Delivering communications to your customers has always been a compliance challenge with the plethora of laws, regulations, court decisions, and regulatory guidance in the debt collection space. Today with more communication channels available and regular communication from debt collection regulators—via consent orders, compliance bulletins, supervisory highlights, and even press releases—your compliance management systems and design must be flexible and easy to update.

To get expert insights on the newest compliance issues and opportunities that need to be front of mind when sending digital communications to effectively engage your customers, Associate General Counsel Lauren Valenzuela and Director of User Experience Shannon Brown teamed up to discuss the Future of Collections & Compliance in TrueAccord’s latest webinar.

Watch the full webinar on-demand here»»

Below are some of the key takeaways from their discussion, plus attendee poll results on top compliance questions.

*This blog is not legal advice. Legal advice must be tailored to the particular facts and circumstances of each unique matter.

The Current State of Compliance

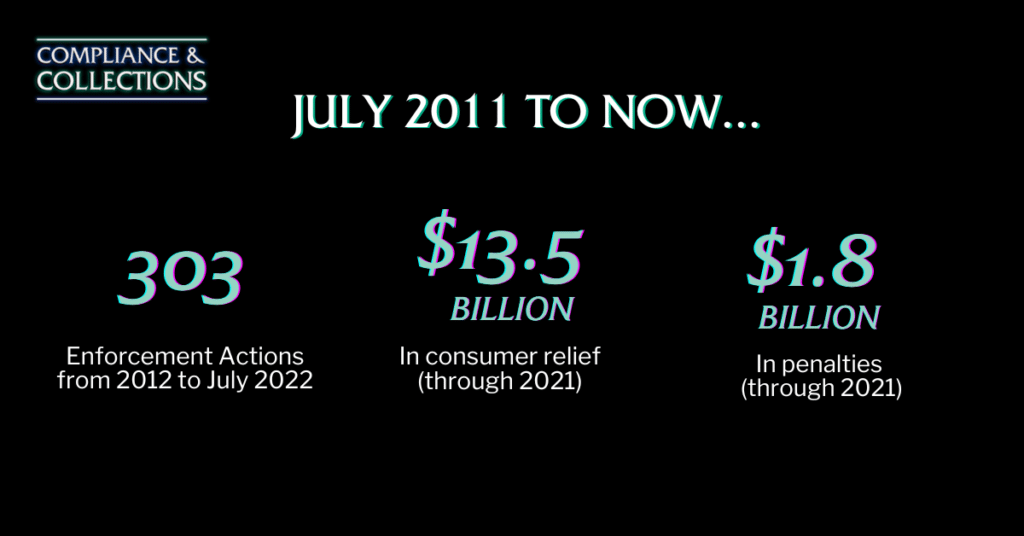

Lauren Valenzuela [LV]: Needless to say, over the last 10 years the CFPB has fundamentally changed how we think about and approach compliance. That has really influenced our industry and how we think about communications in debt collection.

LV: Over the last decade the CFPB has taught us that compliance is an evolving thing. It’s not something that you can set and forget. It is something that is dynamic and that must constantly evolve and mature in order to be effective, because our environment is constantly changing.

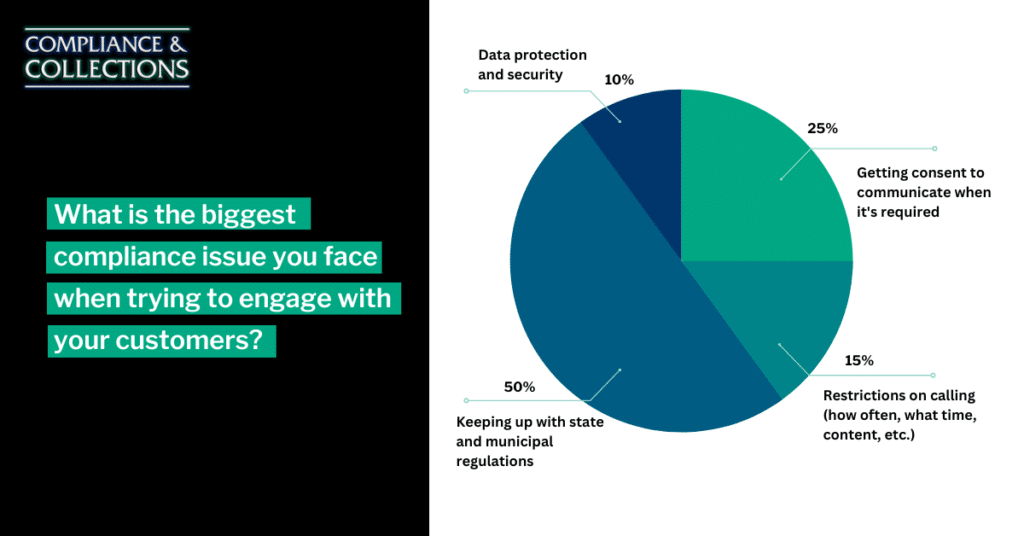

Attendee Poll Question: What is the biggest compliance issue you face when trying to engage with your customers?

Changing Consumer Preferences for Collection Communications

LV: The CFPB recently published a blog and shared that it is a “mobile first” agency, meaning that most people who visit its website are using mobile devices or smartphones. Here at TrueAccord, what does our information show about mobile usage?

Shannon Brown [SB]: Consumer mobile use has skyrocketed. In 2016, about a quarter of our consumers were using their phones to read emails and visit our website—and that number has increased to consistently above 80%. We’ve put a lot of effort into making sure our emails and website are responsive to make sure we’re meeting the needs of our consumers who are overwhelmingly on mobile. We’ve made sure our pages are able to load faster for consumers that have less stable cell connections and really made sure our interactive elements are big and optimized for tapping with a finger instead of clicking with a mouse. As far as communications, our consumer research has really shown that most consumers don’t answer the phone and want to be contacted through digital channels—they want a multi-channel experience.

LV: So we’re seeing consumers increase use in mobile phones. Even the Bureau has seen that, and we’re seeing banks increase their use of digital technologies to communicate and facilitate transactions and engage with their consumers as well.

What’s the Role of the Legal Team in Your Collections Strategy?

LV: There needs to be a partnership between compliance and pretty much all core functions, and especially at a fintech company like TrueAccord where our technology and our digital communications platform are the center of what we do to help consumers. It’s really neat to see compliance interwoven, and I think that’s reflective of its compliance management system and company culture.

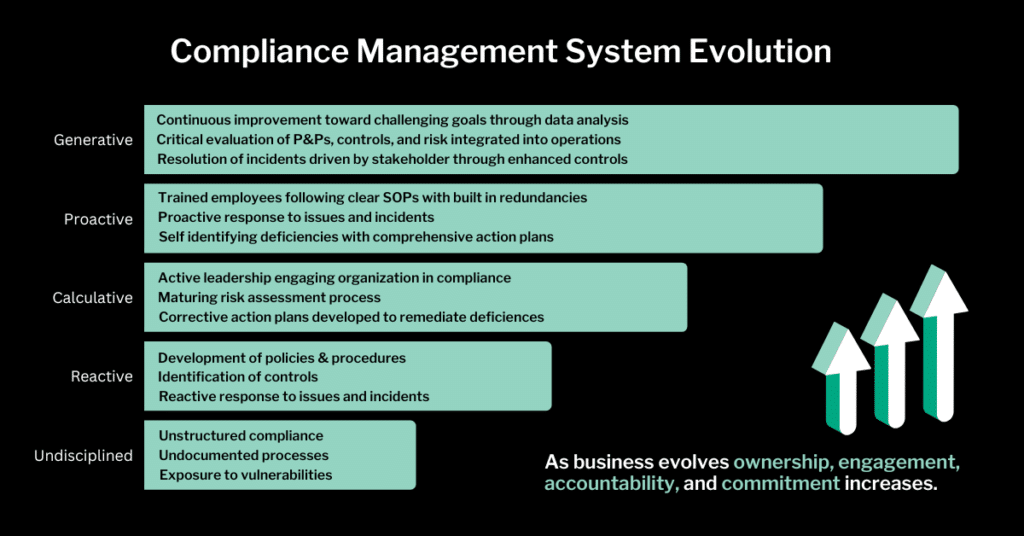

Compliance Management System Evolution

LV: Ten years ago, many collection agencies were likely in the undisciplined stage, where there was some type of compliance ongoing, but it didn’t have much structure—processes may be undocumented, potential exposure to vulnerabilities that expose themselves on lawsuits, for example.

The next iteration is reactive, meaning there is development of some policies and procedures, controls are identified, and the company is responding to issues and incidents reactively.

The next level is calculative. At this level, leadership is actively engaging the organization in compliance, risk assessment processes are maturing, corrective action plans are being developed and executed to remediate deficiencies.

This next level is proactive, meaning employees are trained and following clear policies and procedures, and such procedures have built in intentional redundancies. The organization is being proactive in identifying and responding to issues and incidents and is self-identifying deficiencies and essentially executing on comprehensive corrective action plans.

Generative means that there’s continuous improvement towards challenging goals, which are driven by data analysis. There’s critical evaluation of policies and procedures and controls, and risk is integrated in operations. Issues and incidents resolutions are driven by stakeholders and really enhanced controls.

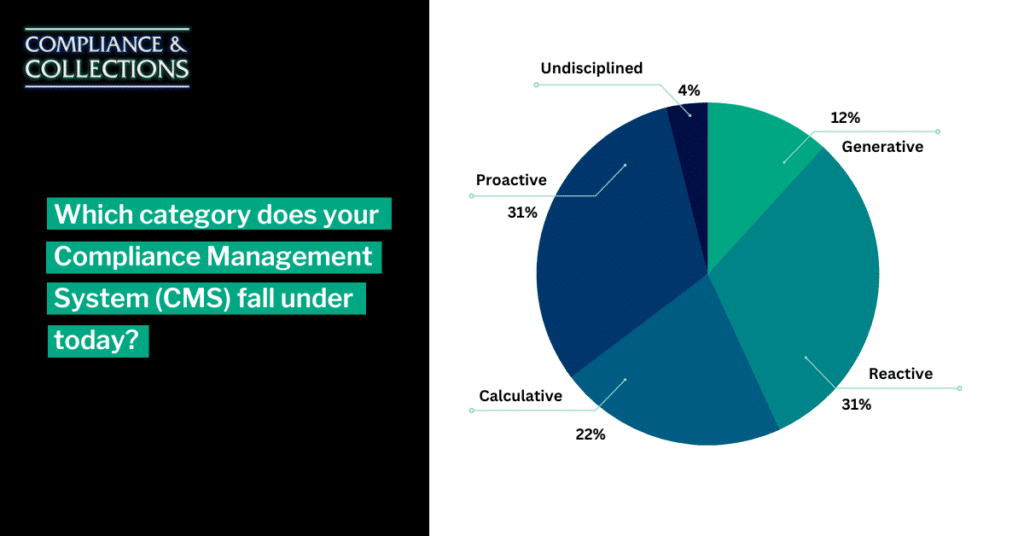

Attendee Poll Question: Which category does your Compliance Management System (CMS) fall under today?

LV: So no matter where you’re at within your compliance management system and no matter what maturity level, the important thing to remember is that you don’t have to stay there—you can evolve. We can’t stress this enough. Compliance is an evolving and dynamic thing, and should be constantly evolving to stay effective in whatever environment it is in.

The fact that TrueAccord has a well-oiled compliance management system allows us to study that climate and then figure out how to translate it and make tangible improvements in our consumers’ experience. That’s something we encourage everyone to do: think about the consumer experience and the environment you’re collecting in, because it looks remarkably different than it did five years ago for example, and we should all be evolving.

The Product Perspective

LV: How has the CFPB influenced how we develop our products here at TrueAccord?

SB: Compliance has been built into our product development life cycle. Besides frequent meetings with our compliance team for feedback and approvals throughout the life cycle, we’ve designed and built our product so we can be nimble in responding to regulatory changes, which we know happen a lot.

LV: There are numerous federal, state, and local laws. Can you give some insight into how we at TrueAccord keep up with all of that?

SB: One of the ways we efficiently keep up with the requirements is through our code-driven approach.

But what does that mean practically? It means, for example, that for any phone call coming in, our agent knows exactly what disclosures need to be given to that consumer via our system, and then gives them an opportunity to log it. It means that any email that goes out has all the necessary disclosures appended, such as out of statute disclosures, state disclosures, et cetera, and these are all kept in our code base. Not only does it take the guesswork out of the equation for our agents and our content team that’s sending communication, it reduces human error. It also means that anytime anything needs to be updated, for example, a wording in a disclosure or when a new disclosure needs to be added, we can do it in one place instead of across a variety of templates and areas of the website. We can do it in one place and then that change propagates throughout the system. This helps us to react to changes really quickly.

Our compliance team is involved in every aspect of the process. They start as educators for the whole product team—we’re all aware of regulatory considerations and know where and when we need to ask for feedback and approvals from our compliance team. So they aren’t just making sure that agents are acting compliantly, but that the product team has that knowledge as well.

And as a product team, we have this wonderful research function that’s constantly talking to consumers and trying to understand their needs and asking for feedback, which we share with our compliance team so that they can go and advocate for consumers when they are talking with regulators and legislators

Future Forecast: Where is Compliance Heading in the Collections Industry?

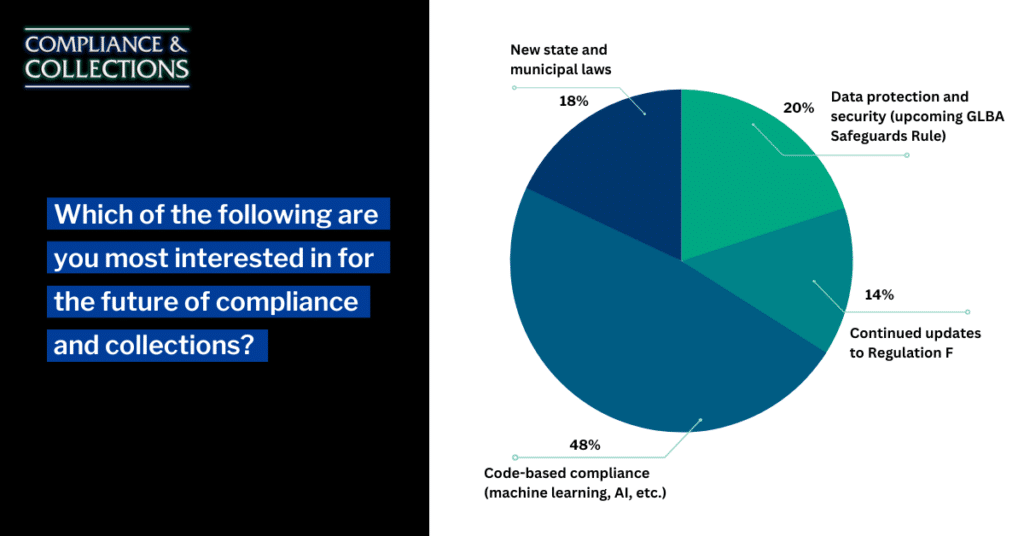

LV: The next iteration of compliance can be seen in some of the recent CFPB and FTC activity. Last year in 2021 for example, the CFPB published a new section of its supervision and examination manual, specifically an information technology focused compliance management review section. The Bureau is looking at any type of technologies that you may employ, like machine learning models, algorithms, or analytics.

If you’re using any kind of algorithms or machine learning to help inform any aspect of your collection strategy—or if any of your service providers are using any type of algorithms or machine learning to help provide a service to you—you must pay attention to this section of the manual because it’s incredibly informative. We’re seeing the CFPB and the FTC addressing companies’ use of data and technology, wanting to make sure that companies have proper governance and oversight of it.

All of this recent activity shows how compliance within any company, more than ever before, must really take a cross functional approach to its work in order to keep up with the evolving environment. The compliance function should not be siloed. It really needs to be in partnership with all different disciplines and functions within the organization. We’re seeing right here and now and into the future, your information technology professionals, your information security professionals, your product professionals, your engineers, your data scientists, anybody who looks, touches, thinks about data and technology should all be working with compliance

Attendee Poll Question: Which of the following are you most interested in for the future of compliance and collections?

Three Key Takeaways

LV: Compliance is more than a department, it’s more than a program, it’s more than a system. It should be part of an organization’s cultural DNA. So when you think about compliance, wherever you are within an organization, think about how you can make it part of your organization’s DNA.

SB: Concentrate on building your tools to be nimble to the regulatory changes. Things like the design systems and the component libraries that allow you to make those changes quickly and easily, and make sure that they’re made everywhere across the system so you don’t have those older disclosures hanging out somewhere that someone forgot to change. Build your tools so you can make changes in one place efficiently.

LV: As our environments get more sophisticated around us, compliance professionals need to collaborate cross functionally more and more with other disciplines within a company to be effective and stay ahead of the evolution.The more the industry uses data and technology, we have a responsibility to make sure that it is being used in accordance with the law and best practices.

Have more questions about compliance in collections? Schedule a consultation with TrueAccord to learn more»»