Reaching consumers can feel harder than ever these days, so struggling to engage delinquent customers can leave some businesses ready to accept losses as just another “cost of doing business.” With 75% of Americans reporting that they will never answer calls from unknown numbers, even the most targeted scoring model for calling has low chances of recovering funds.

But the omnichannel approach—utilizing a combination of calling, emailing, text messaging, and even self-serve online portals—is the preferred experience for 9 out of 10 customers, according to a study conducted by UC Today. And it’s not just beneficial for consumers. The omnichannel approach has been shown to increase payment arrangements by as much as 40%!

So integrating an intelligent digital communication strategy with traditional call-and-collect or letters sounds like a smart plan, but why is it more important now than ever before?

Let’s look at why today’s economic landscape makes omnichannel engagement critical for collections and how your business can get there.

Delinquencies are Rising—And Call Centers Can’t Keep Up

The first quarter of the year revealed that Americans have almost reached $1 trillion in credit card debt, breaking a record set in 2019. Fueled by inflation and higher interest rates among other economic factors, some card issuers’ charge-off and delinquency rates are also rising back up to their pre-pandemic levels.

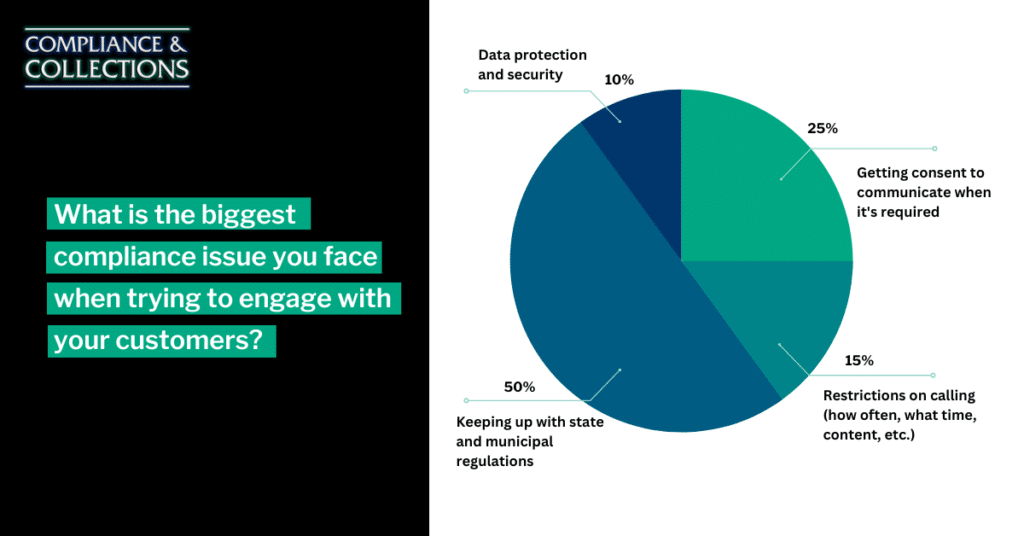

So we know that delinquencies are on the rise in addition to new compliance regulations that have put greater restrictions on calling (such as the inconvenient times rule, 7-in-7 rule, among others), which put greater limitations on the reach call centers can actually have. Even using scoring models to focus on those who have the highest propensity to pay, consumer preferences have moved away from engaging through (or even answering) the phone.

Even if you know which delinquent accounts are primed for repayment, old school methods will never be able to reach them all efficiently in comparison to digital engagement.

On top of that, consumers are typically already carrying out financial transactions online—so why would a business expect their preferences to shift offline when it comes to handling another financial interaction? When a customer defaults on their account, it is a disruption to their lives to suddenly receive phone calls and letters regarding an account for which they previously only communicated via digital channels.

From our own experience, many of TrueAccord’s creditor-clients prefer a seamless transition to debt collection, and will even go so far as to prohibit TrueAccord from making any outbound calls or sending letters on their accounts because their customers have only ever interacted digitally.

It can even stifle the flow of information that helps consumers make informed decisions about their finances. According to the Pew Research Center, “reliance on smartphones for online access is especially common among younger adults, lower-income Americans and those with a high school education or less.” In fact, 87% of TrueAccord consumers visit our web portal from their mobile devices and tablets, not their desktop computers. Choosing not to engage via digital methods can hurt vulnerable populations of consumers who primarily conduct most of their affairs digitally.

But the answer to this challenge isn’t going 100% all-in on digital communications necessarily. There’s a better way to reach past-due customers and collect more, faster (and from happier people).

Enter the Omnichannel Approach

We’ve seen that call-and-collect operations have proven less successful over time, even using propensity to pay scoring models, but there is a time and a place for those traditional methods in an omnichannel strategy. Adding different technologies to your debt collection operation like email, SMS, and even self-serve online portals can actually enhance the hard work your call centers are already doing and make it overall more effective.

Why is the use of different channels—and more importantly a customer’s preferred channel—so critical for today’s debt collection efforts? The numbers speak for themselves:

- 46% of consumers expect to communicate through preferred channels

- Initiating contact with delinquent customers through their preferred channels can lead to a more than 10% increase in payments

- Some banks have found digital communication channels can increase payment rates of customers in late delinquency by 30%

- Lenders that have implemented digital-first solutions have seen their cost of collections fall by at least 15%

- Traditional outreach methods like outbound calling elicited 18% fewer responses from customers with accounts 30 days past due who prefer digital communications.

The key takeaways from these studies go beyond just “going digital”—to see improvements in engagement rates, repayments, and operational costs you must communicate through the consumer’s preferred channels.

At TrueAccord, we’ve seen this approach’s success time and time again for our own clients and their customers.

Statistics and Stories from the TrueAccord Omnichannel Strategy

Almost all TrueAccord communications with consumers (93%) happen electronically with no agent interaction. The remaining 7% of consumers who do interact with an agent, send an inbound email or make a phone call to our inbound call center where any of our customer care agents are prepared to assist with their request. This is a more cost-effective and efficient use of agents’ time versus making outbound calls, which benefits both businesses and their customers, as one consumer told us on June 1, 2022:

“Thank you for not calling a million times and texting me and allowing me to pay this when I could.”

As described above, TrueAccord primarily sends digital communications to help consumers navigate and take actions at their convenience online, as this consumer told us on January 18, 2023:

“I like how you explain everything in detail by email and easy payment plans for people to regain their credit scores and to get back on their feet.”

In fact, more than 21% of consumers resolve their accounts outside of typical business hours (before 8am and after 9pm) when it is presumed inconvenient to contact consumers under the federal Fair Debt Collection Practices Act (FDCPA). If we relied solely on reaching consumers during a call center’s business hours, that is almost a quarter of consumers who wouldn’t engage and take the next steps in their repayment process.

Our omnichannel approach is compelling for our clients as well—and it’s proven to pay off. As Todd Johnsen, Senior Manager of Collections Vendors for Snap Finance, explained:

“This audience [consumers in debt] may have already had experiences with incessant collection phone calls, and they are used to avoiding them. I wanted to find an agency that was doing things differently. I knew that TrueAccord was using technology and digital channels in a way that other providers weren’t. What we saw was almost 25-35% better performance with TrueAccord, compared to the accounts we placed with traditional agencies.”

See what other clients and consumers had to say about their debt recovery experiences with TrueAccord in our case studies and resources here»»

The Recovery Opportunities are Ripe with the Omnichannel Approach

Omnichannel targeting is a more effective way of maximizing repayment and conversation rates by offering a level of service and personalization that customers have come to expect from companies in the digital age.

With this holistic communication strategy, you can engage with every single account while call center agents still deliver the human touchpoint that can never fully be replaced. Reach customers with the right message, through the right channel, at the right time that works best for them—whether through email, text, or with a real person ready to guide customers back to financial health.

Creating an effective omnichannel strategy can seem complicated, but it’s not with the right experienced partner. Schedule a consultation to discover our early-stage collections solutions and late-stage collection services!