Over the past several years, federal and state regulators have started raising red flags about a significant trend in the debt collection industry: companies failing to deliver positive experiences for consumers or properly manage complaints and disputes. With growing scrutiny from agencies like the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), and even the White House, it’s clear that ensuring a good consumer experience is no longer just a best practice—it’s a compliance requirement.

As we move further into 2025, it’s essential for debt collectors and businesses to find the balance between adhering to the myriad of regulations while maintaining a smooth and positive consumer experience through the repayment process. And while digital communication channels have become increasingly favored by consumers, mass blast emails and SMS campaigns don’t equal rave reviews or recovery rates.

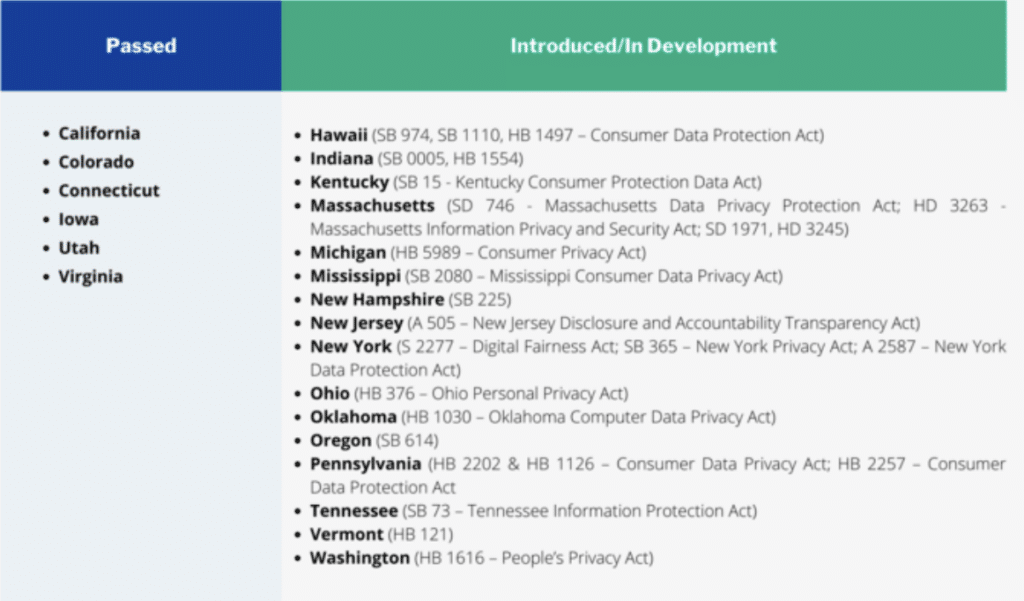

Add on evolving compliance regulations and the modern debt collection challenges mount. While 2024 saw different governing bodies and providers make progress handing down guidelines and best practices for better consumer experience overall, regulations and legislation is still not always 100% clear on what is and is not acceptable for compliance.

So how can your debt collection strategy keep up with the 2025 compliance and consumer preference landscape? Let’s look at ways to navigate the challenges and increase liquidation rates as a result.

Staying on Top of the Shift Toward a Consumer-Centric Compliance Model

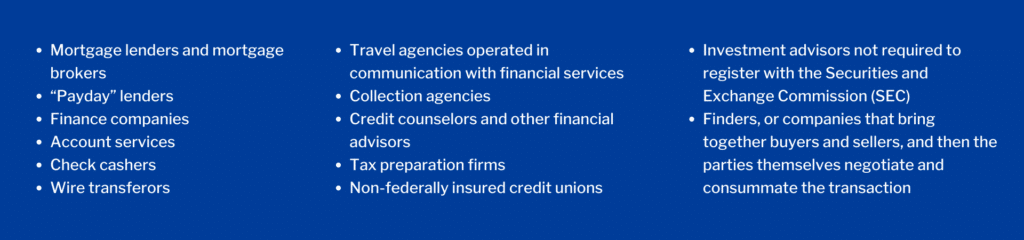

Traditionally, compliance in debt collection focused primarily on following established regulations, such as the Fair Debt Collection Practices Act (FDCPA) and Regulation F. However, recent regulatory actions are increasingly examining how businesses interact with consumers beyond the letter of the law and have emphasized that poor consumer experiences can even trigger legal violations. If a debt collector fails to manage complaints and disputes properly, it could result in potential violations of the Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) standards, or even the Dodd-Frank Act.

Even the use of emerging technologies is being scrutinized through the consumer experience lens: the CFPB has highlighted concerns over poorly monitored artificial intelligence (AI) or machine learning, specifically when it comes to consumer interactions. A poorly designed or maintained automated messaging system can lead to consumers getting “stuck” in automated loops, resulting in complaints and potential regulatory scrutiny or even rise to the level of a compliance issue.

Another area of increasing consumer frustration can be the process of opting out from receiving further digital communications. Automated messages that give consumers the ability to remove themselves from receiving further communications by replying “STOP” but do not account for a range of possible opt-out requests or replies can lead to complaints and trigger regulatory action.

The lesson is clear: compliance is not just about ticking boxes—it’s about delivering a consumer experience that’s transparent, responsive, and respectful. And with a smart approach, businesses can use technology to minimize compliance risk while enhancing the consumer experience.

Best Practices to Strike Balance Between Compliance and Consumer Experience

Understanding this focus shift and the nuances of ever-unfolding regulations still leaves us with the original question: how can your debt collection strategy keep up with the 2025 compliance and consumer preference landscape? While it is imperative to follow all laws and requirements in the collections industry, following the best practices below can help your organization prepare and provide the best consumer experience through the delinquency lifecycle as the regulatory landscape continues to evolve:

- Implement robust compliance oversight programs, particularly when scaling digital outreach efforts

- Establish clear policies and procedures around the use of AI, machine learning, and other emerging technologies in debt collection and digital communication, and continuously assess their impact

- Map and monitor outreach across all communication channels holistically, ensuring that consumers do not get “stuck” in a loop or experience any disruption in their communication

- Ensure any messaging systems appropriately handle variations in opt-out requests (like we mentioned above, “STOP” is just one way consumers might convey their opt out of SMS)

- Automation can be used not only to send messages but also to ensure that every piece of communication complies with the necessary regulations

- Partner with debt collection agencies that have experience successfully using digital communications compliantly

The key is to adopt a comprehensive approach that blends technology, consumer insights, and compliance best practices. By leveraging digital tools to monitor communications, mapping out consumer journeys, and staying vigilant with AI and machine learning systems, businesses can maintain compliance without sacrificing the quality of the consumer experience.

And TrueAccord has a proven track record as an industry leader in digital-first debt collection from both a compliance and consumer experience perspective.

The TrueAccord Difference

To start, TrueAccord is a licensed, bonded, and insured collection agency in all jurisdictions where we collect. We ensure compliance control, auditability, and real-time updates for changing rules and regulations, as well as adapting to shifting trends in consumer preference and behavior.

Our digital collections compliance process is controlled by code, ensuring that all regulatory requirements are met, while still being flexible to quickly adjust to new rules, case law, and consumer experience expectations.

Take the example from earlier about consumer frustration trying to opt-out: at TrueAccord, we’ve found that only 7% of consumers use the word “STOP” to opt out of SMS communications—but our team and machine learning engine, HeartBeat, account for the many other phrases consumers may use to opt-out, staying compliant and reducing consumer friction.

It’s important to remember that most compliance rules were written for the benefit of consumers. As we’ve seen from today’s consumer-centric compliance guidelines, the better we comply, the better the consumer’s experience should be.