With digital lending via neobanks and fintechs on the rise, consumers have more options than ever for obtaining loans. There are a lot of considerations for these digital financial providers when building their business models, but one important and often-overlooked strategy is recovery for delinquent accounts. We sat down with TrueAccord’s Chief Growth Officer, Sheila Monroe, who has held numerous executive-level positions at TrueAccord on top of a multi-decade career in collections, to learn more about the economics of collections and what new lending players should look for when considering a collections solution.

What are the economics of collections metrics for delinquent accounts?

There are a number of metrics to pay close attention to in the management of delinquent accounts. These can be separated into two main categories, portfolio metrics and operational metrics.

Portfolio metrics address the health of the entire portfolio or a defined segment of a portfolio (a certain vintage or a certain risk group or even a particular product). For a U.S.-based lender following GAAP accounting, the lender’s net loss rate (or net charge off rate) is the ultimate metric. It tells investors and management what percent of the portfolio is lost as a result of non-payment, which is a key metric in the overall health of the business. Private equity and venture capital firms, along with companies who invest in a lender’s receivables, will be most interested in a predictable loss rate in line with investment objectives.

Operational metrics are also important in managing delinquency and losses. Operationally, lenders should understand how well consumers follow through on payment plans or promises by monitoring a promise kept rate as well as what percent of payments cover the total payment due to cure the account. For measuring efficiency, lenders look at the ratio of delinquent accounts per collection employee, often referred to as accounts per employee (APE) or accounts to collector ratio (ACR), as well metrics like promises and dollars collected per paid hour of operations. Many also look at the cost to collect a dollar or the cost per delinquent account.

What are credit loss provisions and why are they important to financial providers?

Lending institutions will inevitably have loans that go into default, and this is planned for in their financial modeling. For lenders, even the largest international banks, loan losses are the largest expense line in the budget so it’s important to prepare for those losses. When money is loaned, whether in a 30-year mortgage, a 5-year car loan, or a revolving credit card, some of those accounts will go past due, and some will fail to pay long enough that they get charged off as bad debt (credit loss), and it can take years to see that happen.

But when account balances do get charged off as bad debt, the lender must have enough money “reserved” to absorb those losses and still be able to operate. So any lending company with investors will need to have a reserve for losses that shows up in their balance sheet. Depending on market conditions and actual loss rates, these reserves can be adjusted upward or downward periodically to ensure what is commonly referred to in financial services as “safety and soundness”. This is even more important if a lender takes consumer deposits to fund any of their lending.

What is a roll rate in debt collections?

The roll rate is the sum of account balances that moves from being in one stage of delinquency to the next. For example, if 500 accounts with balances totalling $600,000 are one month past due (often called bucket 1 or one down), and the next month there are 150 accounts with balances totalling $125,000 that are 2 months past due, there was a 20.8% roll rate from buckets 1-2. Roll rates can also be calculated based on number of accounts, but that metric is rarely used in a performance analysis.

How do lenders and debt collectors use roll rates?

Roll rates are primarily used to forecast future charge-off levels, to develop sophisticated risk scoring models to be used in underwriting or collection strategy, and to evaluate the effectiveness of a collection strategy or process. The collection process is designed to effectively intervene when consumers miss payments and to encourage and enable them to get back on track quickly. The longer loans and credit cards go unpaid, the more they accumulate late fees and finance charges and become much more difficult to get back to good standing.

What are “good” roll rate ranges in debt collections?

This can be tricky to determine because portfolio objectives and type of debt come into play. For example, some products might be aimed at riskier customers, those with thin or no credit profiles, or those who have lower credit scores and it would be disadvantageous to compare those roll rates to those of a prime product. It’s important to understand the objectives of a lending product when evaluating performance. Depending on their objectives, some lenders target high-risk customers and have high credit losses, padded by high fees, while others target prime borrowers and enjoy low losses.

If a lender has been in business long enough, they can benchmark roll rates against prior years, but need to account for any changes to underwriting and macro economic conditions. For example, banks can compare delinquency and charge off rates to other banks or look at performance by vintage, meaning how are all the accounts that were opened during a specific period of time performing. Peer benchmarking can be difficult for Fintech and other young lenders who often don’t have a base of publicly traded competitors who must report these key metrics in shareholder reports, but there are some consortium groups that can help (Auriemma Roundtable Group).

Roll rates are early indicators of collection effectiveness and often require more than a glance to understand if they are good. Often looking at connected roll rates or flow rates is more telling. For example, a high roll rate one month may be the product of a short billing month, while looking at a broader metric like debts that rolled from current to 3 months or those that went from 4 months to charge-off, might be a more telling indicator.

What are “good” ranges of cost to collect?

Generally, collection costs include the cost of collection staff wages and fringe benefits, software licensing, management overhead (for quality monitoring, training, supervision, workforce management and others), communication costs (letter and postage, telephony, SMS and other costs), equipment, supplies, scrubs and skip tracing information, and premises (leases and maintenance). If the collection function is completely outsourced, a lot of these costs will be wrapped into the cost per hour or cost per FTE being charged. I’ve seen costs on a per account basis range anywhere from $4.50 to more than $16 for unsecured consumer debt, depending on the strategy, the type of portfolio, and the location of the operation.

As a lender, it’s important to know what you are optimizing for. Spending more to keep losses low may seem like a no brainer, but there is a point of diminishing returns and, worse, a point in which more collection activity drives disproportionate costs in the forms of complaints, litigation, customer attrition and reputational damage. It may make sense for your business to manage delinquency and charge off levels near your industry’s benchmark or even higher, but put more thought into customer retention and how to get them using your product again once their finances have stabilized.

Why should a company that’s new to lending have a collections partner?

New lenders go into business to lend money. They start with a target audience and product market fit, and tailor underwriting to their growth aspirations and customer value proposition. That is absolutely what any new lender should focus on. But often lenders are either naive about the impact of losses (maybe they think their underwriting will be so good they don’t need to think about collections), or they don’t have a full appreciation of how managing losses and taking advantage of recoveries will enable them to lend more money and retain more of those hard-earned customers. Having a trusted collection partner can allow the lender to focus on what they do best while reaping the benefits of sound practices to manage delinquency.

How do you measure success?

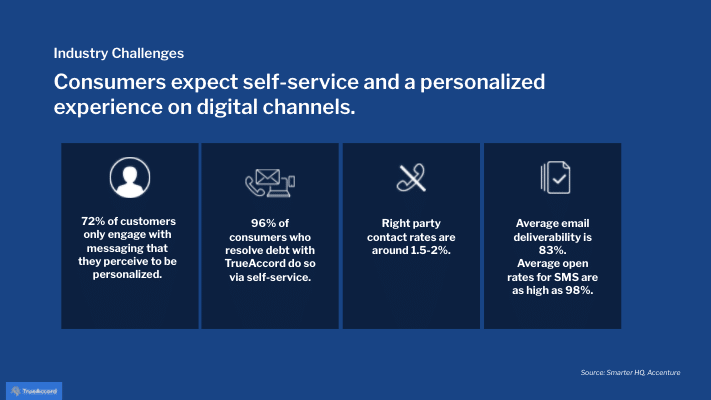

Ultimately, it will be a combination of your lending strategy (did you lend to the right people) and your collection strategy (how well can you get customers back on track after missing a payment) that will influence portfolio metrics. But none of these metrics will drive outstanding performance in isolation. To be effective, it’s important to understand a lender’s reach into the delinquent customer base. What percent of customers are actually engaging with the collection effort? A calling strategy results in about 2% of phone calls reaching a “right party” (the person responsible for paying) and about 1.5% resulting in a payment.

More lenders should look at engagement metrics – what percent of their delinquent customers actually engaged with some form of communication. In a purely digital strategy it is easy to measure email open and click rates, and SMS engagement rates as strong top of the funnel indicators. For Fintech we see a 46% email open rate and 2.5% click rate, with SMS delivering click rates between 25-32%. This is substantially higher engagement than what can be achieved in a calling environment and is better received by consumers.

What should a digital lending company consider when choosing a collections partner?

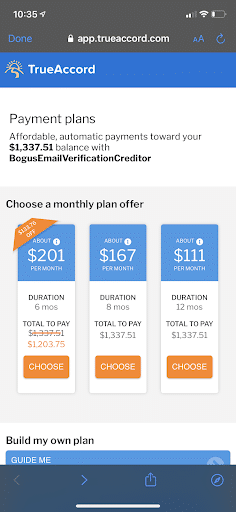

Companies new to lending are originating loans, and therefore the entire customer relationship, online. Their customers had a digital experience to begin the relationship and they will expect a digital experience throughout their relationship with the lender. With that in mind, some things a digital lender should consider when choosing a collections partner include:

- Does the collection company primarily communicate with my customers in their channel(s) of choice? Many collection companies will say they use email, but it is often not the primary mode of communication and can amount to less than 10% of an otherwise heavy, offensive phone calling strategy.

- Are customer communications personalized when it comes to the channel being used, the time of day the communication occurs, the content and tone of the message or do they segment broad groups of customers for a one size fits all treatment strategy?

- Does the collection company leverage any machine learning that could augment what I already know about my customers based on my internal data alone?

- What process does the collection company have for continuous improvement enabled by a strong champion/challenger testing capability?

- How much execution risk does my collection partner expose me to? Operations that rely on more collection agents will carry more risk exposure. Poor agent attendance or high attrition will impact expected coverage. Poor quality or agent errors across a varied labor pool will impact collection results and pose compliance risks. Cultural bias or unneutralized accents of offshore agents have been shown to result in lower contacts and lower average commitments than more expensive on-shore agents.

- If you are outsourcing to an agent-intensive provider, make sure you understand what drives the agent incentive plan. Agents interested in making incentives don’t always have your customers’ best interests in mind.