and $20 billion, respectively. With increased balances, delinquency remains a concern as it simultaneously continues to rise regardless of product type. Experian’s Ascend Market Insights for August reports overall delinquency (30+ DPD) rose in August, with a 2.81% increase in delinquent units and an increase of 3.11% in delinquent balances month over month. Serious delinquency (90+ DPD), which has been rising for all products, now exceeds pre-pandemic levels for auto loans and unsecured personal loans and is approaching pre-pandemic rates for bankcards, retail cards and secured personal loans. In August, the Fed reported that at the 100 largest banks, charge-off rates have been rising, most notably with credit cards. The charge-off rate for all consumer loans was 2% at the end of the second quarter, up from 1.1% a year ago. As for credit card debt, the charge-off rates stood at 3% in the second quarter, up from 2.75% in the first quarter, and up from 1.7% a year ago. Putting this in perspective, amid the Great Recession the overall charge-off rate hovered near 8% while the rate for credit cards hit 9%. While comparatively the situation may not seem as dire, the increasing trend on charge-offs is worth watching. After bottoming out in September 2021, analysts at Goldman Sachs report that since Q1 2022, credit card companies are seeing an increasing rate of losses at the fastest pace in almost 30 years, on par with the 2008 recession. Losses currently stand at 3.63%, up 1.5% from the bottom, and Goldman sees them rising up to 4.93%. Also in August, Americans' $2 trillion in pandemic savings was nearly exhausted, with the current remainder of $190 billion projected to be spent down by the end of the third quarter. This has started showing up as roughly 114,000 consumers had a bankruptcy notation added to their credit reports in Q2, slightly more than in the previous quarter. And approximately 4.6% of consumers had a 3rd party collection account on their credit report, with an average balance of $1,555, up from $1,316 in Q1. Elevated inflation continues to strain budgets - the level of inflation in July meant families spent $709 more per month than two years ago. Battling the current economic challenges, consumers still have to make essential purchases and pay bills. According to PYMNTS, 43% of Gen Z consumers have been using their credit cards more often, and 66% of this segment lives paycheck to paycheck, up from 57% last year. Upon the resumption of student loan repayments in October, this group could lose as much as 4.3% of discretionary spending power, leaving less money on hand to pay back debt. Gen Z isn’t alone - Gen X borrowers with federal student loans on the books could see their discretionary income decrease by as much as 8.8%. With a similar proportion of this cohort living paycheck to paycheck, 71% of Gen Xers reported actively using credit, with 26% reportedly using credit more often than normal for everyday purchases. And according to a recent report from PYMNTS, this group has started embracing Buy Now, Pay Later (BNPL) as a strategic tool to manage spending and cashflow. 14% of Gen Xers said they had used BNPL - that’s more than the amount of Baby Boomers, less than millennials (20%), and roughly the same as Gen Z. Consumer Sentiment on Financial Outlook Deteriorates As more consumers are turned down for much-needed loans due to financial tightening and using more credit options for everyday expenses, the general sentiments around financial wellbeing aren’t very positive. According to Deloitte’s State of the Consumer Tracker, 38% of Americans feel their financial situation worsened over the last year and less than half feel they can afford spending on things that bring them joy. A similar 48% are concerned about their level of savings and only 44% feel they can afford a large, unexpected expense. The Federal Reserve Bank of New York concurs – in its August 2023 Survey of Consumer Expectations, income growth perceptions declined that month, and job loss expectations rose sharply to its highest level since April 2021. Sentiments are down across the board: Perceptions about current credit conditions and expectations about future conditions both deteriorated, and households’ perceptions about their current financial situations and expectations for the future both also deteriorated. The key takeaway: many consumers are feeling stressed about finances and are uncertain about their financial future, which will impact their payment decisions and willingness or ability to engage with debt collectors. Preparing for Debt Collection in Q4 and Beyond As we approach the end of the year and enter the holiday spending season, businesses should prepare for the possibility of increased delinquencies as consumers reach a tipping point in savings and expenses. Last year marked a particular surge in consumers putting seasonal spending on credit, with 41% of Americans putting more than 90% of their holiday expenses on their credit cards, and nearly 42% anticipated going into debt—understandable as the average US shopper took on more than $1,500 in holiday debt in 2022. Compound the holiday expenses with resumed student loan payments, persistent inflation and high interest rates and the consumer financial outlook appears fragile. So what’s the best way forward in engaging customers in debt collection who are balancing a delicate financial situation? Any or all of these best practices can help: Go digital with communications. The numbers speak for themselves: 59.5% of consumers prefer email as their first choice for financial communication compared to only 14.2% who prefer to receive a phone call. Factor in working hour considerations and it becomes even more difficult to engage consumers via phone. Further, contacting first through a consumer’s preferred channel can lead to a more than 10% increase in payments. And digitize payments, too. Consumers have long been transacting online for purchases, and now three in five Americans expect all payments to be digital. The benefits of online payment options range from customer ease-of-use and adoption to operational cost reduction while offering increased payment volume to boot – 14% of bill-payers prioritize payments to billers that offer lower-friction payment experiences. Stay top of mind, respectfully. There’s a lot on consumers’ minds in today’s economy, and your bill may not be at the top of their priority list. When engaging delinquent customers, there are strategies to getting your message across that are better for maintaining customer relationships while effectively collecting debt. It’s important for both your customer relationships and compliance considerations to keep in mind the tone and content of your messages along with the cadence of your communications.

Top KPIs for Your Recovery Operations

The goal of a recovery operation is to maximize profitability by efficiently recovering money lent to consumers—while maintaining consumer loyalty. This means that measuring the success of a recovery strategy goes beyond just dollars and cents and into consumer-centric metrics as well. But how do teams measure overall portfolio performance, and what are the most important portfolio-level key performance metrics (KPIs)? Let’s take a look at a few of the top KPIs and how they can be categorized. Key Collections Metrics Key performance indicators for debt collection and recovery efforts: Accounts per Employee (APE) or Accounts to Creditor Ratio (ACR): the number of delinquent accounts that can be serviced by an individual recovery agent Net Loss Rate or Net Charge Off Rate: measures the total percent of dollars loaned that ended up getting written off as a loss Delinquency Rate: total dollars that are in delinquency (starting as soon as a borrower misses a payment on a loan) as a percentage of total outstanding loans - often an early warning sign on the total volume of delinquent debt Promise to Pay Rate: the percentage of delinquent accounts that make a verbal or digital commitment to pay Promise to Pay Kept Rate: the percentage of delinquent accounts that maintain a stated commitment to pay Roll Rate: the percentage of delinquent dollars that “roll” from one delinquency bucket to the next over a given period of time - provides visibility into the velocity with which debts are heading into charge off Metrics like net loss rate are the north star of a recovery program, while metrics like delinquency rate and roll rate are leading indicators of future portfolio performance. But just as critical as these traditional KPIs, today’s collection operations need to focus on implementing and measuring digital engagement. Digital Engagement Metrics A range of KPIs that capture how effectively digital channels are reaching and engaging consumers: Coverage: the percentage of users for whom we have digital contact information Deliverability: the percentage of digital messages that are actually reaching consumers Digital Opt-In: the percentage of users who have consented to receive digital communications in a particular channel Open Rate, Clickthrough Rate: the percentage of users who are actually opening and clicking digital communications Following key collection and digital engagement metrics are all well and good, but how do recovery teams move the needle on those critical KPIs? Operational metrics are the KPIs that collectively drive overall portfolio-level performance. They represent the “levers” available to change the economics of a recovery model. Operational Metrics Metrics that create simple framework to explain the profitability of a recovery operation: Profitability of a Collections Operation Formula: R x ResF x E R [Reach]: percentage of consumers in delinquency can you actually reach ResF [Resolution Funnel]: how effectively you can convert initial contact with a consumer into a commitment to pay – and ultimately, a payment promise kept (see Promise to Pay Rate and Promise to Pay Kept Rate) E [Efficiency]: calculation of what the “unit economics” of your collection are and how much it costs, on average, for every account that you rehabilitate In the hyper-competitive financial services space, consumer experience is a source of competitive advantage. That’s why it stands to reason that alongside the “traditional” metrics of recovery economics, forward-looking businesses have pioneered a new set of KPIs that measure the value of consumer experience. Consumer-Centric Metrics A new set of KPIs that measure the value of consumer experience: Net Promoter Score (NPS): how likely a consumer is to recommend a given brand after an experience with a brand’s collection organization Customer Retention Rate: how likely a consumer is to be reacquired by a given brand after his or her delinquent account is rehabilitated Keep a Close Watch on These KPIs for Collection As payment-driven organizations across verticals focus further into the world of recovery, it is safe to anticipate that digital engagement and consumer-centric KPIs like the ones we covered above will become even more deeply woven into the fabric of the organization. Ready to evaluate your debt recovery operations using more sophisticated KPIs? Schedule a consultation to get started today»»

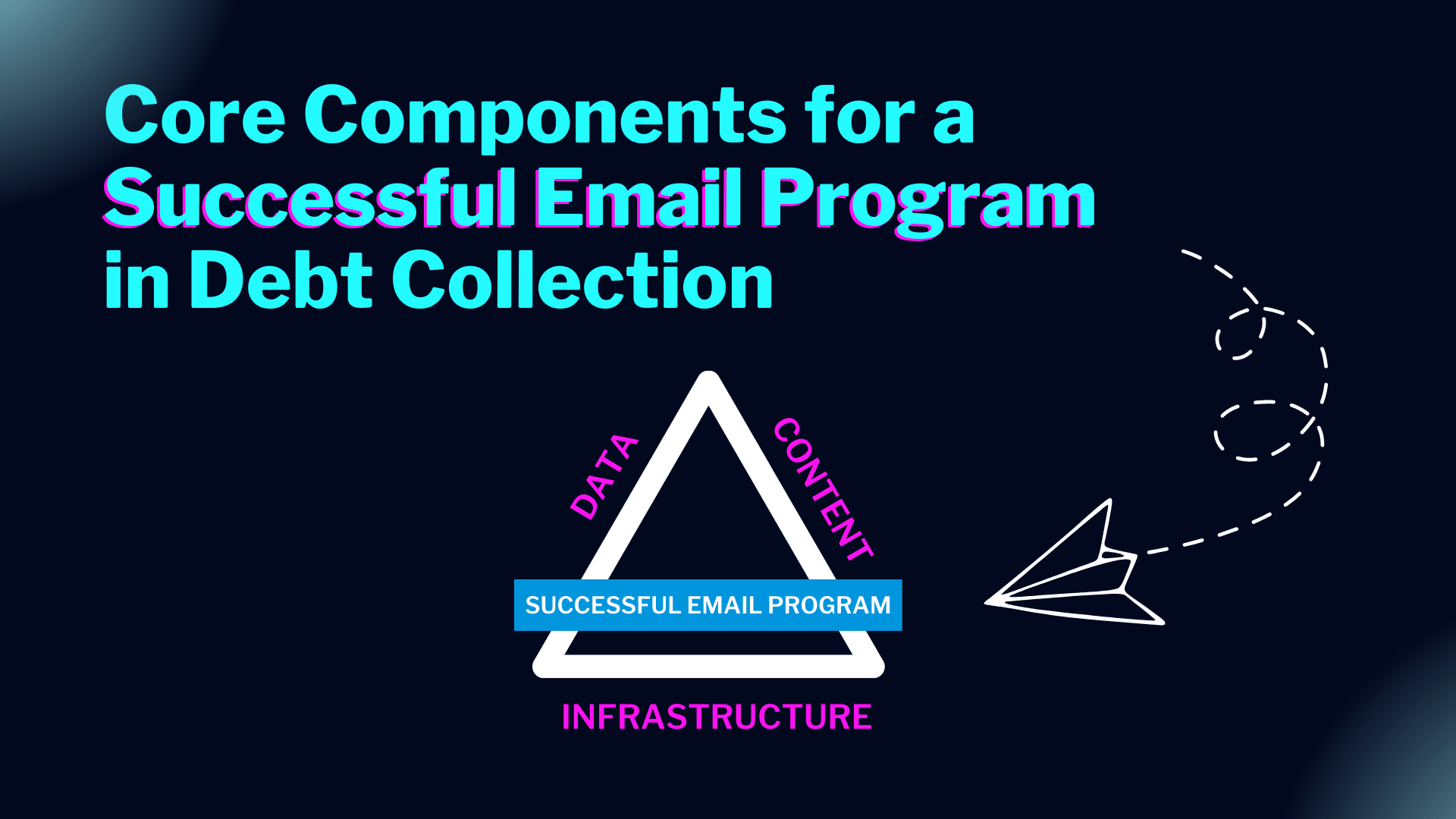

Core Components for a Successful Email Program in Debt Collection

If your business and collection partners aren't utilizing email in your debt recovery strategy, you’re leaving vital engagement opportunities (and potential collections) on the table. There are plenty of reasons why digital communications are the way to go, but reaching out through email is especially important in collections. Surveys show that 59.5% of consumers prefer email as their first choice for communication, and 14% of bill-payers prioritize payments that offer lower-friction payment experiences, which increases to 23% for millennials specifically. Considering this, it shouldn’t come as a surprise that courts have actually ruled that “an email is less intrusive than a phone call” for debt collection. But what makes a successful email program when it comes to connecting with delinquent accounts? Whether your business is handling collections in-house or are looking at working with a third party, your operations should be confident that you have these core components covered. Core Components for a Successful Email Program While adding email into the communication channel mix is critical, it is the set up, execution, and continued optimization of that email program that can actually make a difference when it comes to consumer engagement. There are many elements to a successful email strategy, but here are three of the core components that we’ll focus on: Infrastructure, Data, and Content All 3 are required for a successful email program—each one relies on the other two to create a high performing program. Let’s take a look at why each of these is important and the risks that can occur without each component in place. INFRASTRUCTURE The infrastructure an email program is built on has many components itself: Mail Servers, Mailbox Providers, Internet Service Providers (ISPs), Email service providers (ESPs), and more. How these components are set up and work together influences sender reputation, which in turn influences email delivery rates. You can learn more about these different pieces in our blog focusing on the The (Hidden) Anatomy of Email here»» While infrastructure can admittedly be complex, the risks your operation runs without a sound infrastructure are clear and quite consequential, including having your emails blocked, deferred or delayed delivery, or winding up lost in the recipient’s spam folder. DATA In today’s digital world, data is everywhere—but how you harness that data can make or break your email program (and even get you into hot water if you or your collections partner are not following all the necessary compliance regulations around data privacy and protection). Understanding data helps intelligently influence an email program, especially when focusing on email engagement metrics such as: Opens Clicks Unsubscribes Spam complaints Hard Bounces Spam traps But without quality data analyzed appropriately, your emails could result in consumer complaints, hard bounces, falling into spam traps, not to mention negatively impacting all the engagement metrics listed above. CONTENT Solid infrastructure and reliable data are essential in any email program, but when it comes to debt collection, content can be the tipping point between a consumer committing to repayment or ignoring the outreach altogether—or even reporting your communications as spam or harassment. From subject lines to your call-to-action (CTAs), sending the right message to your customers is crucial. Without compelling content you miss opportunities to capture consumers attention resulting in fewer opens, fewer clicks, or even pushing consumer perception in the wrong direction. If you lose your customers’ trust, you’re most likely going to lose the chance to recover their debt. Successful Email Engagement Can Boost Debt Recovery Studies have shown that engaging consumers through digital methods can increase resolution rates by as much as 25%. But if your digital efforts are missing any of the core components we just covered above, it doesn’t matter if your collection strategy includes email—your operations are going to be missing recovery opportunities. Ready to step up your engagement with better email strategies? Schedule a consultation to get started»»

Between Hitting “Send” and Reaching the Inbox: The (Hidden) Anatomy of Email

When it comes to reaching consumers, it’s no secret that email has surpassed phone calls as the preferred method of communication. In fact, 59.5% of consumers prefer email as their first choice for communication. But just because your business sends emails to consumers doesn’t mean that your messages make it to their inbox. And if that email never reaches the intended recipient, it doesn’t matter what that customer’s preferred method of communication may be. There are more factors than you may realize that go into whether or not your email reaches the consumer’s inbox, so let’s look at the hidden anatomy of email and the factors that influence where your emails end up. What’s the Difference Between Mail Servers, Mailbox Providers, ISPs, and ESPs? Before we look at what happens when you hit “send” on that email, it’s important to identify some of the key components that operate behind the scenes to get your message from point A to point B. Mail Server: A mail server (also known as a mail transfer agent or MTA) is an application that receives incoming email from the sender and forwards outgoing messages for delivery to the recipient. Mailbox Provider: A mailbox provider provides email hosting and implements email servers to send, receive, accept, and store email for the recipient. ISPs: Internet Service Providers (ISPs) provide internet. Although ISPs can provide email services, separate ESPs are often used for business email operations—but ISPs play a major role in email delivery and landing in the recipient’s inbox. ESPs: Email service providers (ESPs) are a service that enables businesses to send emails and email campaigns to a list of subscribers. How Does Email Actually Work? When you hit the “send” button, your ESP sends the email to the recipient’s mail server through various protocols such as SMTP (Simple Mail Transfer Protocol). The delivery process involves establishing a connection with the recipient’s mail server, transferring the email content, and receiving a response indicating whether the email was accepted or rejected by the mailbox provider. Several key factors play into whether an email gets tagged in spam or junk or filtered into “social” or “promotion” categories. Mailbox providers and anti-spam filters make inbox placement decisions based on a 30-day rolling history of sender reputation metrics Inbox placement is based on the subscriber’s interaction, regardless of your business model All types of emails are subject to the same filtering, regardless of content At TrueAccord, every time we send an email our email providers notify us of events like delivered, open, click, hard bounce (such as an email being sent to an invalid or nonexistent email address), soft bounce (typically an indicator of a temporary technical issue on the recipients’ end), and spam complaints. In the case of bounces, TrueAccord stores that data and categorizes it as not delivered. Emails that result in a soft bounce are temporary bounces and could get delivered within 72 hours. For hard bounces, we will not send to those again—or it severely hurts our reputation among ESPs and ISPs. For Regulation F compliance when delivering disclosures electronically, debt collectors are required to monitor for deliverability. TrueAccord presumes that any hard bounce or undelivered soft-bounce (one that is not delivered after 72 hours of the first soft bounce) has not been delivered. Why are ISPs So Selective? the ISPs are selective on what emails get accepted and which actually reach the inbox. But there are three key initiatives ISPs consider: To protect email account owners from: Spam Scams Poor experience To protect and prioritize company resources: Limited email engines i.e. mail servers Limited bandwidth Limited personnel or internal expertise To continue driving revenue: Lower email interaction reduces ad impressions and revenue Too many emails can lead to account abandonment from subscribers Best Practices to Get Your Emails Delivered Understanding the different components of email, how it actually works, and the selective filters in place to protect consumers are all important to a successful email program. Now let’s look at several best practices to follow: Build and maintain a positive sender reputation with ISPs and ESPs Ensure good email list hygiene Send to actively engaged subscribers Maintain consistent volume and cadence (avoid spikes) Avoid spammy subject lines Develop valuable content that would engage subscribers While many of these best practices may seem like no-brainers, achieving them can take more skill and effort than most businesses expect. Each of these contribute to email delivery rates and more importantly, deliverability to recipients’ inboxes—key drivers towards consumer engagement and your bottom line. Ready to step up your engagement with better email strategies? Schedule a consultation to get started »»

Q2 Industry Insights: Higher Monthly Expenses for Consumers, Regulatory Guidance for Financial Institutions