If transforming the way you reach customers to recover delinquent accounts isn’t on your radar in 2022, a year where projected delinquencies are expected to soar, you’re at risk.

Fortunately, we recently rounded up a panel of experts to share their insights and experiences taking those first steps away from outbound calling and toward better consumer communication in our webinar “What Labor Shortage, Wage Inflation, and Regulatory Restrictions Mean for Your Call Center”—available to watch on-demand now»

Below are some of the top questions, answers, and first-hand accounts from our discussion (plus some attendee poll results):

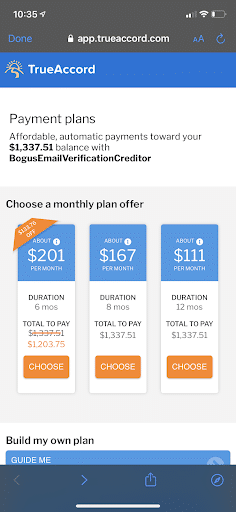

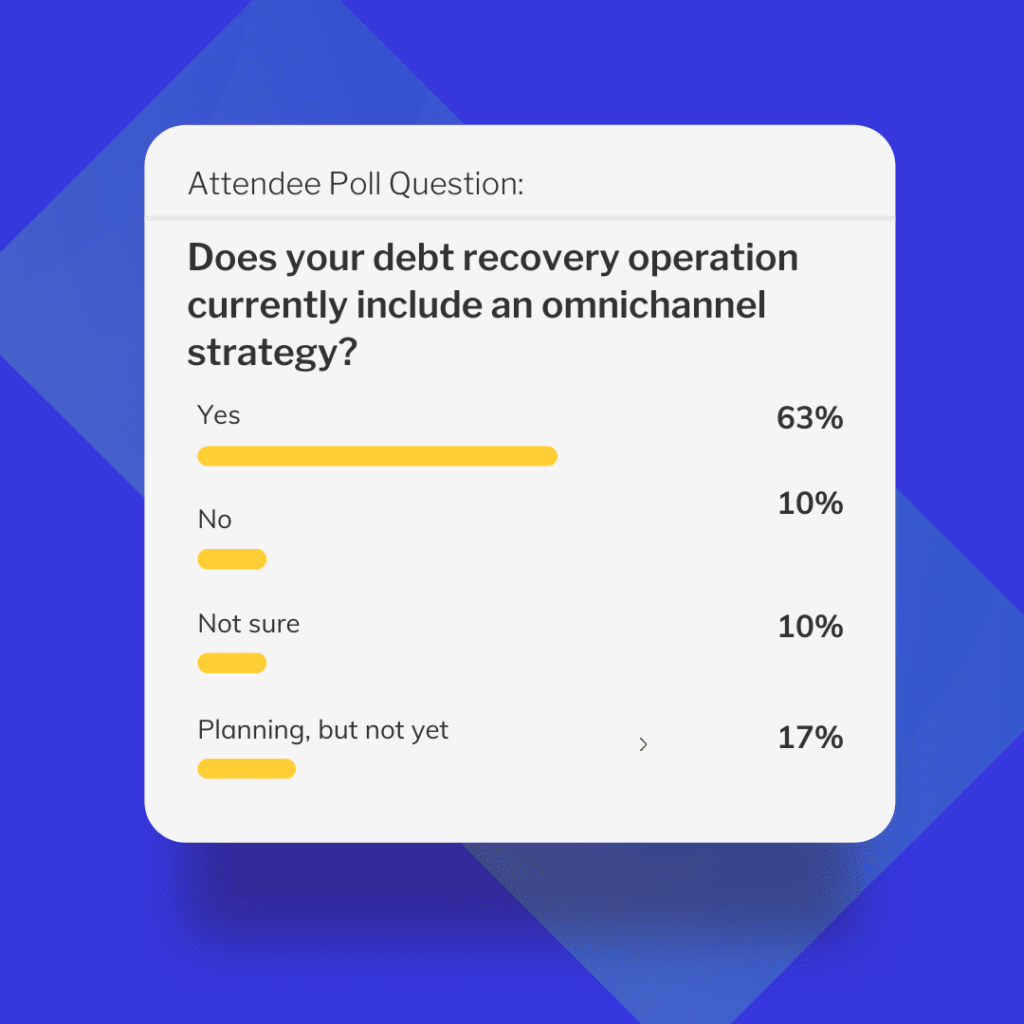

What percentage of contacting consumers is done via phone vs other channels?

Heather Bentley [HB]: Overall a little bit above 50%, but that includes outbound calling from live agents and interactive self-serve calls, which really is more the digital channel.

John Craven Sr [JC]: Live agent we’re at 0%. We do use a virtual agent, so I would say we use that virtual agent probably 40% to 45% of the time.

Jennifer Masterson [JM]: We’re close to 50/50. We will always be taking phone calls, but we are doing a lot more now in the digital space trying to contact people.

Richelle Rocazella [RR]: Less than 1% of our communication is via phone. And that is all inbound when we do engage with our customers. We will only make an attempt to reach a customer via phone if they have requested a call.

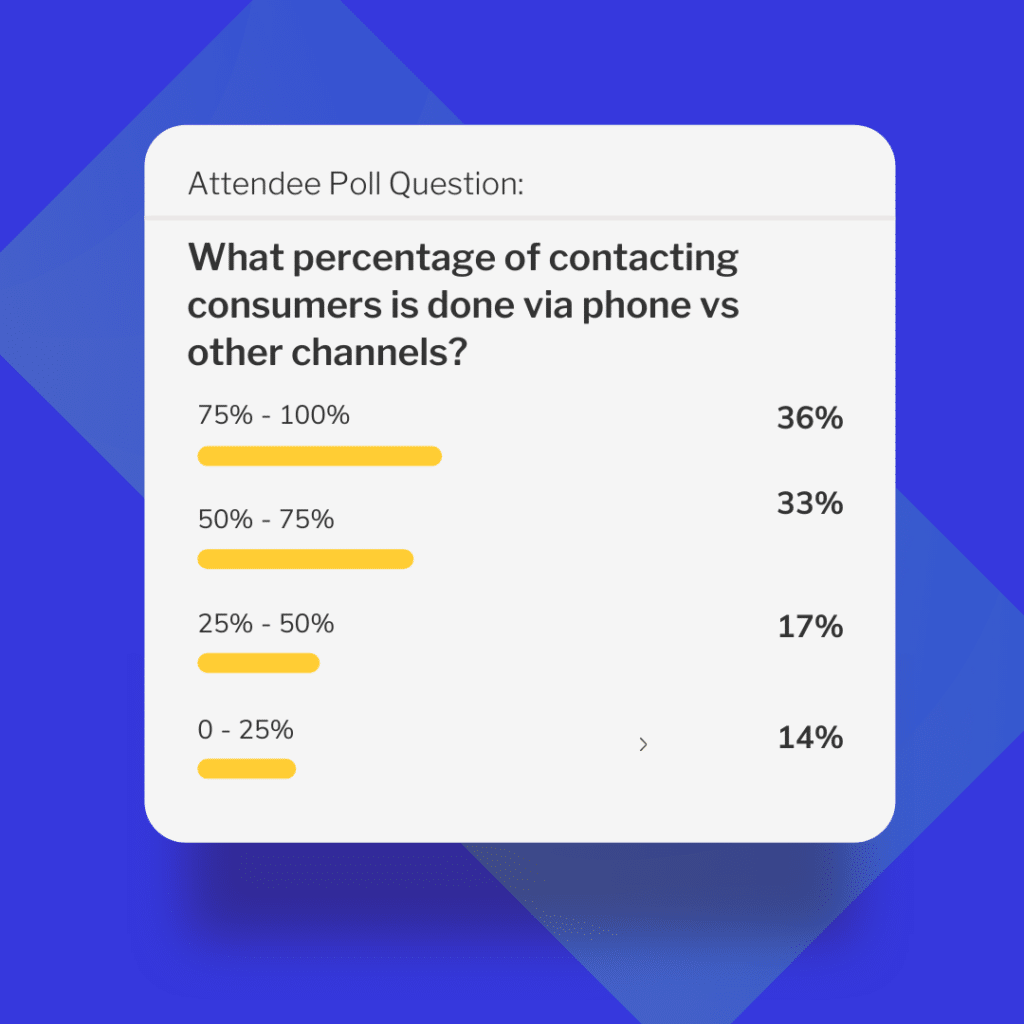

What does outbound calling versus an omnichannel strategy look like at your organization?

JM: An omnichannel strategy triggers customers to get them to self-serve and frees up our agents to talk to customers that need more help or more assistance. That’s really where the more valuable conversations happen.

HB: It’s really about putting the two pieces together [outbound and other channels], and trying to find the sweet spot of customer experience and collection effectiveness. Pulling those two things together – so if we find customers who are responding to a specific channel like text, but then if they go past the point we would normally see in delinquency, we can say, “Wait a minute, something’s different. Now we need to call this customer.”

JC: When you take a person that’s spending a good portion of their day making outbound calls, and you turn them into an inbound agent where they’re talking to a customer almost every time that the phone rings, the maximization of your employee’s time puts you into a completely different realm of being able to perform.

Was COVID or labor shortage and wage inflation a driving factor in the shift to a more digital approach and self-service approach?

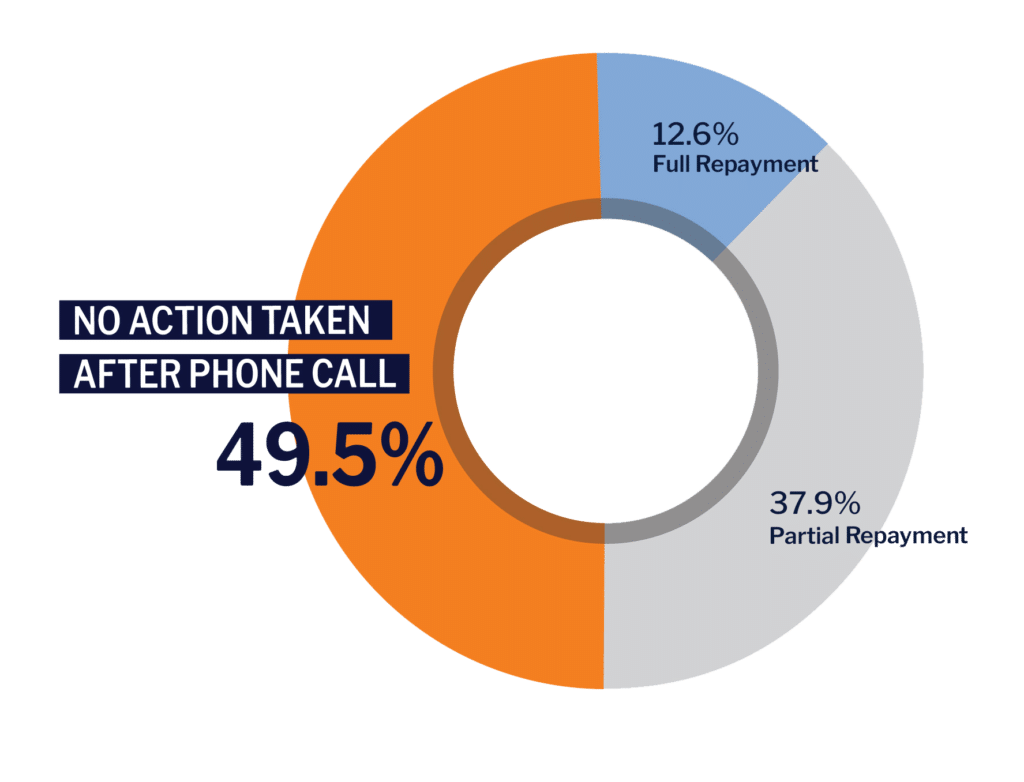

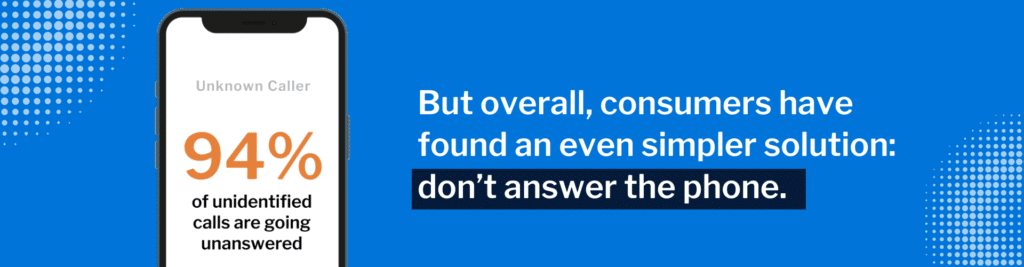

JM: We started before COVID because consumer behavior was dictating it. It’s really hard to get someone to pick up the phone. The number of times that you actually connect to somebody live on dials is really low. That’s really what drove us to start going down the digital path. Now, I think there’s a ton of benefits to be gained from that, things like when COVID happened, this labor shortage. Once you have the channels in place, it becomes easier to ramp them up or down depending on what’s happening in the economy.

Once you have the channels in place, it becomes easier to ramp them up or down depending on what’s happening in the economy.

Jennifer Masterson, Executive Vice President, Retail Lending Solutions, PNC

How did you get started?

HB: We started individual channels at times with easy things like virtual messages, then interactive messaging and email and text, and then moved into two-way in those channels. And we’re still working so that you could have the same experience in that digital space that you’d have with an agent on the phone.

JC: In 2014 [Cox Communications] started texting customers and then we added email around 2017, but we didn’t have a digital platform at that time. We implemented a digital platform in early 2020, and fortunately we were able to go full omnichannel with integrated channels that we were able to roll out.

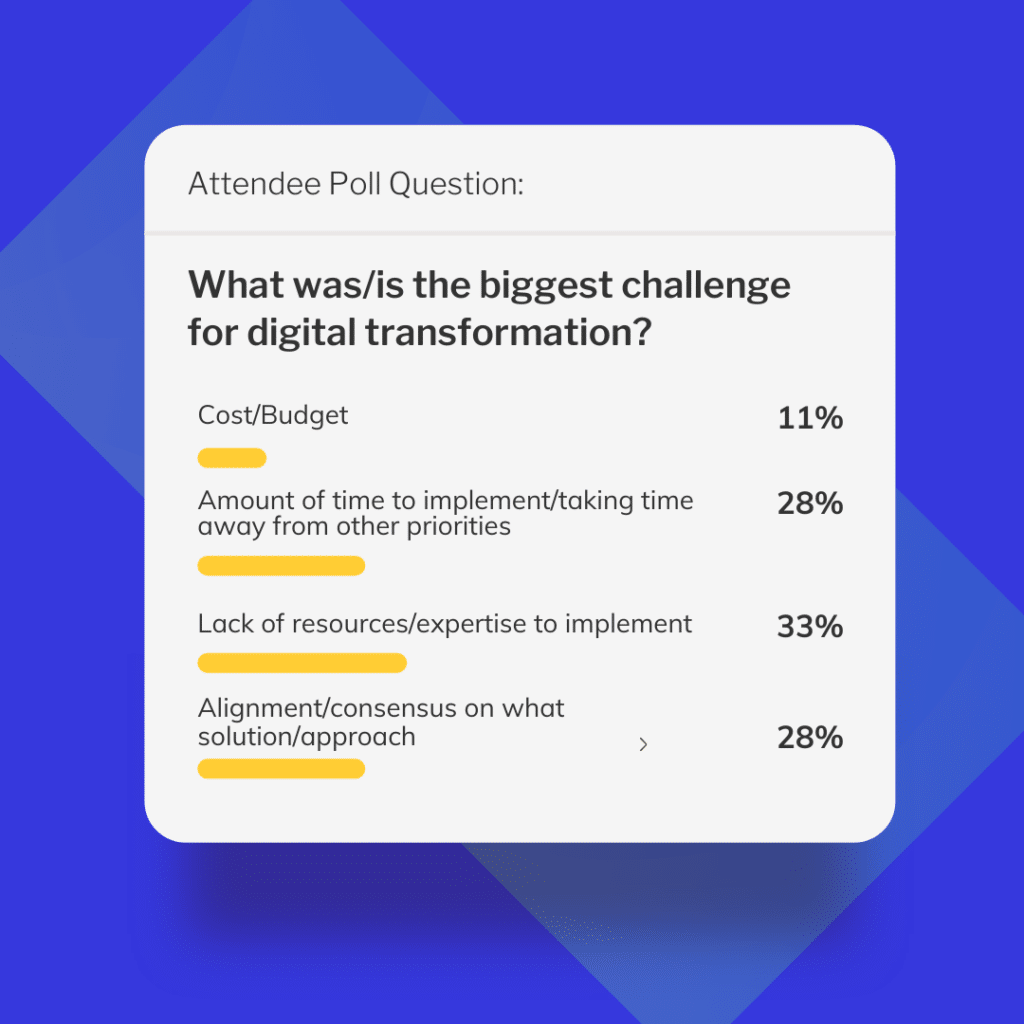

What are some of the challenges to building an omni-channel strategy?

RR: Making sure all channels are integrated to develop a full customer experience journey. Also ensuring service levels are maintained as more channels are added.

HB: If you’re not sequencing [the channels] and working them together, it can be like bombing your customers again. If you’re bombing them with calls and now you’re bombing with text and with email and it’s just, “Hey, we’ll just try everything.” You quickly desensitize your customers to your communications.

JC: We set up all the channels and then we went on a journey to bring them all in and orchestrate them so they were working together. If I can suggest anything to those that are using the phone strategy, if you’re ready to start your digital journey, start with a journey that is an orchestrated journey, instead of building out the channels and then trying to bring them all together. You’ll get so much further ahead and a quicker response to digital integration.

From a self-serve standpoint for debt collection and recovery, what are some of the compliance or regulatory challenges to keep in mind?

HB: As we move to digital channels, [regulators] move their focus to what happens in email and on your website and in text messages, because before their focus has been about calling over the last 10 years. So as an industry we have to stay ahead of that and think both like a customer and like a regulator. Be a bit conservative in some of your interpretations of how far and wide your communications go.

JC: From the risk side of things, if you’re moving from an analog or non-digital traditional approach to a digital approach, think how to digitize your compliance rules that may have some risk mitigation in it. Don’t create a new reality—make sure that you replicate what you have already in place to make sure you have safeguards.

JM: On the phone side you’re dealing with agents that have to remember to say things right. But coming out of COVID a lot of the banks and other financial institutions put hardship assistance online just as an example, and I think the regulators like that because everybody’s essentially getting the same experience. I think it’s easier to be in compliance and meet all the regulatory requirements in a channel like that, than it is with agents.

As an industry, we have think both like a customer and like a regulator.

Heather Bentley, Senior Vice President Head of Consumer Specialty Operations, Citizens Bank

What was the best way organizations should have prepared to meet the guidelines for the CFPB’s Regulation F to move to a more omnichannel approach?

RR: The best thing any organization could have done for Reg F would be to have a strong legal and compliance group that you work with. While it’s not something that drives revenue, it is a must in every organization.

Where would be an ideal place to start exploring or considering if you’re moving away from the outbound call center and looking to integrate more channels?

JC: Whatever your strategy is, you need to set yourself on a path making sure that your digital journey has a brain. Recognize that different profile customers react differently to different contact channels. As you use your omnichannel approach, having that brain mentality. Knowing what your customers’ preferences are and then leveraging those preferences will set you on a great path to performance.

JM: Every company is different in terms of what capabilities you have or don’t have. While texting and emailing made sense for PNC at first, maybe there’s another channel that a company can easily plug into. Start wherever you can because consumers don’t want to pick up the phone and call. Whether it’s the ideal option or not, give consumers another path and another option. Start somewhere and then build off of that in whatever way makes sense for your organization.

RR: For businesses in the early stages of adopting a more omnichannel approach for collections, email or text would be a good place to start.

Knowing what your customers’ preferences are and then leveraging those preferences will set you on a great path to performance.

John Craven Sr, Enterprise Center of Excellence Call Center Director, Cox Communication

Watch the full webinar for even more insights, advice, and answers to even more audience questions»

Ready to get started on the digital transformation of your collection strategy? Schedule a consultation to learn how you can take the first steps»