“Death of the call center”—you may have heard this phrase before, but today’s labor shortage, wage inflation, regulatory risks, and changing consumer behavior are all nails in the coffin of this once sure-fire business tactic.

But don’t say a final farewell to the call center just yet. There is a way to utilize those phones to more effectively reach your business goals—especially when it comes to recovery and collection operations.

Let’s take a look at how call centers operate today, what factors threaten their effectiveness, and what we can do to make them viable again. You can take an even deeper dive and read our full coverage of “Outbound Calling Doesn’t Work, Here’s What Does” here»

Outbound Calling vs. Inbound Servicing

To understand how collections call centers can survive and remain profitable in recovering delinquent funds, we need to understand the difference between two basic functions of a call center: outbound calling vs. inbound servicing.

Outbound Calling: Call center agents dial out directly to customers

Inbound Servicing: Call center agents answer incoming calls made by customers

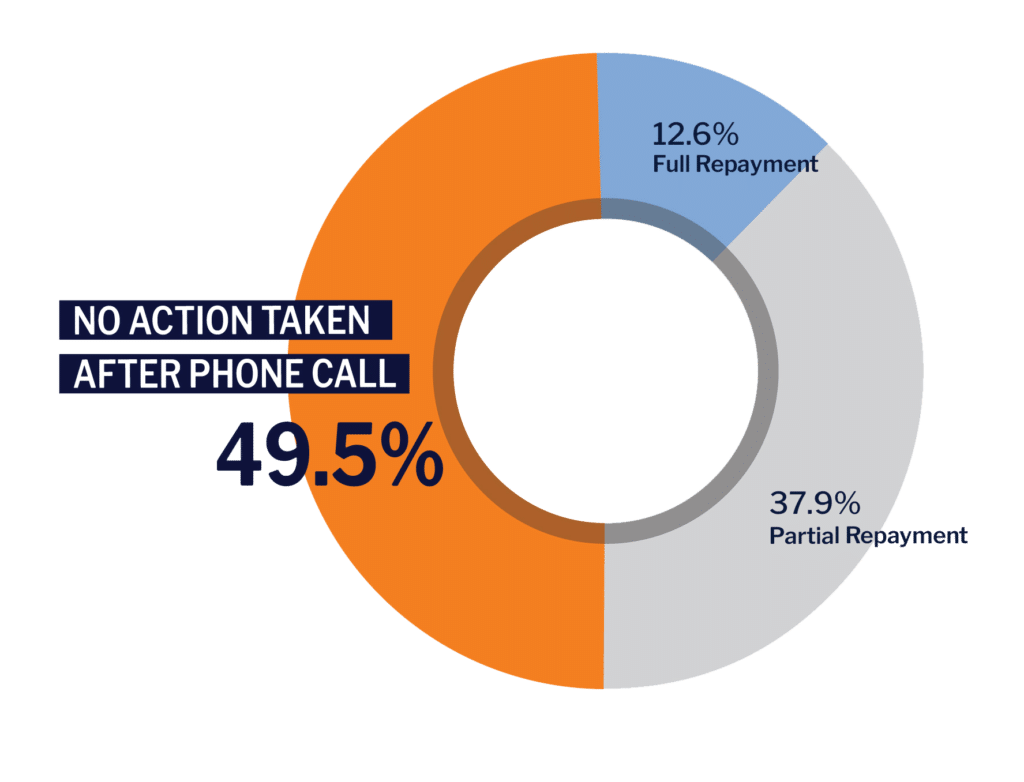

A 2020 survey showed the effectiveness (or ineffectiveness) of outbound phone calls to collect debts due for more than 30 days.

When we break it down, we can start to see that the outbound model to collect on delinquent accounts is truly on life support this time around.

So What are the Killers of Outbound Call Centers in 2022?

When the “Death of the Call Center” was first foretold back in the early 2000s, the culprit was firmly identified as the internet and technology taking over the call center career opportunities for people.

But a closer look shows this isn’t the case given today’s massive shifts in the labor market, regulations, and consumer behavior.

Labor Shortage & Wage Inflation

New technologies aren’t pushing people out of working in call centers—people just don’t want outbound calling jobs like they used to. Competition to hire is fierce and compounded by the Great Resignation sweeping through the market. Unfortunately, many outbound call centers already faced notoriously high (and costly) attrition rates as well.

On top of that, call center wages have increased by 15%+ since the pandemic began, an astounding spike even when every industry is riding the wave of wage inflation.

Regulations & Consumer Expectations

Outbound dialing platforms must comply with a long list of regulations—especially in the debt recovery and collection sector, like the TCPA, FDCPA, and Reg F—all before they can even start talking about recovering delinquent accounts…that is, if anyone even answers their call.

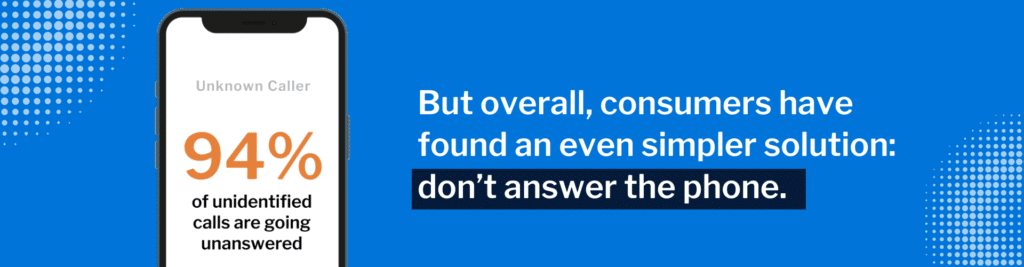

Consumer preferences have moved away from talking on the phone and moved towards self-service options online. Do a quick google search on how to stop debt collection calls and an endless amount of articles will pop up. But overall, consumers have found an even simpler solution: don’t answer the phone.

So can you actually connect with your customers through a call center?

A Second Chance for Call Centers

In the wake of changing labor markets, regulations, and consumer behavior, businesses must evolve to integrate digital-first solutions into call center operations to save manpower, regulatory compliance efforts, and customer satisfaction. We may be perpetuating the old trope, but 2022 really could spell the end for outbound call centers as we know them, and be the opportunity to transform them into inbound engagement centers.

Find out how in our full coverage of “Outbound Calling Doesn’t Work, Here’s What Does” here»

None of us should be sad to see it go. Not consumers, not employees, not businesses. It’s time to say R.I.P. to outbound calling for the betterment of all.