What is your core business? It probably isn’t chasing down delinquent accounts—and it shouldn’t be. Attention, resources, and bandwidth should be dedicated to what drives revenue and pushes your company’s goals forward.

But delinquencies are a reality for any business that handles payments. And when a customer misses a payment on the due date, you shouldn’t let their delinquency slide for too long, otherwise before you know it, that delinquent account will eventually get charged off and considered a loss.

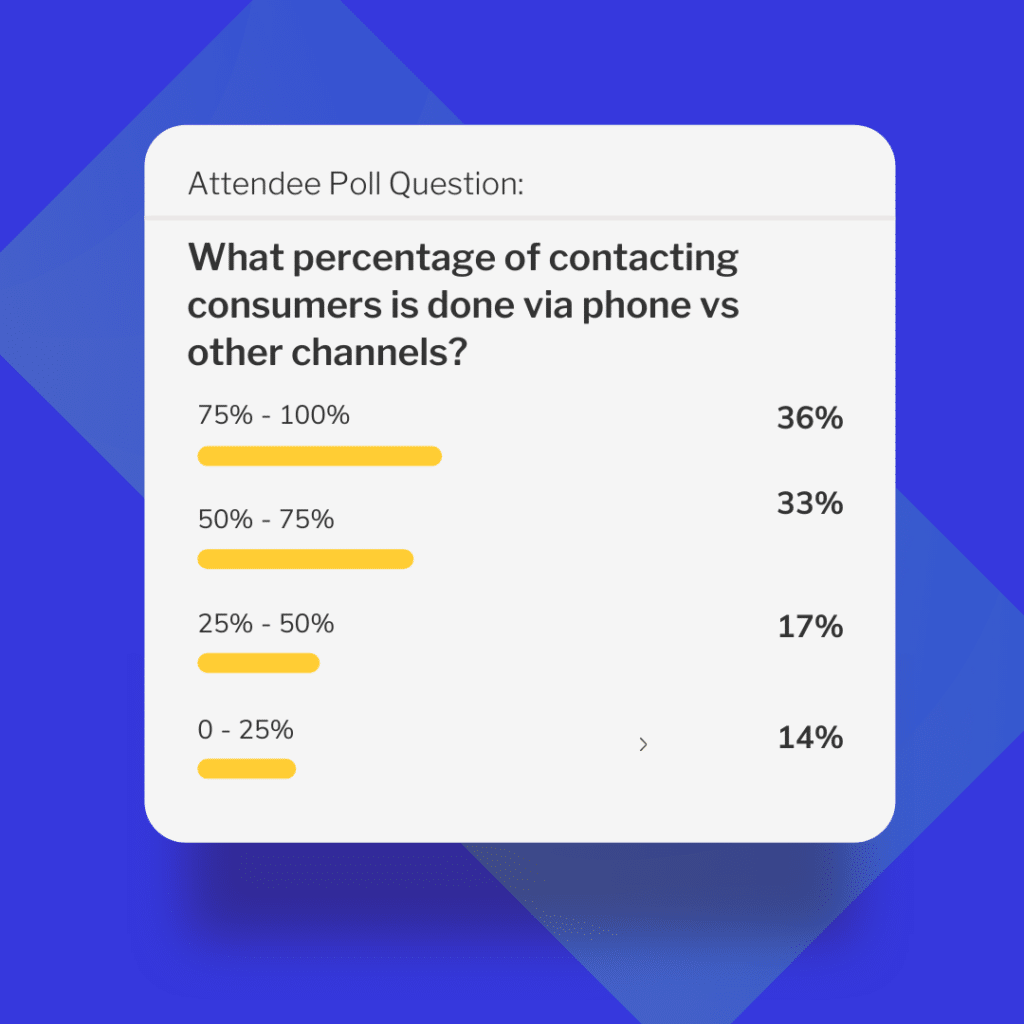

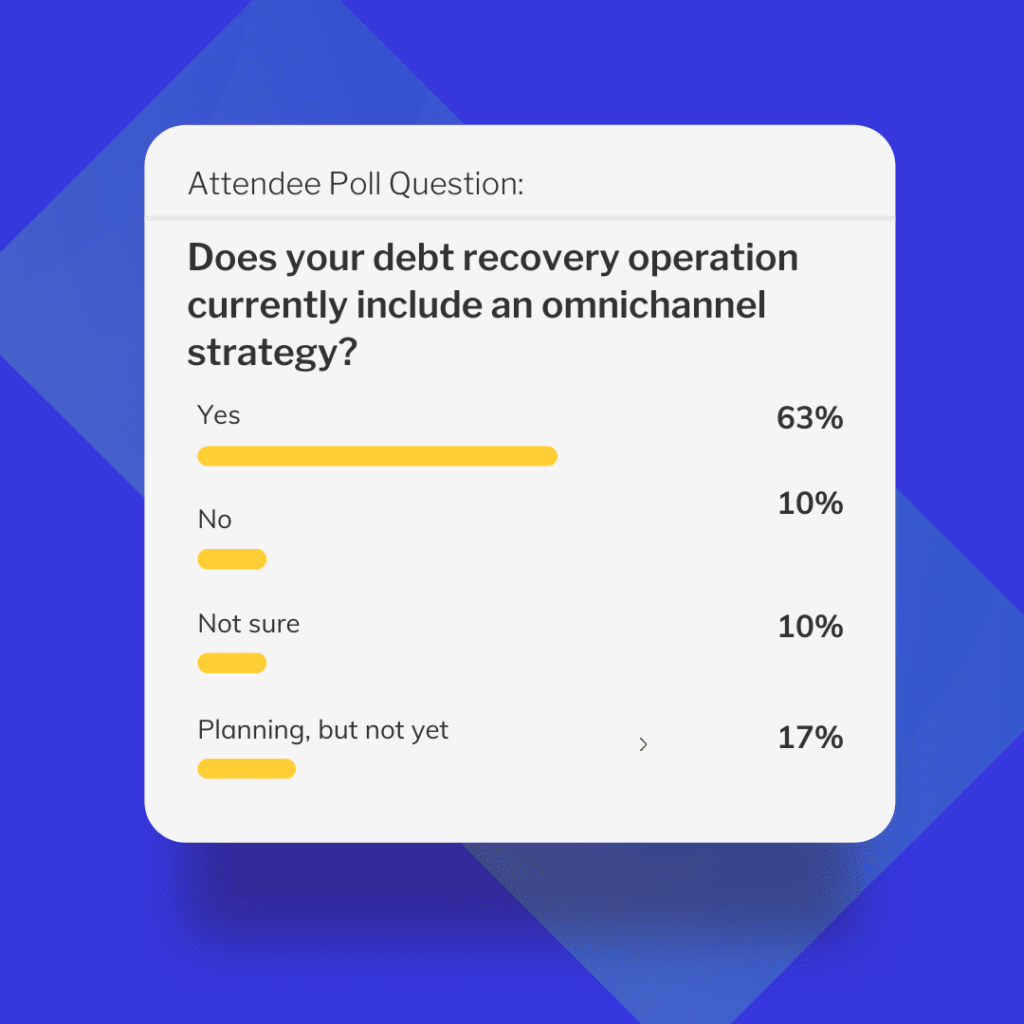

While charge offs aren’t completely unavoidable, ineffective recovery efforts on those defaulted, post-charge off accounts (typically handled by a third-party partner) are completely avoidable. Effective pre-charge off (also known as first-party) collection efforts are just as important as well. For today’s consumers, that means engaging with them in more innovative ways outside the traditional call-and-collect methods and moving into a more digital approach.

But without a consumer-centric strategy for both pre- and post-charge off accounts, digital outreach can stumble just as easily as an inexperienced call center rep on their first day—ineffective or even damaging to customer relations.

So what do effective strategies look like for first-party and for third-party debt collection? Let’s first take a look at the nuances to consider between first-party and third-party collections.

First-Party vs Third-Party Collections—What’s the Difference?

First-Party

First-party refers to using the creditor’s brand in customer communications. The focus is on remediation of newly delinquent accounts and getting the customer back on track. The communications address the part of the loan that is late, which is often not the whole amount, and refer the customers back to the creditor’s call center, payment portal, or online account system.

Third-Party

Third-party refers to outsourcing collections through a third-party partner on the entire balance of the account. At this point, many creditors believe the customer relationship has been lost—but this does not have to be the case with the right digital strategy!

First or Third—Customer Engagement is Key to a Homerun in Collections

For both first- and third-party collections, success hangs on reaching each customer with the right message, through the right channel at the right time. This can be no small feat for smaller in-house teams attempting to recoup pre-charge off debts. And how can you trust that your third-party partner is actually engaging with customers in the best way possible?

So Who’s on First and Who’s on Third for Your Debt Collection?

It may seem like a silly question: who is on top of your first-party, early delinquency collection communications? Many companies assume that they must handle pre-charge off collection efforts completely by themselves or by outsourcing with a first-party company, but there are communication alternatives such as TrueAccord’s Retain. Retain is the client-branded pre-charge off digital engagement product, directing customers back to you enabling your customers to choose the right time, place and channel to contact you. Improve your cash flow, reducing losses and allowing you to spend more time and energy on core business objectives.

Learn more about first-party communications, including the top 10 questions to evaluate your current strategy, in our new eBook the Buyer’s Guide to Digitally Engage Your Past-Due Customers»»

While third-party, post-charge off collections may feel more “out of sight, out of mind” than first-party since organizations outsource to third-party vendors, it’s still crucial to have a comprehensive digital communication strategy that aligns with individual business standards. TrueAccord goes above and beyond with Recover, our late-stage collection solution that proves digital-first delivers: 96% of consumers who resolve with Recover do so using only self-serve digital tools.

Learn how to evaluate your third-party collection partners, including the top 10 questions to ask vendors, in our new eBook the Buyer’s Guide to Effective Third-Party Collections»»

TrueAccord’s mission to help organizations recover more (from happier consumers) is comprehensive for both first-party, pre-charge off and third-party, post-charge off, whether using one or both intelligent digital-first solutions together.