Your Guide to Key Terms for Today’s Debt Recovery Strategy

Reaching consumers today requires a more sophisticated process than simply dialing the phone or sending a generic email, especially when it comes to debt recovery and collection. But reviewing potential strategies can often leave you lost in a sea full of acronyms and buzzwords. Between terms like AI, machine learning, and data science, it can be difficult to keep up with the different definitions—and understand how they impact your business and bottom line.

To help keep this word salad straight, we’ve compiled a glossary of helpful terms, definitions, and examples to help differentiate them:

- Accounts per employee (APE), account to collector ratio (ACR): The number of delinquent accounts that can be serviced by an individual recovery agent – often used to measure cost effectiveness.

- Artificial Intelligence (AI): AI is a blanket term describing a range of computer science capabilities designed to perform tasks typically associated with human beings. Machine learning (ML) is a subset of AI. Through AI, processes like debt collection can become more efficient by developing better outreach and deployment strategies.

- Big Data: This term means larger, more complex data sets . Big data can save collectors a lot of time by using many variables for analytics-based customer segmentation, insert, insert..

- Coverage: The percentage of users for whom organizations have digital contact information, such as email addresses or phone numbers.

- Customer Retention Rate: Measures the total number of customers that a company keeps over time. It’s usually a percentage of a company’s current customers and their loyalty over that time frame.

- Data Science: A cross-discipline combination of computer science, statistics, modeling, and AI that focuses on utilizing as much as it can from data-rich environments. Data science (which includes machine learning and AI) requires massive amounts of data from various sources (customer features such as debt information or engagement activity) in order to build the models to make intelligent business decisions.

- Deep Learning (DL): A subset of machine learning. Deep learning controls many AI applications and services and improves automation, performing analytical tasks with human intervention.

- Delinquency rate: The total dollars that are in delinquency (starting as soon as a borrower misses as a payment on a loan) as a percentage of total outstanding loans.

- Deliverability: The percentage of digital messages that are actually reaching consumers (e.g., as opposed to ending up in email spam filters).

- Digital engagement metrics: A range of KPIs that capture how effectively digital channels are reaching and engaging consumers.

- Digital opt-in: The percentage of users who have indicated their preference to receive digital communications in a particular channel.

- Efficiency: Measures a company’s ability to use its resources efficiently. These metrics or ratios are at times viewed as measures of management effectiveness.

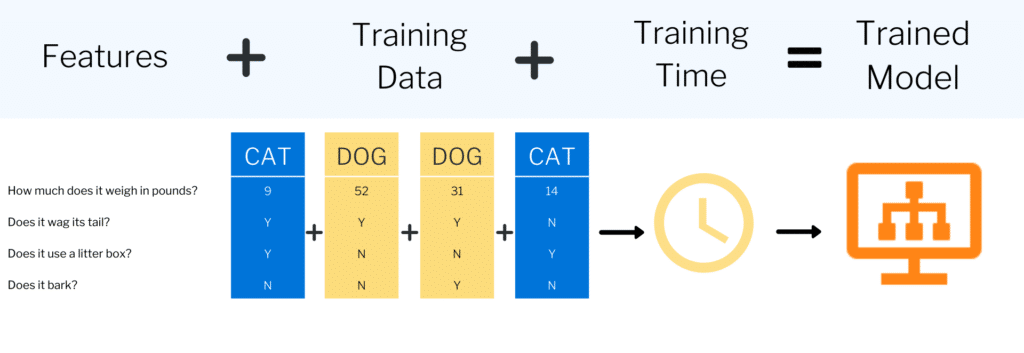

- Machine Learning (ML): Technology that uses algorithmic modeling techniques to observe patterns and trends, reassessing the best approach to achieve a goal, and adapting behavior accordingly. It continuously, automatically learns and improves at a massive scale as more data is observed. With the help of machine learning, companies can make sense of all their data and take on new approaches to debt collection processes from better customer experience to more efficient delinquent fund recovery.

- Net loss rate: The total percentage of loan dollars that get charged off (written off as a loss).

- Open rate, clickthrough rate: The percentage of users who are actually opening and clicking digital communications.

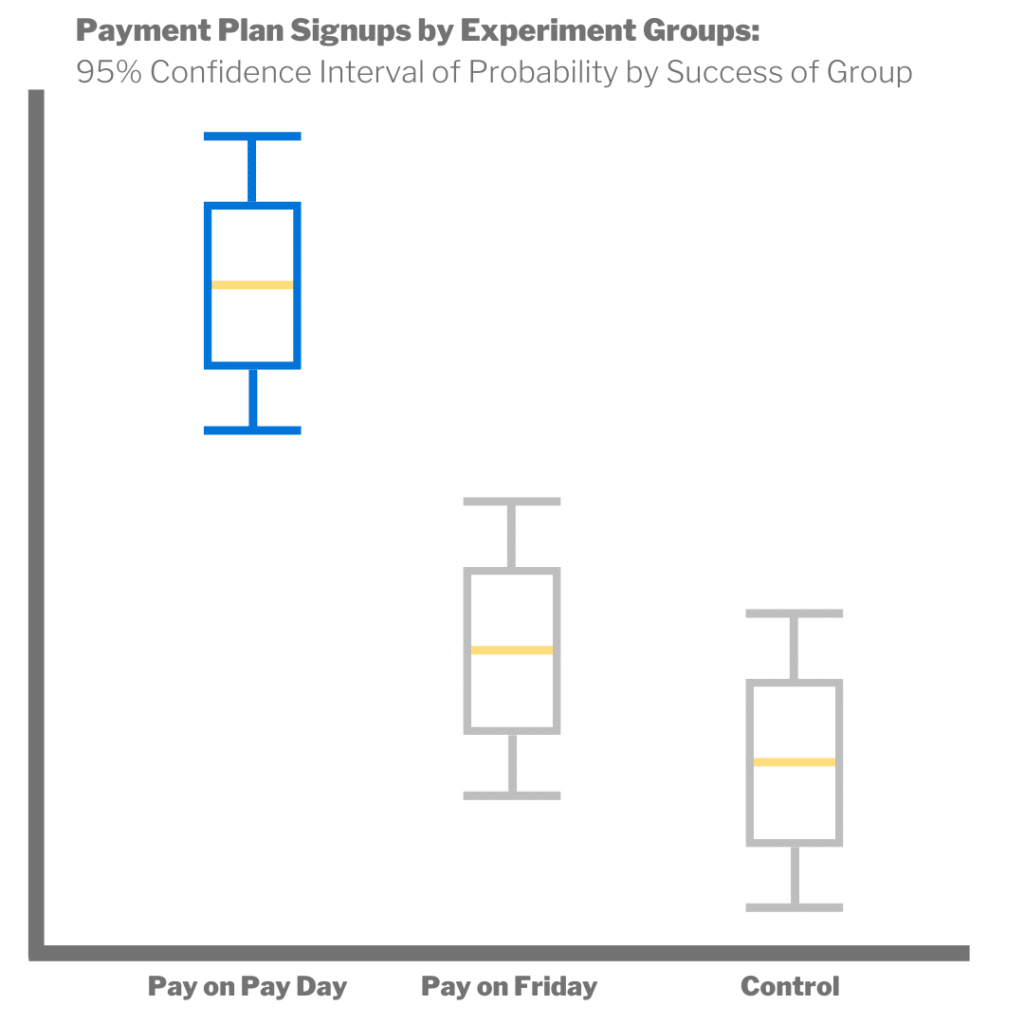

- Predictive Analytics: Predicting outcomes is one specific application of machine learning. It allows companies to predict which accounts are more likely to pay sooner and allows them to better plan operations accordingly.

- Promise to pay kept rate: The percentage of delinquent accounts that maintain a stated commitment to pay.

- Promise to pay rate: The percentage of delinquent accounts that make a verbal or digital commitment to pay.

- Right party contact rate: The rate at which a collections team is able to establish contact with the consumer associated with a delinquent account.

- Roll rate: The percentage of delinquent dollars that “roll” from one delinquency bucket (e.g., 60 days past due) to the next (e.g., 90 days past due) over a given timeframe.

- SMS: An acronym that stands for “Short Message Service” referring to text messages on cellular devices.

For more information on how to get started integrating innovative technologies into your debt recovery strategy, schedule a consultation today.