Creating an effective compliance strategy is a crucial component of a business’s chance of success. Debt collection is highly regulated and must adhere to different regulations and laws like the FDCPA, Regulation F, and unique state laws—including regulations that may not be specifically focused on debt collection but still apply to the practice. Noncompliance with laws and regulations that govern or even parallel an industry can result in unhappy customers, litigation, reputational risks and/or enforcement actions.

Using a high-level overview of what an effective compliance strategy can look like, this article will help outline how to create a compliance management system to help your business mitigate risk and keep your customers happy.

What are the key elements to create a compliance strategy for collections?

Some of the key elements to an effective collections compliance strategy may seem like no-brainers but can be more complex than you realize. Being aware of what laws and regulations apply to your specific business, industry, state, and even local jurisdictions is a critical element. Equally, internal audits to make sure your business’ processes are working as intended is a great way to get a temperature check on your compliance’s health. Internal audits should be conducted on a routine basis.

Additionally, due diligence should be conducted on any third-party servicers you may work with for debt collection and recovery purposes: make sure they are legitimate, law-abiding, consumer-respecting businesses. For example, a great way to verify you’re working with a reputable debt collector is by searching the Receivables Management Association (RMAi) database. If a company is RMAi certified, that means they have passed and/or comply with the organization’s rigorous background checks, industry standards and best practices guidelines.

Beyond what can feel like the no-brainers of compliance strategy, another key element is having a Compliance Management System.

What is a Compliance Management System and what does it cover?

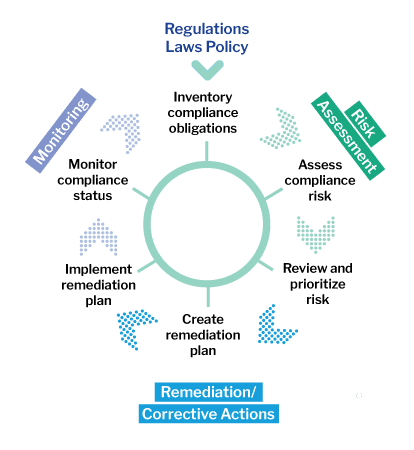

From a high-level view, a compliance management system (CMS) is how a company sets, monitors, and oversees its compliance responsibilities. The CFPB describes a CMS as how an institution:

- Establishes its compliance responsibilities

- Communicates those responsibilities to employees

- Ensures that responsibilities for meeting legal requirements and internal policies and procedures are incorporated into business processes

- Reviews operations to ensure responsibilities are carried out and legal requirements are met

- Takes corrective action and updates tools, systems, and materials as necessary

What are the components of a Compliance Management System?

- Board Management and Oversight

- Allocate the right resources to compliance and risk management

- Regular Board of Directors reporting

- Policies and Procedures

- Documented and updated at least annually by the business owner

- Detect and minimize potential for consumer harm

- Reviewed by Audit and Compliance to ensure followed and meeting requirements

- Risk Assessment – Controls & Corrective Action

- Documented and evaluated regularly by the business owner

- Reviewed by Audit & Compliance to ensure mitigating risks and control gaps

- Deficiencies remediated by business owner through corrective action plans

- Training

- Consistent with policies and procedures

- Ready before a change or roll-out

- Consumer Complaint Response

- Recorded and categorized – used to improve processes

- Investigated, prompt responses provided, corrective action

- Monitoring & Audit

- Aligned with risks

- Independent – reporting shared with top management

Why is a Compliance Management System important?

A compliance management system is important because it’s the checks and balances of the business you’re operating. One of the most important parts of a CMS are the policies and procedures—these help to manage risk by setting a framework and infrastructure to proactively and reactively respond to incidents, issues, and change, such as:

- Changing product and service offerings

- New legislation, regulation, interpretations, court decisions, etc. that address developments in the marketplace and are relevant to the product and service offerings of the organization

- Unexpected incidents (data breach, global pandemic, etc.)

How can you ensure your compliance strategy is effective?

A compliance strategy is not “set it and forget it”—the strategy needs to be tied to the evolving consumer preferences and corresponding new compliance requirements to be effective. This helps businesses be proactive versus reactive. Ensuring checks and balances are in place helps establish proactive stance in case normal policy fails, gaps are discovered, or other unforeseen issues arise.

What can you do to ensure compliance strategy is effective for the future?

Want to learn more about the different facets of what makes a compliance strategy effective in collections? Join us Thursday September 29th at 1pm ET for our interactive webinar, The Future of Collections & Compliance, hosted by TrueAccord Associate General Counsel Lauren Valenzuela and Director User Experience Shannon Brown.

Reserve your space now for an interactive discussion on:

- Cutting edge digital collection compliance

- The role of the legal team in creating a digital collection strategy

- How compliance drives collection revenue

- The future of digital compliance

Register now for the upcoming webinar»»

*Leana serves as TrueAccord’s Paralegal Operations Analyst II. This blog is not legal advice. Legal advice must be tailored to the particular facts and circumstances of each unique matter.