While many financial service institutions can offer basic payment portals, these are often limited when it comes to collecting on delinquent accounts. TrueAccord delivers a robust difference.

Self-serve options should be a key part of any collections operation. In fact, research from McKinsey found that consumers who digitally self-serve resolve their debts at higher rates, are significantly more likely to pay in full, and report higher levels of customer satisfaction than consumers who pay via a collection call.

At TrueAccord, we provide more than a basic payment portal—the power of our self-serve solutions gives your business and your customers better control over the repayment process. TrueAccord’s self-serve portal delivers less friction for delinquent consumers ready to manage their debt, while your organization determines the extent of account details to display, what flexible payment options you’d like to provide, and more.

Let’s look at how TrueAccord provides a superior consumer experience and better bottom-line results for your business through our self-serve portal and solutions.

Why Offer Self-Serve Options on Top of Traditional Collection Methods?

Two of the most prominent use cases for deploying self-serve channels are consumer preference and compliance—and both are success stories for TrueAccord.

The numbers cannot be ignored: 98% of delinquent consumers serviced by TrueAccord resolve their debt without any human interaction, which in turn saves time, resources, and headcount. When asked why they pay bills online, three in 10 consumer survey respondents said they like the flexibility to pay whenever and wherever they want—a convenience traditional call-and-collect methods cannot extend to consumers due to FDCPA’s “Inconvenient Times” rule under Regulation F.

The “Inconvenient Times” rule prohibits calls to consumers before 8 a.m. or after 9 p.m. in the consumer’s local time zone, because calls made during those times are presumed inconvenient. But self-serve options put the power in the consumer’s hand 24/7. At TrueAccord, 29% of online payments are made outside of traditional FDCPA hours.

Self-Serve Success with Advanced Machine Learning and Omnichannel Engagement

Does your digital debt collection outreach strategy extend beyond email or SMS? A true omnichannel approach goes further to interweave self-serve options—and TrueAccord delivers.

Whether via email, text message, or even physical letters, there are several ways TrueAccord reaches consumers in debt collection and empower them to take charge of their repayment journey through the self-serve portal.

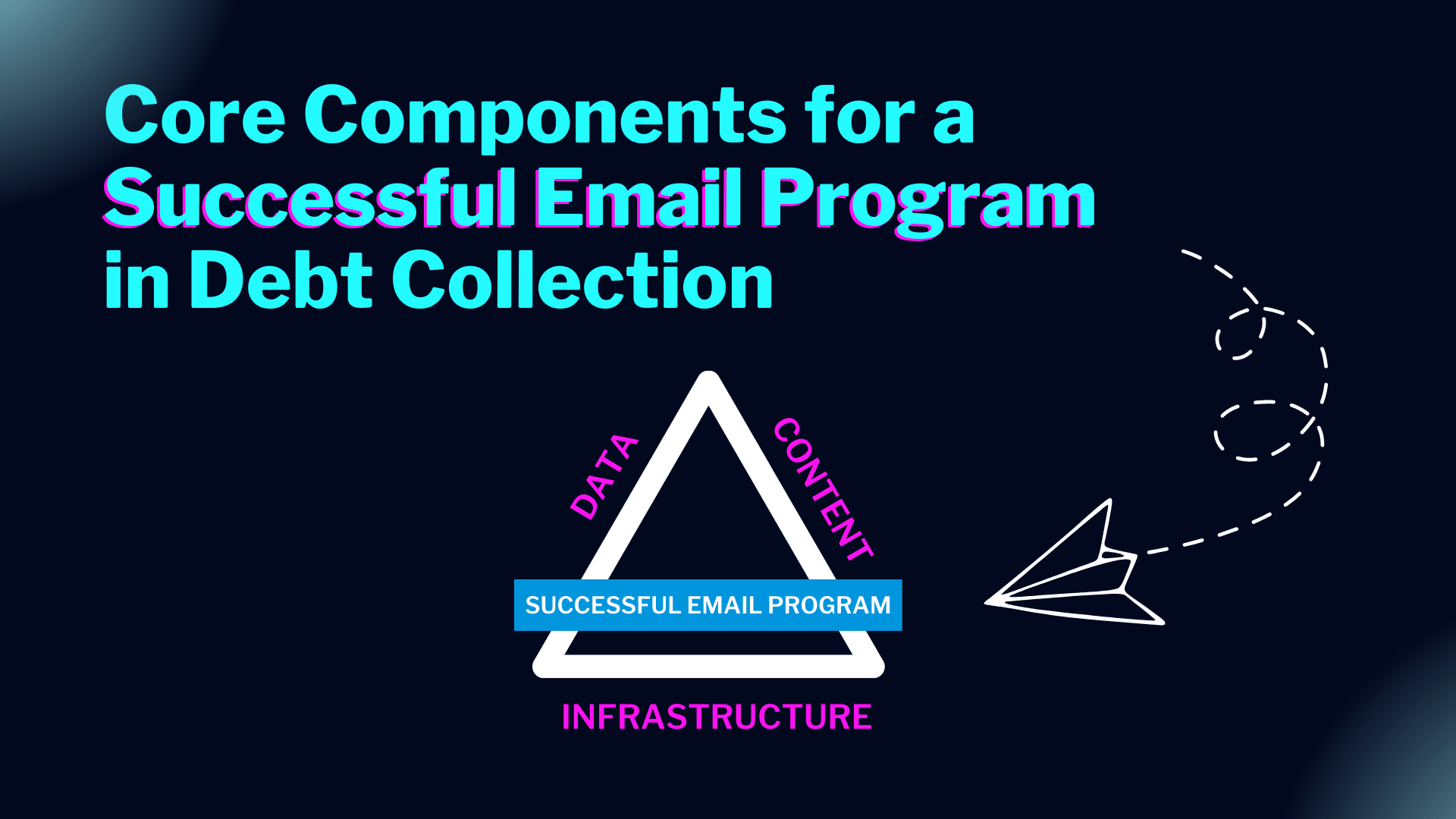

And even if the first engagement attempt is unsuccessful, HeartBeat—TrueAccord’s patented machine learning decision-engine—will adjust communication cadence, content, and even channel dynamically.

Studies show that 54% of consumers expect their financial provider to leverage the data they have about them to personalize their experience, so HeartBeat looks at individual account characteristics—like debt type, creditor, balance size, age of debt, etc.—and selects a message (written by experienced debt collection content creators) based on previous interactions with consumers that have similar characteristics. Thanks to our 35 million consumer interactions collected, HeartBeat drives both the optimal engagement and repayment rates while working within both our client’s guidelines and regulatory requirements.

Want to take an even deeper dive into the consumer experience-side of TrueAccord’s self-serve portal? Download our free eBook for more details and a visual walkthrough of the consumer experience when using our portal here»»

What Do TrueAccord Consumers Have to Say?

Don’t take our word for it—read testimonials and feedback from real consumers who have resolved their delinquent accounts through TrueAccord’s self-serve portal:

- “This was a great experience for me. The portal was so easy to operate quickly and easily. Thank you.”

- “Easiest to work with, never had to speak with a representative, was able to fully manage and pay off the account via their online portal.”

- “I appreciated the zero harassment, easy portal interface. I have been stressed about this for a while, hardship came up, but you made it easy and less stressful to take care of.”

- “Thank you for being patient and for having a portal that makes it easy to make the payment without filling out a bunch of stuff and having to make an account.”

- “I appreciate you notifying me via email and having a great online payment portal. It made the process really easy.”

Ready to Get Started?

Empower consumers with a self-serve experience—and collect faster from happier people. Schedule a consultation and get set for a live demo of the TrueAccord self-serve portal»»

Sources: