The big inflation situation plaguing the U.S. for the past three years seems to be coming to an end, and it could be that American consumers are partially to thank. Tired of paying higher prices, consumers increasingly turned to cheaper alternatives, bargain hunted or simply avoided items they found too expensive, pressuring retailers to accommodate them or lose their business. That’s not to say Americans have stopped spending altogether—the economy continues to expand and people continue to struggle against inflated prices for necessities across the board, often still turning to credit cards to make ends meet.

With consumers setting the demand amidst elevated prices and inflation declining slowly, retailers have gotten an even earlier jump on holiday promotions this year in the hopes of boosting sales in a price-wary environment. Spreading holiday expenses out over a longer period of time may ease the financial burden slightly, but the cumulative dollars spent will still weigh heavily on consumer finances for Q4 and rolling into 2025. The National Retail Federation is forecasting that winter holiday spending is expected to grow between 2.5% and 3.5% over last year, with a total reaching between $979.5 billion and $989 billion.

We are starting to feel an economic shift, but what does this all mean and what’s the outlook for the end of the year? Read on for our take on what’s impacting consumer finances, how consumers are reacting and what else you should be considering as it relates to debt collection today.

What’s Impacting Consumers?

While not the straight line decline economists would like to see, the September results show that inflation is slowly and steadily easing back to the Federal Reserve’s 2% target. After several months of decreasing inflation and amid slowing job gains, the Fed in September announced the first in a series of interest rate cuts, slashing the federal funds rate by 1/2 percentage point to 4.75-5%. Federal Reserve Chair Jerome Powell indicated that more interest rate cuts are in the plans but they would come at a slower pace, likely in quarter-point increments, intended to support a still-healthy economy and a soft landing.

The rate cut plans have been made possible by consistently declining inflation. The Consumer Price Index rose just 2.4% in September from last year, down from 2.5% in August, showing the smallest annual rise since February 2021. Core prices, which exclude the more volatile food and energy costs, remained elevated in September, due in part to rising costs for medical care, clothing, auto insurance and airline fares. But apartment rental prices grew more slowly last month, a sign that housing inflation is finally cooling and foreshadowing a long-awaited development that would provide relief to many consumers.

The September jobs report supported the economic optimism by adding a whopping 254,000 jobs, far exceeding economists’ expectations of 140,000. The unemployment rate lowered to 4.1%, below projections of remaining steady at 4.2%. The government has also reported that the economy expanded at a solid 3% annual rate Q2, with growth expected to continue at a similar pace in Q3. This combination of downward trending interest rates and unemployment plus an expanding economy is great news for consumers and businesses alike, and can’t come soon enough for many financially strained Americans.

Coming out of Q2, total household debt rose by $109 billion to reach $17.80 trillion, according to the latest Quarterly Report on Household Debt and Credit. This increase showed up across debt types: mortgage balances were up $77 billion to reach $12.52 trillion, auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion.

Unsurprisingly, delinquency and charge-off rates ticked up as consumers struggled against still relatively high prices and interest rates. In mid-September, shares of consumer-lending companies slid after executives raised warnings about lower-income borrowers who are struggling to make payments. Delinquency transition rates for credit cards, auto loans and mortgages all increased slightly, with a steeper increase in flow to serious delinquency for credit cards, up more than 2% over last year from 5.08% to 7.18%. This kind of delinquency can be especially difficult for consumers to recover from given the record-high credit card rates many are stuck with.

While still low by historical standards, the mortgage delinquency rate was up 3 basis points in Q2 from the first quarter of 2024 and up 60 basis points from one year ago. The delinquency rate for mortgage loans increased to a seasonally adjusted rate of 3.97% at the end of Q2, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey, an increase that corresponded with a rise in unemployment and showed up across all product types.

For those with student loans, September marked the end of the ‘on-ramp’ to resuming payments, which was the set period of time that allowed financially vulnerable borrowers who missed payments during the first 12 months not to be considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies. However, the grace period is over and anyone who doesn’t resume making student loan payments in October risks a hit to their credit score—we will see these delinquencies reported in Q4.

Financial Protection for Consumers Across the Board

The Consumer Financial Protection Bureau (CFPB) continued with a high level of activity through the summer. Along with taking action against more than a handful of financial services companies in the name of consumer protection, the agency made headway on myriad other issues.

To kick off Q3, the CFPB published Supervisory Highlights sharing key findings from recent examinations of auto and student loan servicing companies, debt collectors and other financial services providers that found loan servicing failures, illegal debt collection practices and issues with medical payment products. The report also highlighted consumer complaints about medical payment products and identified concerns with providers preventing access to deposit and prepaid account funds.

Then, the CFPB and five other agencies issued a final rule on automated valuation models. The agencies, including the OCC, FRB, FDIC, NCUA, and FHA designed the rule to help ensure credibility and integrity of models used in valuations for certain housing mortgages. The rule requires adoption of compliance management systems to ensure a high level of confidence in estimates, protect against data manipulation, avoid conflicts of interest, randomly test and review the processes and comply with nondiscrimination laws.

Next, the CFPB joined several other federal financial regulatory agencies to propose a rule to establish data standards to promote “interoperability” of financial regulatory data across the agencies. The proposal would establish data standards for identifiers of legal entities and other common identifiers.

Also in August, the CFPB responded to the U.S. Treasury’s request for information on the use of artificial intelligence in the financial services sector. The CFPB emphasized that regulators have a legal mandate to ensure that existing rules are enforced for all technologies, including new technologies like artificial intelligence (AI) and its subtypes. It’s clear that the CFPB has an interest in how those technologies are used and what the consumer impact may be.

In September, the bureau issued its annual report on debt collection, which highlighted aggressive and illegal practices in the collection of medical debt and rental debt. The report focused on improperly inflated rental debt amounts and on debt collectors’ attempts to collect medical bills already satisfied by financial assistance programs, also noting that many medical bills from low-income consumers do not get addressed by financial assistance in the first place.

Finally, the CFPB published guidance to help federal and state consumer protection enforcers stop banks from charging overdraft fees without having proof they obtained customers’ consent. Under the Electronic Fund Transfer Act, banks cannot charge overdraft fees on ATM and one-time debit card transactions unless consumers have affirmatively opted in.

Disjointed Consumer Sentiment Weighs Heavy

A September Consumer Survey of Expectations found that Americans anticipated higher inflation over the longer run as their expectations of credit turbulence rose to the highest level since April 2020, according to the Federal Reserve Bank of New York. While perceptions and expectations for credit access improved, the expected credit delinquency rates rose again and hit the highest level in more than four years. According to the survey, the average expected probability of missing a debt payment over the next three months rose for a fourth straight month to 14.2%, up from 13.6% in August, suggesting some Americans are concerned with their ability to manage their borrowing.

Despite inflation easing, consumers perceive that the costs of everyday items are on the rise. According to the latest report from PYMNTS Intelligence, which tracks the percent of consumers living paycheck-to-paycheck, 70% of all consumers surveyed said their income has not kept up with inflation. This feeling is stronger for paycheck-to-paycheck consumers, with 77% of those struggling to pay bills on time reporting that their income hasn’t kept up with rising costs. Even for those not living paycheck to paycheck, 61% shared this concerning sentiment. As a result, consumers are buying cheaper or lesser quality alternatives, if they’re buying at all.

Prior to the September interest rate cuts, the Conference Board’s Consumer Confidence Index showed consumer confidence plunging to the most pessimistic economic outlook since 2021, based on a weaker job market and a high cost of living. Americans reported being anxious ahead of the upcoming election and assessments of current and future business conditions and labor market conditions turned negative.

However, following the Fed’s rate cut announcement, another report from the University of Michigan’s sentiment index showed a rise in late September, reaching a five-month high on more optimism about the economy. Consumer expectations for price increases dropped simultaneously with more expectations for declining borrowing costs in the coming year. Consumer sentiments on their finances directly impact their spending and payment behaviors, so understanding where they stand can inform a better debt collection approach.

What Does This Mean for Debt Collection?

You’ve heard of Christmas in July, but Christmas in September? With the holiday shopping season starting earlier and in the midst of a high-stakes election, consumers will continue to prioritize expenses and spending based on their current financial outlook, which hasn’t yet caught up with the optimism showing up in the overall economy. The unknowns of what happens post-election along with the delayed impact of lower interest rates and inflation on spending leave the outcome for consumer finances uncertain. Delinquencies continue to persist and it may be some time before the benefits of a friendlier economy show up in consumers’ bank accounts. For companies looking to recover delinquent funds now, understanding how, when and in what way to engage consumers can increase recovery success. For lenders and collectors, here are some things to consider for 2025 planning:

• Self-serve = more repayment. For both businesses and consumers, reducing the need to engage directly with human agents to make payments or access account information saves time and resources. Solutions like self-serve portals represent a shift towards greater consumer control over their financial health, providing an efficient way for individuals to address and manage their finances—and debts specifically—on their own terms.

• Omnichannel or bust. If your business relies solely on one channel for customer communications, it’s time to evolve. Utilizing a combination of calling, emailing, text messaging and even self-serve online portals is the preferred experience for 9 out of 10 customers. And it’s not just beneficial for consumers–the omnichannel approach has been shown to increase payment arrangements by as much as 40%!

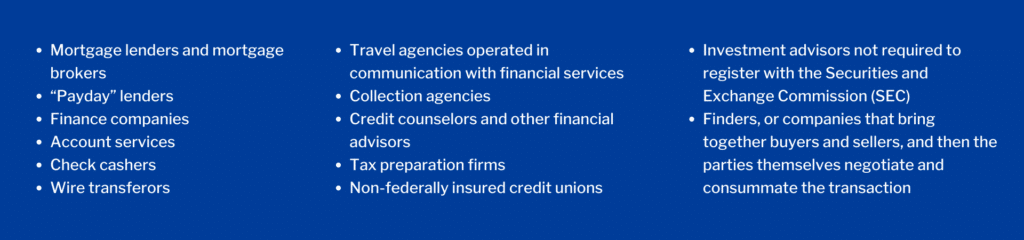

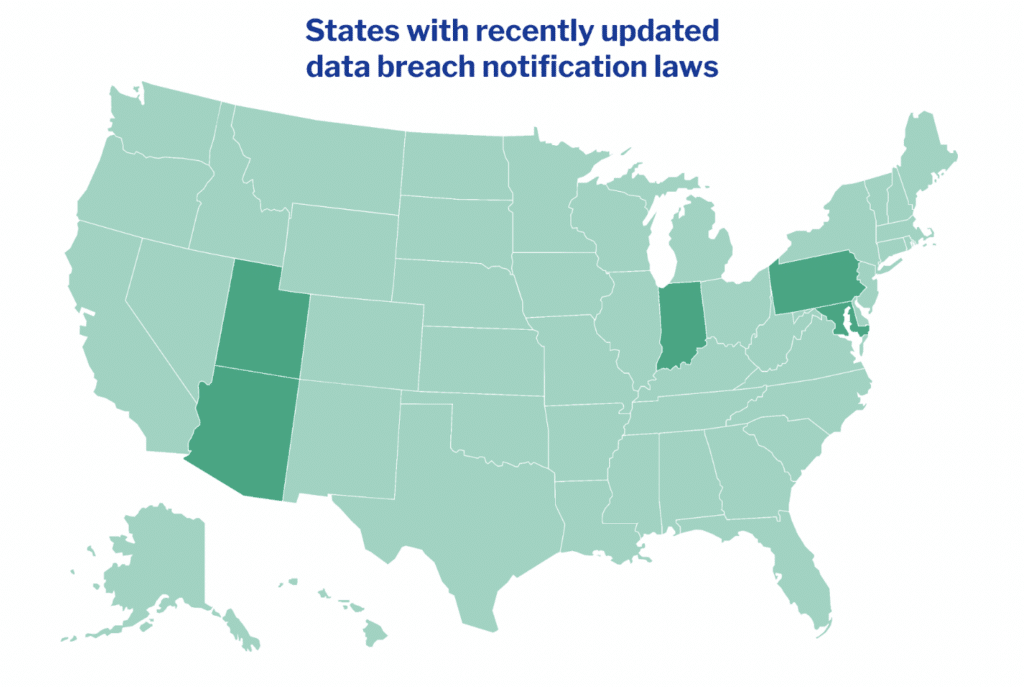

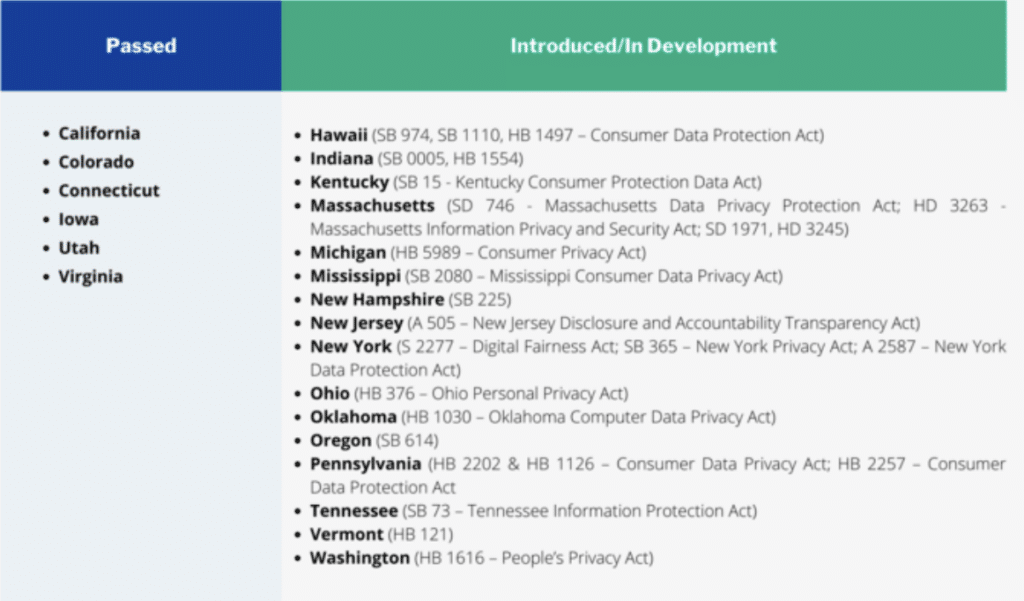

• Keep an eye on compliance (or make sure your debt collector does). The regulatory landscape will continue to change, especially post-election. Your risk and success hinges on how well you can keep up with the changes, so having someone responsible for monitoring and tweaking your strategy is critical.

SOURCES:

- NRF – Holiday Spending

- AP News – Inflation

- AP News – Rate Cuts

- USA Today – Sept. Jobs Report

- NY Fed – Household Debt

- AP News – Economic Growth

- MBA – Mortgage Delinquencies

- WSJ – Consumer Lending Companies Concerned

- USA Today – Student Loans

- CFPB – Loan Servicing and Medical Debt

- CFPB – Automated Valuation Models

- CFPB – Standardizing Data

- CFPB – AI in Financial Services

- CFPB – Annual Report

- CFPB – Overdraft Fees

- Reuters – Consumer Inflation Expectations

- PYMNTS – Paycheck to Paycheck

- Conference Board – Consumer Confidence

- Bloomberg / University of Michigan – Consumer Sentiment

- FICO – Omnichannel