I’m very honored to have been appointed to the CFPB’s Consumer Advisory Board. With this appointment, the CFPB is sending a strong message about how it views technology’s role in shaping the future of consumer finance in general, and debt collection in particular. I’m proud to be able to represent the industry’s point of view while making sure we usher in a new era of great user experience and technology innovation. Even with Director Cordray’s planned departure, the CFPB remains a strong and active regulator. While some of the weight is likely to move to State level examinations, keeping in touch with Federal regulators remains a top priority as a way to contribute to consumer protection broadly, and to support TrueAccord’s long-term mission.

Anyone can apply to be a CAB member through the CFPB’s site. I applied and was appointed earlier this year. I did so because at TrueAccord we believe in the Bureau’s mission – protecting consumers – and also that engaging with your regulator is the smart thing to do. I was humbled and excited to be sworn in, because there is still so much in financial services in the US that can be improved, and innovation to be encouraged. I truly believe in the role of the CAB in informing the CFPB on important trends and how to support consumer protection and choice. I am lucky to be serving alongside academics such as Prof. Lisa Servon, consumer advocates such as Chi Chi Wu from the NCLC, and industry leaders such as Max Levchin. It’s a broad set of experiences and opinions that foster great discussions and set us up for the challenges in front of us.

The CAB looks at financial services in general, but my I cannot disregard my own backyard. In tricky, regulated markets like debt collection, with its active rulemaking process, it is even more important to take part in crafting fair and forward-looking rules that protect consumers. Any work I can do to ensure innovation can finally reach the debt collection market is a net positive for consumers and the industry.

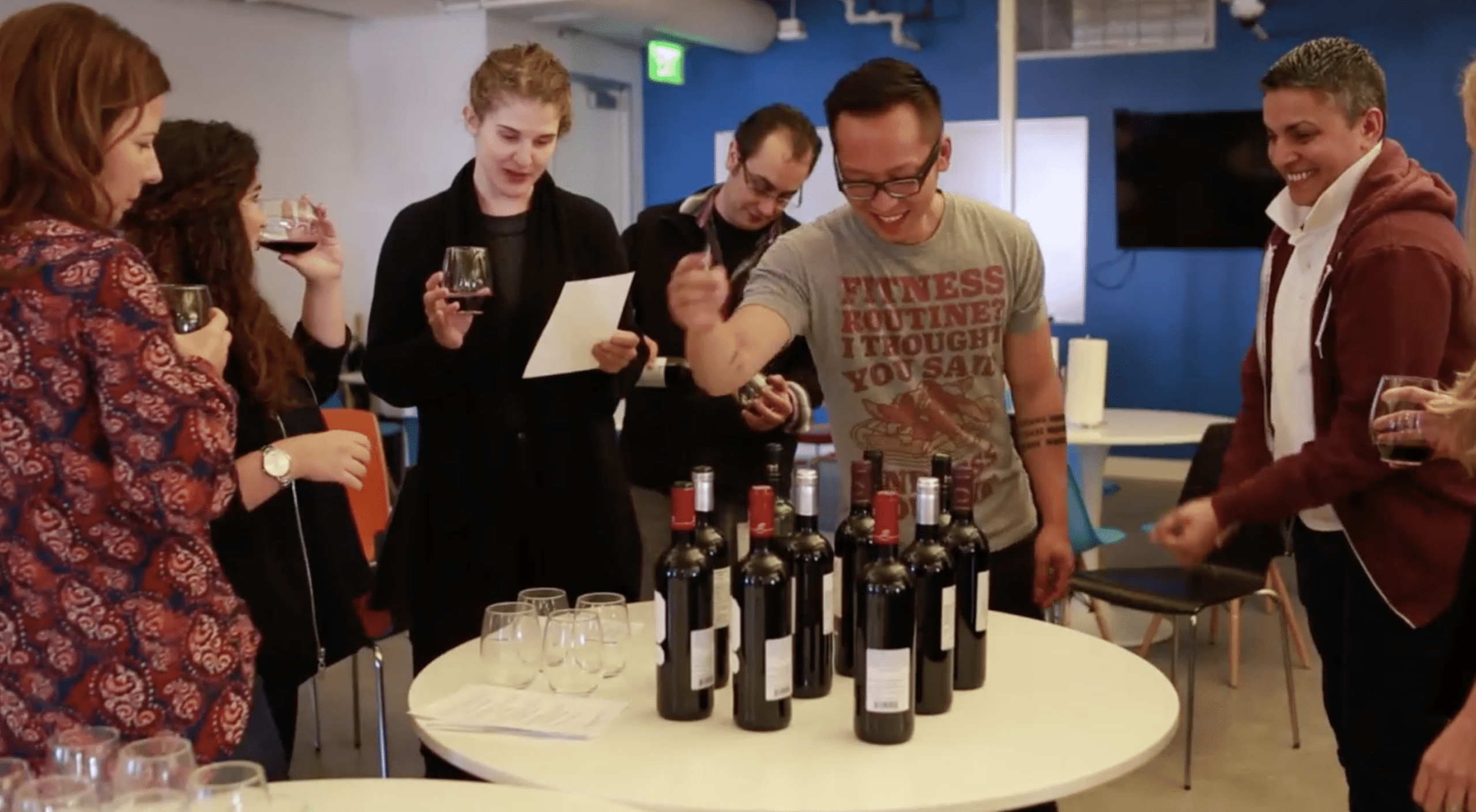

The meeting span three full days in Tampa, Florida, and culminated in a public session with comments about the new PayDay rule. Bureau staff kept a tight schedule presenting latest developments in regulation, consumer education initiatives, and for first time members – an intro to the Bureau and its divisions. During the third day, I was also asked to give a 45-minute presentation on trends in the debt collection market. I used it to discuss the transformative role technology has in making the debt collection process customer-centric and digital first, creating better experiences with less friction and stress for consumers.

All in all, my first meeting was an incredibly positive experience. Staff turned out to be a diverse group of intelligent and thoughtful people, and the (now ex-)director a highly engaged and knowledgeable person. CAB members bring impressive backgrounds and facilitate an effective discussion, especially when they disagree. I am already looking forward to our next meeting, and reviewing developments we’ll see until then. I personally expect the debt collection rule to be one of them, though Bureau staff gave no formal guidance on this matter.